An Update on Cloud Markets and AI Value Creation

I like to provide a quarterly update on the hyperscalers as they give us the best gauge on technology markets as a whole. We get data across infra, cloud, and applications. For those interested in AI adoption, they also give us the best insight into AI adoption (Capex, AI cloud revenue, and AI app adoption).

For background info, I published a primer on the cloud here, providing a breakdown of its history, technology, and markets.

This article will be structured as follows:

- Background on the Hyperscalers’ AI Strategy

- The Capex Story

- Market Share Data

- Azure Quarterly Update

- AWS Quarterly Update

- GCP Quarterly Update

Important Disclaimer: As always, I like to clarify that I’m an investor studying the space, not an expert on the industry. I look for opportunities in both private and public markets that provide value to investors, and I hope this research provides value to investors doing the same. That said, none of this is investment advice and should not be used as a guide to investing in the industry.

1. Background on the Hyperscalers’ AI Strategy

The goal for the hyperscalers is to be vertically integrated compute providers. The three large CSPs have the same AI strategy, taking on the market with three layers:

- Hardware - Each of the three hyperscalers design AI accelerators, with Google’s TPUs being the most advanced, AWS’ Trainium and Inferentia next, and Microsoft’s Maia recently released. The hyperscalers each design elements of their data center stack from scratch as well.

- Platforms—AI and data platforms provide “do-it-yourself” AI services, including data platforms, model fine-tuning services, and build-your-own AI.

- Applications - AI applications for end users. The best examples now are “copilots” like Github Copilot and Amazon Q. I think increasingly this will become “agents” who execute tasks on your behalf.

Generally, this follows the same strategy I outlined in the diagram below:

Some historical context on vertically integrated firms in emergent industries:

We have historical context for this vertical integration as well. Industries, when they are first born, tend to be brought to life by one or a few vertically integrated providers. As complexity increases, it becomes too challenging to maintain leadership in each segment of the vertical integration.

So, the incumbent will cede off its least profitable (and least defensible) segment of its company. Over time, the company will slowly retreat around its most defensible IP.

In my opinion, the stopping point of that “upmarket retreat” is dependent on how technically complex the industry becomes. For example, semiconductor companies were initially fully vertically integrated. However, they have become so complex that each vertical now has one or two companies dominating the market for leading-edge processes. On the other hand, enterprise software, for example, hasn’t become much more complex than when it was originally invented. This has resulted in vertically integrated firms with distribution networks being the most powerful players in the space.

When I think about the evolution of AI, the most important question is how complex each layer of the stack will become. That gives us a framework for assessing how defensible the current vertically integrated provider moats are.

In the near term, the hyperscalers (and Nvidia) are the best-positioned companies in AI. They have clear, profitable business models, demand, and exposure to multiple levels of the stack.

2. The Capex Story

The narrative is starting to become clear on AI capex: about 50% of current capex is on land, leases, and construction. We’ve yet to see the real buildout of AI data centers, and we’re at the beginning of this trend.

“Roughly half of FY '24's total capital expense, as well as half of Q4's expense, it's really on land and build and finance leases, and those things really will be monetized over 15 years and beyond.” - Amy Hood, CFO of Microsoft

It’s quite literally a land grab for the hyperscalers.

The rest of the capex is mostly going to GPUs and other AI infrastructure which will be driven by demand:

“In the capital spend, there is land and there is data center build, but 60-plus percent is the kit, that only will be bought for inferencing and everything else if there is demand signal.” - Satya

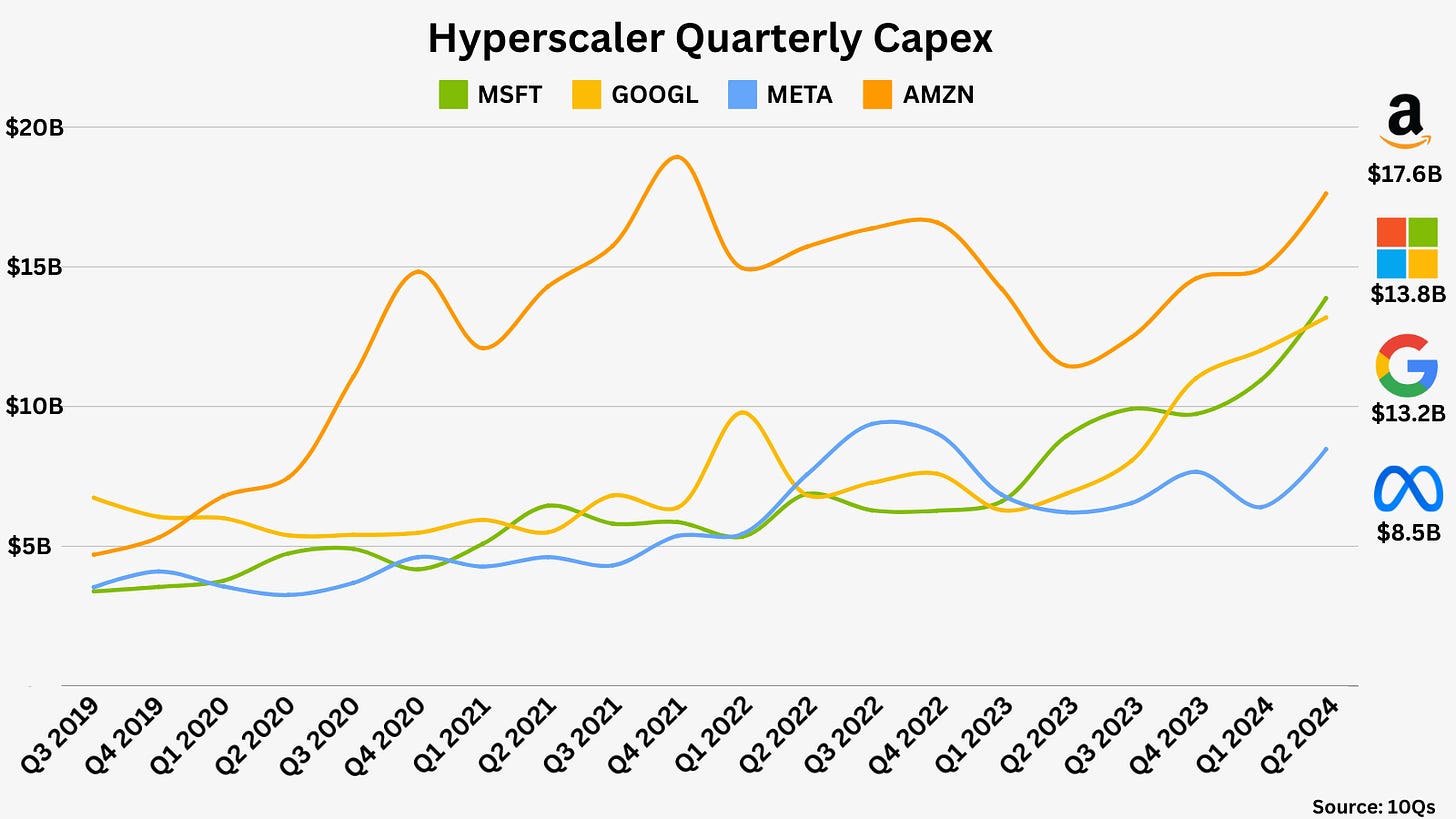

We can see capex across the hyperscalers here:

Quarterly capex change for the hyperscalers:

Amazon: $11.4B -> $17.6B = 54% Y/Y Growth

Microsoft: $8.9B -> $13.9B = 55% Y/Y Growth

Google: $6.9B -> $13.2B = 91% Y/Y Growth

Meta: $6.2B -> $8.5B = 36% Y/Y Growth

The hyperscalers want to secure as much capacity in land and energy as they can get to be able to deliver the computing needs of the next decade. When we think about ROI, the basic calculus here assumes much higher computing needs in the future and that the cloud will be the avenue for delivering that computing. IF that’s true, and the hyperscalers can continue to maintain a strong operating margin on that compute power, then they’ll see ROI from these investments. It’s important to call out that the capex right now is an investment for the next 15 years, and we may not see the ROI for a multi-year period.

The last interesting note is that we have somewhat of a Goldilocks situation on Capex between the three hyperscalers. Microsoft can’t get enough compute, Google’s hinting at potentially overinvesting, and AWS is pretty happy with themselves:

“We've talked about now for quite a few quarters, we are constrained on AI capacity. And because of that, actually, we've, to your point, have signed up with third parties to help us as we are behind with some leases on AI capacity.” - Satya

“One of the least understood parts about AWS over the last 18 years has been what a massive logistics challenge it is to run that business…we disclosed both our revenue and our operating income in AWS that we've learned over time to manage this reasonably well.” - Andy Jassy (Note: Amazon did say they were constrained for AI capacity later on.)

“The risk of under-investing is dramatically greater than the risk of over-investing for us.” - Sundar Pichai

That said, it’s clear that the hyperscalers are capacity-constrained for some AI workloads right now; the question is how much and for how long.

3. Market Share Data

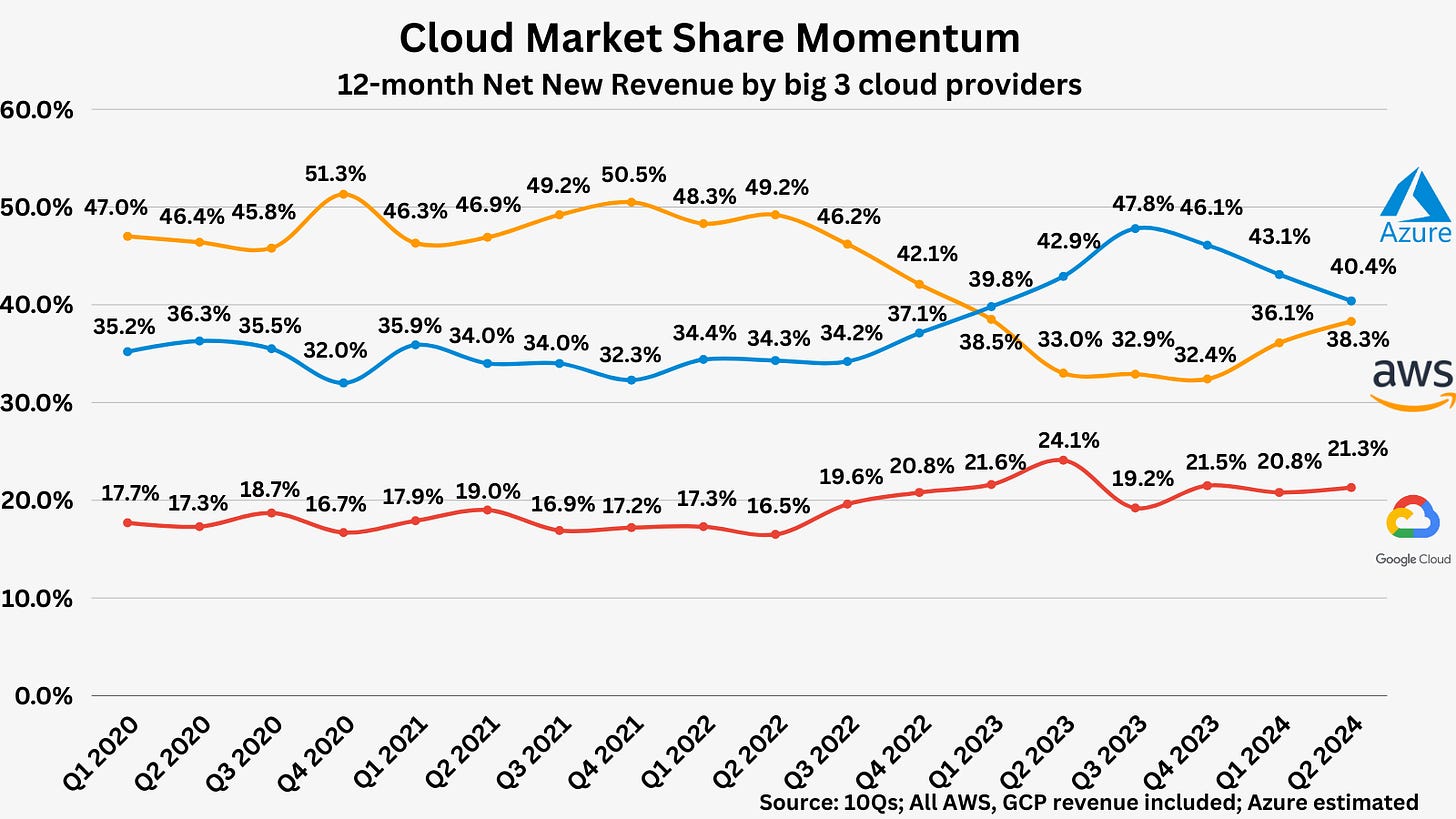

AWS continues to slowly cede share to Azure and GCP. This isn’t an indictment of AWS, it’s a product of their strategy and the nature of buying dynamics in the cloud. AWS has chosen an infrastructure-first strategy where they partner closely with cloud SaaS companies like Crowdstrike and Snowflake, instead of investing more heavily in their own offerings. This results in lower overall revenue growth, but higher operating margins, at least in the short term.

When it comes to momentum (net new revenue generated by quarter), AWS actually had the strongest quarter:

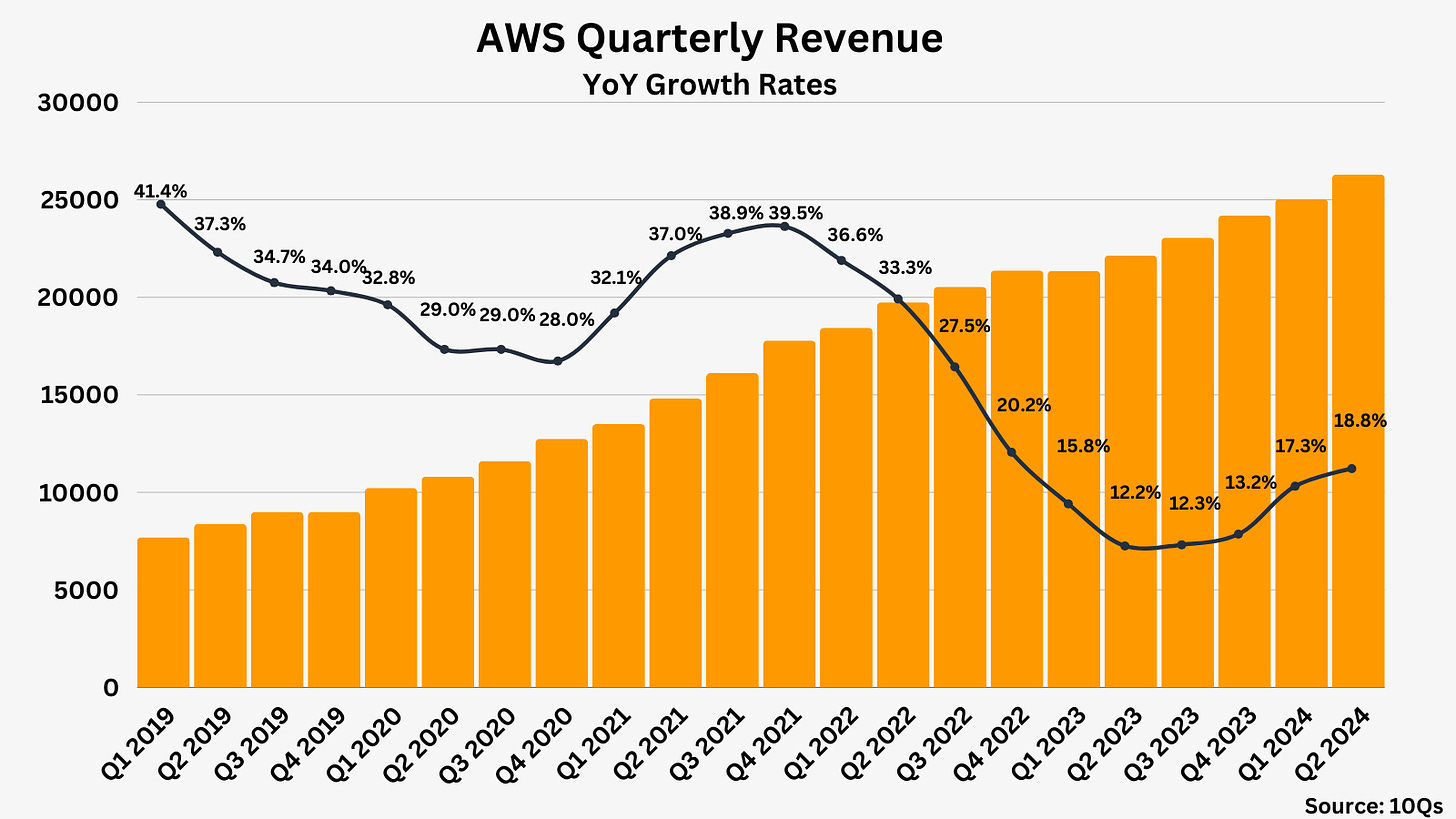

This gives us the best indication of where cloud market shares are trending; after AWS’ brutal decline from Q2 ‘22 to Q2 ‘23, they’ve rebounded.

This confirms a trend we’ve been seeing for a while: Azure and AWS will be the top two cloud providers, with GCP in a clear third place.

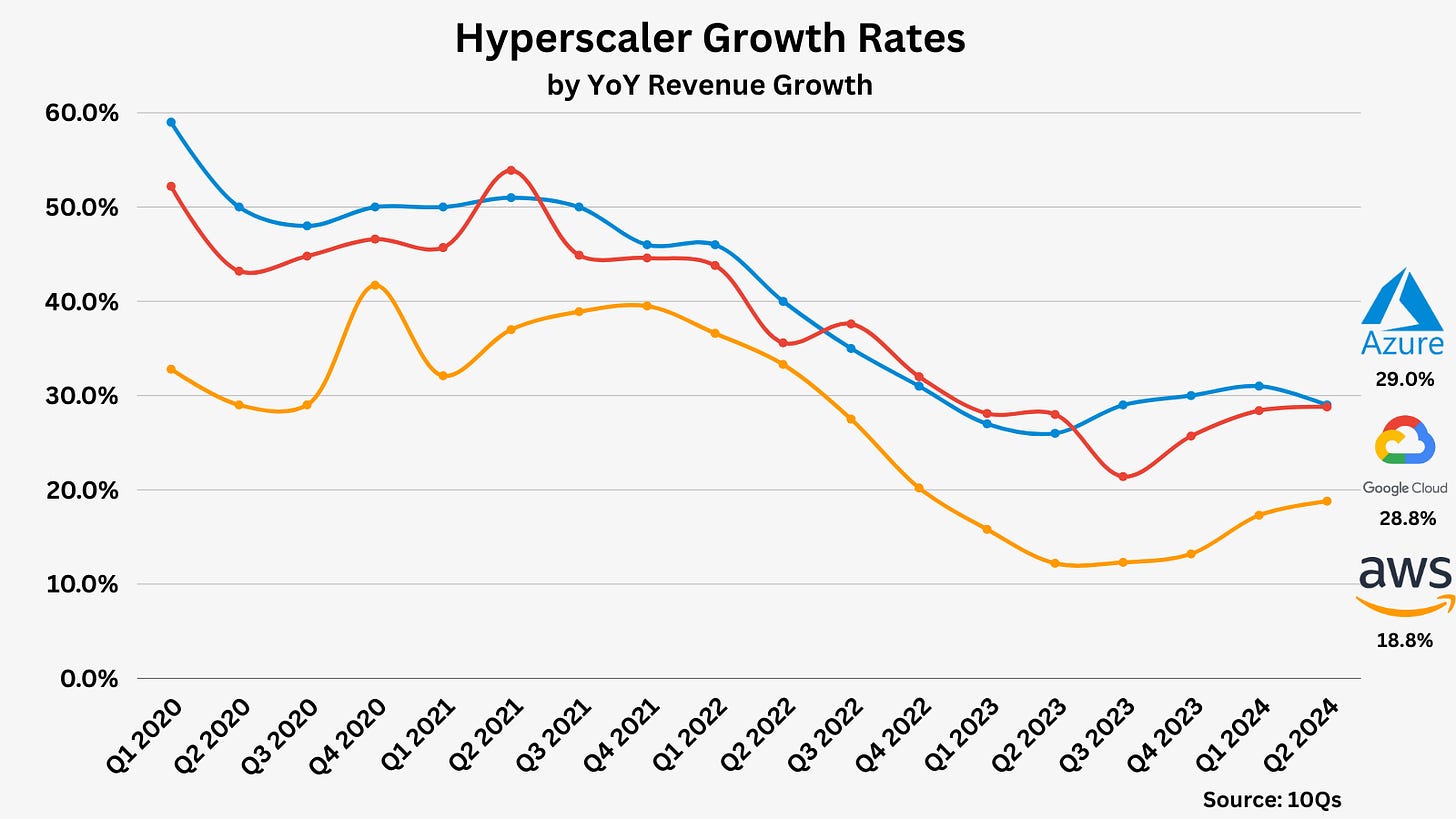

Finally, growth rates remain strong across the hyperscalers. If I can remind everyone: AWS, Azure, and GCP are at run rates of $105B, $78B, and $41B growing at 18%, 29%, and 29% Y/Y. These businesses are some of the best to ever exist.

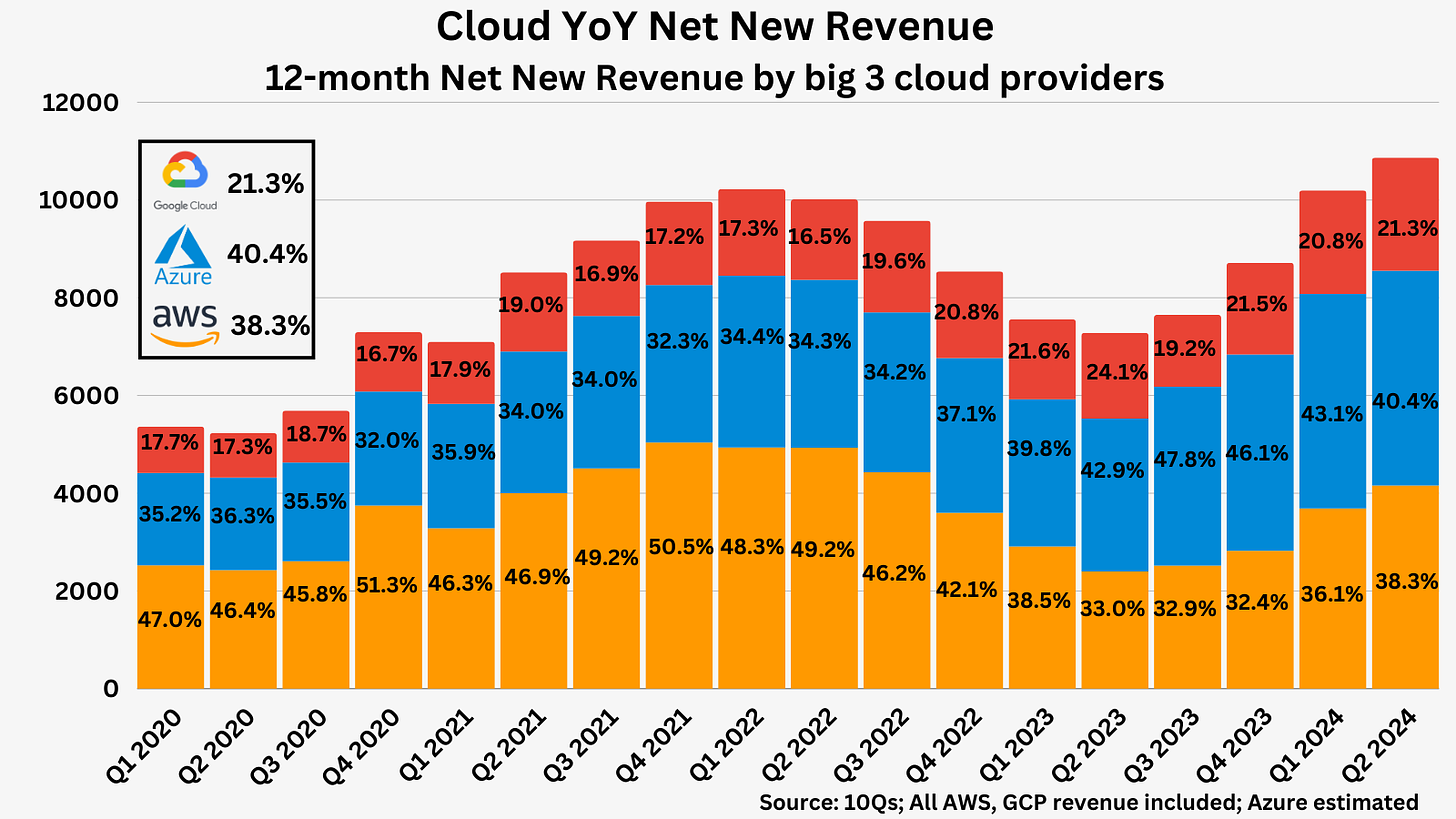

Finally, the cloud market remains strong as a whole. TTM net new revenue has continued to increase for the last four quarters:

The CSPs have remained resilient, especially in comparison to other enterprise software companies.

4. AWS, Azure, and GCP Results

AWS

Three trends were called out by Andy Jassy on the earnings call:

First, companies have completed the significant majority of their cost optimization efforts and are focused again on new efforts. Second, companies are spending their energy again on modernizing their infrastructure and moving from on-premise infrastructure to the cloud. And third, builders and companies of all sizes are excited about leveraging AI.

AWS competes in its own lane strategically. Microsoft and Google want to dominate every layer of the stack. AWS says this, but their actions show that they’re an infrastructure provider. This is what they do best, and they’re maintaining that in AI as well. This quote sums up AWS’ strategy well:

At the heart of this strategy is a firmly held belief which we've had since the beginning of AWS that there is not one tool to rule the world. People don't want just one database option or one analytics choice one container type.

AWS doesn’t care that much about the application layer as long as companies are building apps on top of AWS infra.

Azure

Microsoft is the story of the distribution network, and that’s being shown in AI. Thus far, Microsoft is the biggest revenue winner of AI applications (both from first-party apps and apps built with Azure OpenAI).

Some highlights from the quarter:

- All up, we now have over 60,000 Azure AI customers up nearly 60% year over year and average spend per customer continues to grow.

- The number of Azure AI customers also using our data and analytics tools grew nearly 50% year over year. Microsoft Fabric, our AI-powered next-generation data platform, now has over 14,000 paid customers, including leaders in every industry.

- Just over two years since its general availability, more than 77,000 organizations from BBVA, FedEx, and H&M to Infosys and Paytm have adopted Copilot up 180% year over year.

- Copilot is driving GitHub growth all up. GitHub's annual revenue run rate is now $2 billion.

We can do some back-of-the-napkin math to estimate their Azure AI revenue. For each of the last 5 quarters, they’ve disclosed Azure AI revenue growth contribution. Combining that with net new Azure revenue gives us an idea of how much AI revenue they added each quarter:

Q4 2023 (1% contribution to 26% growth rate): ~$120M

Q1 2024 (3% contribution to 29% growth rate): ~$379M

Q2 2024 (6% contribution to 30% growth rate): ~$803M

Q3 2024 (7% contribution to 31% growth rate): ~$991M

Q4 2024 (8% contribution to 29% growth rate): ~$1.2B

Ballpark, they’ve hit a $5B run rate last quarter. This is great in a year, but not incredible when compared to the hype around AI.

We can also add Github Copilot revenue into this:

Copilot is driving GitHub growth all up. GitHub's annual revenue run rate is now $2 billion. Copilot accounted for over 40% of GitHub's revenue growth this year and is already a larger business than all of GitHub was when we acquired it.

In Oct 2022, Github hit an ARR of $1B, up from ~$300M at the time of their 2018 acquisition. So we can say Github Copilot adds $300M+ run rate to that Azure number.

Finally, we don’t know the rest of the Copilot AI revenue (Microsoft Copilot, Sales Copilot, Security Copilot) so Microsoft has (at the very least) $5.3B in AI revenue run rate but more likely $6B+.

GCP

Finally, we get to GCP. For those who have read my past cloud reports, I discuss GCP the least simply because Google’s earnings calls give us little information about GCP.

GCP accelerated revenue growth again, crossing $10B in quarterly revenue with $1B in operating profits.

Other interesting notes:

- [A small quantitative on AI revenue] “Generative AI solutions for cloud customers have already generated billions in revenues”

- [Continued emphasis on vertical integration] “We are innovating at every layer of the AI stack, from chips to agents and beyond, a huge strength.”

My position on GCP stays the same: I admire their technology and branding. They’re the best-positioned hyperscaler (from a technology perspective) in AI chips, models, and data offerings.

But Microsoft has done a much better job on GTM execution. They’ve moved quickly to release apps, marketed those apps incredibly well, leveraged their distribution network to upsell, and partnered to make up for technical gaps (e.g., OpenAI).

5. Public Comps Data

We can see data across the hyperscalers and other cloud companies on Public Comps. For example, across the BVP Cloud 100, we rank by revenue, ARR per employee, FCF, and other:

My final comment on the cloud space is an observation of the broader technology markets as a whole. For the last year, markets’ narratives have been driven by AI, specifically AI infrastructure. Ultimately, AI will be measured by the application layer: what problems is AI solving? How big are those problems?

Candidly, we haven’t seen large-scale value creation from AI applications yet. It’s unclear to me what that value accretion will look like (if it will primarily be cost-cutting or revenue generation for example). I think it’s a terrible idea to bet against technology, but I also think there’s a divide between reality and expectations right now.

It will be interesting to see whether AI value catches up to valuations or valuations catch up to AI value.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.