The Bear Case for Palantir in 2021

A deep dive on the current state of Palantir and the dangers of its business in 2021.

Summary

- Palantir is the largest pure play big data management and analytics software which is used by 1) government institutions like the CIA and 2) commercial customers in industries like aviation, retail, and financial institutions

- The company was co-founded in 2003 with the initial mission to "reduce terrorism while preserving civil liberties", which was consistent with their business model of selling intelligence-based software Gotham to government agencies

- Palantir's initial GTM model was a high friction sales motion which led to a competitive advantage because it entrenches Palantir's software within existing customer systems, resulting in substantial switching costs

- A few years before going public via direct listing in September of 2020, Palantir introduced Foundry, which is software that targets commercial customers using a modularized and a simpler software deployment approach so they could scale efficiently, akin to traditional SaaS where sales friction is minimal

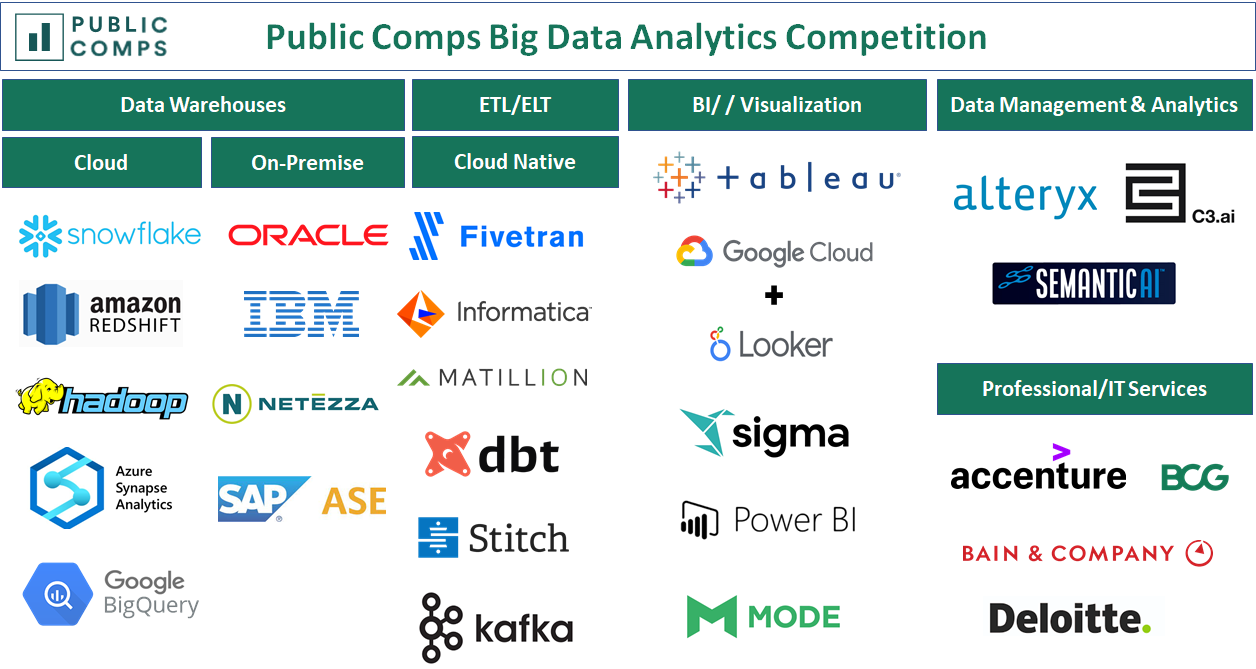

- Largely for commercial customers, Palantir competes with the alternative and traditional solution of using ETL (extract, transform, and load) software to pipe data into a data warehouse, where thereinafter analytics software is deployed to derive insights

- Palantir's success is largely attributed to its value add in the public sector because it builds custom solutions that are deeply entrenched in private government systems, but will have challenges in the commercial market where a scalable product is crucial

- In other words: Palantir will likely have to pay the fare of sacrificing a key part of its competitive edge to compete against a crowded market and achieve scale in the commercial market

Business Overview

What is Palantir?

It's helpful to start with the most obvious: its name. First coined in the Lord of the Rings (the one written in 1948...), palantíri were "seeing stones" that enabled their owners to magically view anything in the world they so desired. Fast forward to today, that exact vision actually isn't very far from fiction. There's only one difference: instead of through magic crystals, the power is enabled through software/AI.

The business was co-founded in 2003 by Peter Thiel (who founded and sold PayPal), Joe Lonsdale, Alex Karp, Stephen Cohen, and Nathan Gettings. At their core, Palantir sells software that 1) unifies and secures data from extremely disparate sources to 2) perform analytics on that data, which can be powered by machine learning algorithms.

This means that Palantir seeks to displace the legacy three-step solution of 1) using ETL (extraction, transform, and load) software; 2) creating or using a data warehouse from something like Snowflake; then 3) deploying products on top of the data warehouse to derive analytics. In other words: I think of Palantir as the more advanced, secure, and convenient way to get deep insights into big data distributed across disparate platforms.

There's quite a complex history behind the company; here's a high-level breakdown:

- 2005: Palantir secures the CIA as their first client for intelligence analytics services.

- 2006-2008: Referrals catapult Palantir into additional contracts with other US agencies including the: FBI, NSA, Homeland Security, SEC, and NYPD.

- 2008: Palantir expands internationally; interestingly, the company diversified geographically before targeting new customer markets

- 2016: "Foundry" is launched to target commercial customers using a modular approach that doesn't require as much customizing

- 2020-present: Strong tailwinds from COVID-19. Palantir continues to grow its commercial product but still largely relies on one-time government revenues

Primary revenue streams come from 1) subscriptions for customers to deploy on their own internal hardware; 2) subscriptions for software run in an environment hosted by Palantir; 3) services revenue from installation and maintenance of Palantir's software. Revenue is not broken down into these segments, but it's fair to assume that their top-line is recurring in nature.

Product Deep Dive

Palantir has two core products: 1) Palantir; 2) Gotham. Before diving in, it's important to note almost all Gotham solutions are bespoke to their customers in one way or another. Palantir sends "forward deployed engineers", or so they call them, to places all around the world like Afghanistan to build modules that are optimized for customer use cases. The S-1 alone includes 18 product screenshots!

Both products share the same DNA: they're central data operating systems that sit in data management + data analytics within the big data value chain. How it works:

- Engineers merge structured + unstructured data from disconnected sources (think traffic cameras, phone records, informant reports) into one place

- Engineers funnel relevant data into a model and that data is tagged as objects (think people, places, events)

- Users can interact/analyze with data through integrated applications either via 1) point-and-click; 2) advanced AI models

Gotham versus Foundry:

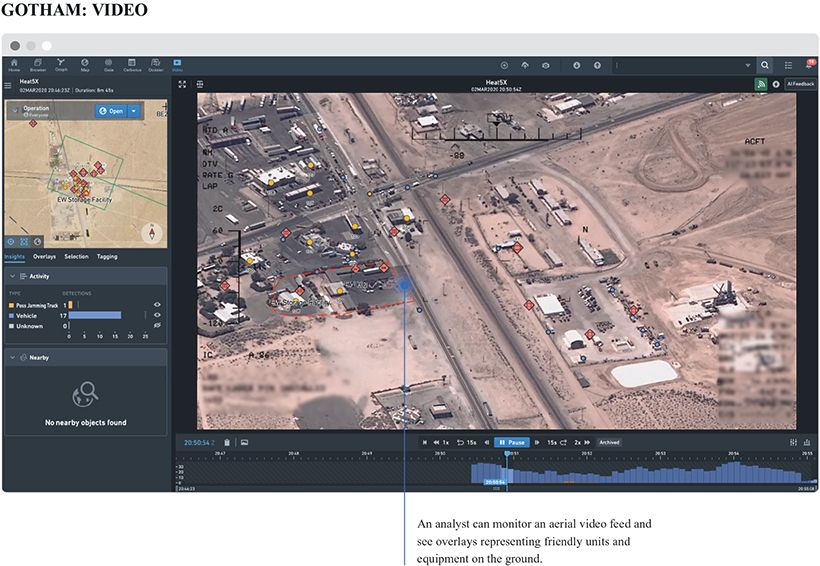

- Gotham: their first key platform (2008 launch) after years of R&D developed initially for government agencies to unify structured (spreadsheets, tables, names) and unstructured (images, articles, voice), in a way so relationships can be drawn between that data. It's designed to help agencies navigate investigations by planning missions, based on tremendous amounts of data that Palantir helps analyze with AI tools.

Imagine: You're a military commander who is planning a coordinated attack on enemy territory and you need to scope out the area before taking action. You know there's video footage from drones/aircrafts, but you're unsure which footage source is best suited for your needs. Even worse, the raw footage is extremely poor quality, unreliable, and doesn't tell you much by itself. Enter Gotham. Palantir equips your agency with an end-to-end platform where all intelligence is stored, raw footage is enhanced using geospatial data, and objects are graphically overlaid to tell you inform you of friendly units using artificial intelligence. It sounds almost too good to be true, but it's a real use case (Gotham: Video) that intelligence agencies use:

Palantir's AI analytics aren't meant to completely outsource human decision-making; rather, it's meant to help analysts see complex patterns of data they would've missed without AI, and ultimately allow operators to focus only on making the most important decisions.

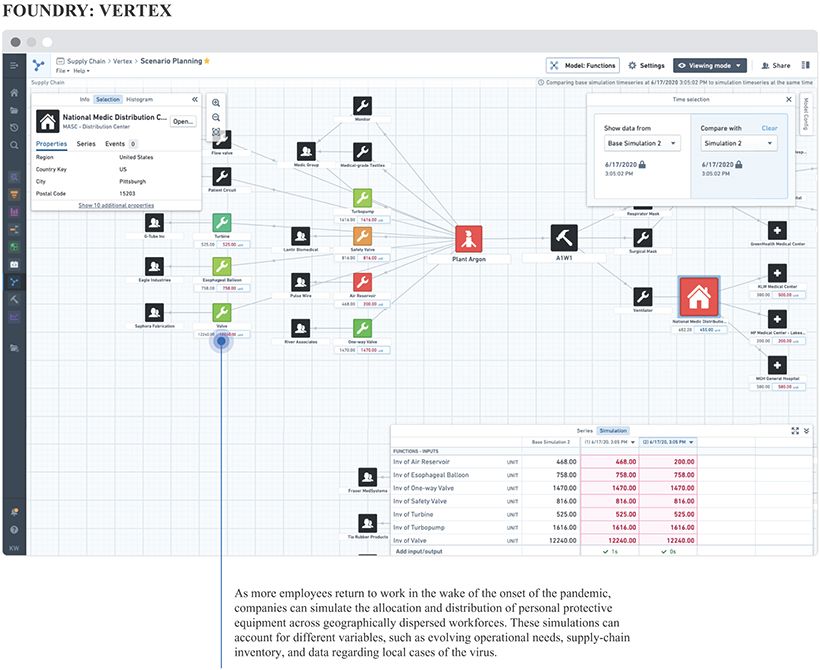

- Foundry: Palantir's official launch of a commercial product (2016 launch) to expand beyond concentrated government contracts. The key difference is that Foundry is optimized to handle massive-scale analytics to answer commercial questions for businesses, whereas Gotham serves as more of a centralized operating system for sensitive government data.

Imagine: You're the CFO of a retailer that wants to understand your supply chain better so you can optimize when to replenish your inventory. However, this is only becoming more difficult as data is increasingly generated from disparate sources (supply chains are incredibly complex). Enter Palantir: you're now able to integrate massive datasets into a unified data asset, and use integrations Palantir has to deploy ML algorithms to track your supply chain. On top of that, you're able to visualize your supply chain and be alerted if, for example, inventory of XYZ item falls below a threshold. This saves you a ton of money in lost sales that you would've incurred from out-of-stock situations and warehousing costs.

Gotham and Foundry is the core of Palantir, but they can be used in conjunction with one another. Per an interview with then-lead PM of Gotham's platform:

"This might look like Gotham as the backbone intelligence platform for an agency — where analysts, agents, and operators build knowledge — with Foundry as the key system used for massive-scale analytics and management of data pipelines".

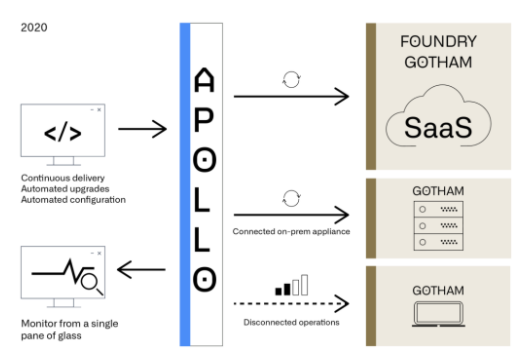

Separately, Palantir has a third "product" they've invested in to support their products and give rise to a competitive edge over traditional public cloud SaaS companies.

- Apollo: Palantir's product infrastructure and continuous delivery platform. This allows for two things: 1) PLTR products can be run in environments that the public cloud can't reach (think submarines or classified government clouds); 2) software updates can be delivered to customers regardless of where they're running. Separately, the company launched Apollo for Edge AI in April 2021, which makes it easier for customers to deploy AI models across their data, regardless of location.

Apollo is not a standalone product so much as a layer that stands between Palantir and the environments their customers deploy Gotham/Foundry on.

GTM Strategy

There are key shifts in their history worth highlighting, with the most important being that Palantir went from:

- Selling custom full-stack (integration + analytics + visualization) data analytics software to government agencies, to

- Selling parts of the Foundry product with a more standardized and modular approach to commercial customers

And it makes sense: in order for Palantir to scale in the commercial market, they needed to reduce the friction they were used to with government customers to shorten the length of their sales cycle, integrate into existing solutions, and improve unit economics.

Per Palantir's then-lead PM: "One of the things that makes Gotham so unique is the level of partnership we have with our customers. We are not technologists in a lab in Silicon Valley — we are engineers on the ground, in the battlefield, at the operations centers... Real collaboration with our partners is what pushes the Gotham product forward."

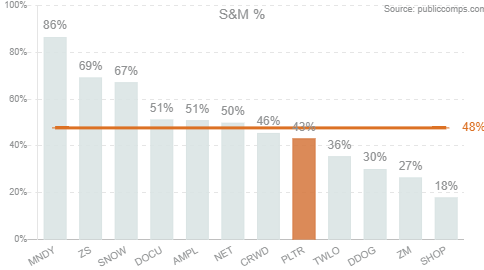

Palantir's focus has always been moving up the value chain via a heavy services component (i.e. a forward deployed engineer ("FDE") deployed to a physical site to build customized solutions) as opposed traditional SaaS (think Crowdstrike) where solutions can be deployed more simply.

In #1, you can imagine how the following S&M channels would reflect a higher-friction sales motion (per the S-1):

- Direct sales force: an account-based sales force requiring FDEs to build solutions for bespoke use cases

- Account growth: exactly what it sounds like; account growth largely via upselling custom product capabilities

- U.S. Government: the company won a court case in 2019 that requires the government to have reason to build their own software over a third party's, which puts healthy pressure on PLTR to continue solving bespoke challenges for the government

Whereas in #2 you can imagine how the following S&M channels are more frictionless in a modularized "SaaS-based" model:

- Direct sales force + account growth: still an account-based sales force but a lesser reliance on FDEs to custom build products

- Sector and industry platforms: rather than building bespoke solutions for individual customers, engineers build bespoke platforms for individual industries

- Channel sales & cloud partnerships: partnerships with public, private, and hybrid cloud providers that have their own sales forces

- Joint ventures & new business partnerships: collaborations with companies to target entire industries / geographies

The Dangers of Palantir's Model in 2021

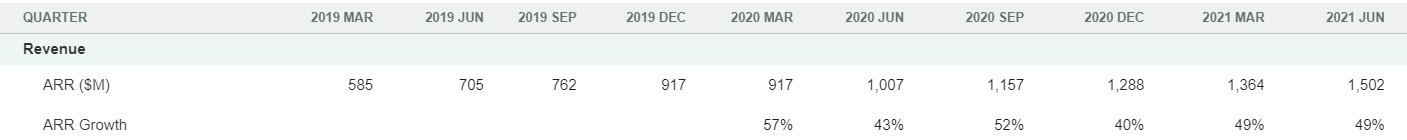

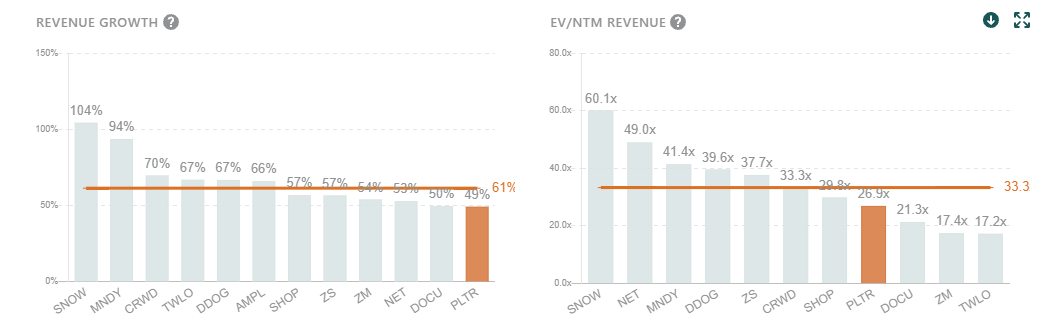

At ~$23/share, Palantir is up 164% from its opening price after direct listing in September of 2020 largely due to 1) optimism for Palantir's transition into commercial applications with Foundry; 2) product stickiness; 3) a largely unpenetrated TAM in tandem with revenue growth in line with the fastest growing software companies (40%-60%).

To put Palantir's valuation into perspective, revenue growth has been in line with some of the fastest growing SaaS companies (40%+) and NTM revenue multiples are slightly under the median ~33.3x NTM revenue.

Palantir's success over the past decade has largely been attributed to its value add in the public sector because it builds custom solutions that are deeply entrenched in private government systems, but will have challenges in the commercial market where a scalable product is crucial.

- They're a company that has excelled at its current GTM strategy (a high-friction acquire, expand, and scale strategy) for the public sector because it's competitively differentiating, sticky, and lucrative to customize solutions to solve one-off challenges for large government accounts (average revenue per customer was $7.9M in Q2'21).

- The challenge with this strategy in the commercial market: most commercial customer accounts are simply not as large as lumpy government contracts, and such a high friction strategy isn't sustainable to scale because of weaker unit economics. Instead, they're required (which they've done) to shift to a simpler software deployment model and a modularized product – meaning customers can take what use parts of the software they want instead of a full platform – with Foundry in order to scale outside of government contracts.

- It's a problem because 1) it weakens Palantir's historical competitive strategy of being deeply ingrained in customer systems; 2) it is expansion into a crowded market of competing SaaS offerings. The way I see it: Palantir must likely pay the fare of sacrificing a key part of its competitive edge to compete and achieve scale in the commercial market.

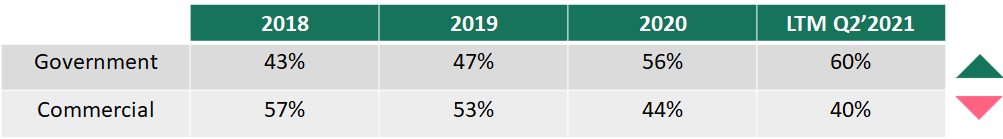

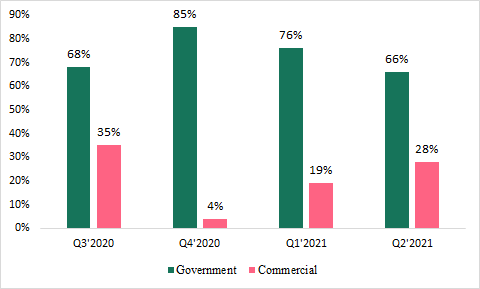

Government contracts make up a sizable piece of total revenue (60% as of LTM Q2'2021) and are ostensibly increasing in weighting:

And YoY revenue growth over the past four quarters is still clearly driven by government revenue:

It's true that COVID-19 could've been a tailwind for government revenues since Palantir entered contracts to work closely with US and UK governments and a headwind for the commercial segment as companies aggressively cut expenses.

With that being said, revenue from commercial customers grew only 17% from 2018 to 2019 compared to 35% growth from government contract revenue. If the bullish argument is that Palantir is in a completely different position to blitz the commercial market because of new COVID-19 tailwinds, that's a slightly different debate which would then – to me – be centered around the question of how sticky Foundry is for commercial customers.

Market Opportunity

Management estimates the total addressable market for Gotham and Foundry (powered by Apollo) to be ~$119B, of which $56B comes from commercial opportunities and $63B of which comes from the government sector. Both are calculated in a fairly reasonable and simple approach:

- Commercial: 1) Find the number of companies around the world that have >$500M in annual revenue (there's about 6,000); 2) multiply by an assumed contract value for each customer based on organization size and internal customer spending data

- Government: 1) Use stats published by the International Monetary Fund (IMF) to calculate total spending by federal and state expenditures; 2) allocate a percentage estimate of government spending (~5%) on software/consulting services; 3) apply a further percentage management believes can be captured; 4) do the same method to international governments and sum the US figure.

The only caveat to wonder is if all companies that generate >$500M in revenue can truly derive as much value relative to one another from Palantir's product offerings. The methodology assumes pricing is based solely on organization size, but it may be an overestimate if pricing is simply correlated to size and not value provided. It's hard to imagine customers locking themselves into huge contracts if they don't have a strong need for Palantir's offerings.

Competition

Given that Palantir's Gotham offering is a full-stack solution that covers everything from data management to advanced data analytics, they naturally compete with specialists with similar services. I'm personally less concerned about Gotham because of court orders and the ever-increasingly high switching costs for government agencies that want to build internal systems because Palantir is only further entrenched within their customers as time goes on.

To me, Foundry is more concerning because it is a modularized, traditional SaaS solution that faces stiffer competition from specialists within the big data value chain:

Direct competition: There are several competitors that are offer similar full-stack solutions to Palantir, including C3.AI, Alteryx, and Semantic.ai. However, management still cites that the biggest threat is from internal systems built by customers themselves. With that being said, Palantir is currently the biggest pure play data management and analytics provider.

ELT/ETL software: Data integration software provider Fivetran just raised at a $5.6B valuation last month, which means they quadrupled their valuation... in a just little bit more than a year from their $1.2B Series C in June of 2020. Although only a single part of the data stack that Palantir doesn't necessarily directly compete with, the implications definitely pose a threat: Snowflake and other data warehouse providers symbiotically benefit because ELT/ETL software makes it easier to pipe data from disparate sources into warehouses.

Data warehouses: Snowflake, Hadoop, Redshift, every single public cloud provider, and legacy on-prem data warehouses like Oracle are threats. Competition here poses a stronger threat for commercial customers because deploying analytics software on top of a data warehouse like Snowflake can do a lot of what Palantir can do for its commercial customers.

Business intelligence analytics: Standard BI and visualization software like Tableau, Power BI, Sigma, and Looker sit here. I don't see the current space as a significant threat in the short-term because they're for different use cases. Palantir's analytics are much more advanced and deploy AI models to derive insights, whereas BI tools are more simply used to visualize ready-to-go data. However, it's almost certain BI players will continue investing heavily into analytics, or more feasibly, an acquisition (e.g. Salesforce/Tableau) will fuel that growth.

Professional services: It's worth noting a miscellaneous category that Palantir indirectly competes with because of the nature of its model. This includes professional services from IT and management consultants like Accenture that the potential customers may use to build their own internal systems.

Valuation & Investment Thoughts

Ahead of their huge $823M contract win with the US Army and rallying more than 10% during afterhours this Wednesday (10-6-2021) – along with the size of the government market opportunity left unpenetrated – it's fair to presume that revenues will continue growing at >40% levels. However, it's worth noting that the total deal value with these kinds of high-profile contracts may be likely overstated because they often bake in the value from hardware, sensors, and other ancillary purchases that go to other vendors.

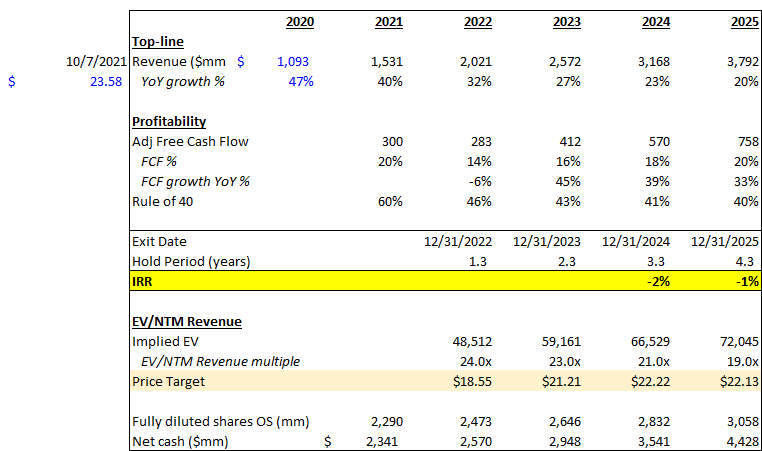

I believe revenues may see deceleration (yet still assuming fair revenue growth persistence of 93%) from 2021-2025, based on the premise that Palantir has already penetrated many high-profile government entities and will have struggles replicating its services-oriented model as management sets its sight on commercial market expansion. Management guides revenue to be >30% from 2021-2025.

For valuation, I chose EV/NTM revenue multiples based on high-growth software comps (defined as >40% growth), and I believe multiples will deflate over time as growth tapers, profitability is reached, and as the market begins to evaluate Palantir's business model as one that is more services-based.

With the current valuation, I maintain a bear view of the company as I believe the long-term reward/risk is bleak, and expect to see deceleration in growth as Palantir struggles to shift its focus away from the public sector. However, given the sentiment of a next-generation AI data analytics company with a critical mission shared among retail investors, it makes it a difficult name to short as multiples are likely to continue to remain afloat.

Conclusion

Palantir's management under the leadership of Alex Karp has undoubtedly built a hugely successful business. Revenue growth is expected to remain among the fastest-growing software companies at >40% levels, and tailwinds from commercial applications will also help drive the top line.

However, the path to sustaining their top-line in the commercial market may be a bleak one if Palantir does not aggressively take action to invest in industries outside of the public sector. Only time will tell how Palantir will seek to sustain their growth over the next five years!

As always, feedback/thoughts/requests are greatly appreciated. Feel free to reach out: jimmy@publiccomps.com.

Jimmy Zhou, Public Comps Team (@jimmynzhou on Twitter)