BigCommerce $BIGC Investment Note

BigCommerce $BIGC is poised to become one of the leading e-commerce platforms for middle-market and enterprise companies. We outline the investment thesis for BigCommerce and analyze the key metrics, market, competition, and valuation.

Hey Public Compers, this week we are outlining an investment thesis for BigCommerce before Q3 2021 earnings this Thursday. I will continuously update this post with a breakdown of earnings and other business updates as well. If you want me to write a more detailed investment note, please email me or DM me on Twitter.

Summary:

- BigCommerce $BIGC is an open SaaS e-commerce platform that powers both customers' branded e-commerce stores and their cross-channel connections to popular online marketplaces, social networks, and offline point-of-sale systems.

- Customer Replatforming: BIGC is uniquely positioned to capture market share in the ecommerce-as-a-service (EaaS) space due to its commitment to multi-tenant open SaaS and management’s opportunistic penetration of legacy player customer bases.

- New Accounts: BIGC’s best-in-class software functionality and shift to middle-market and enterprise merchants enable it to land incremental accounts ahead of its competitors.

- Customer Onboarding: BIGC's land-and-expand model is misunderstood resulting in low projections for implied GMV and revenue.

Company Overview

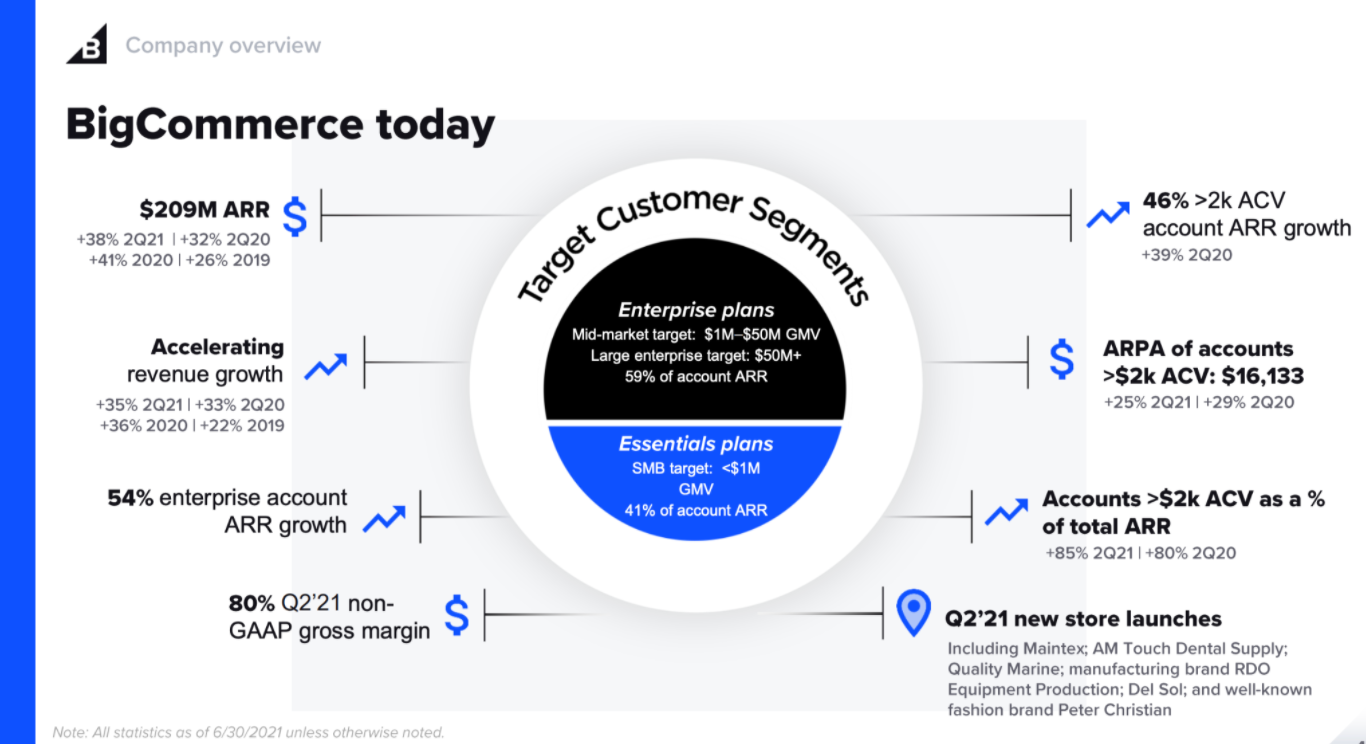

BigCommerce is a $3.2B SaaS platform that provides services to launch and grow a business’ e-commerce presence. BIGC’s platform powers both customers’ branded e-commerce stores and their cross-channel connections to popular online marketplaces, social networks, and offline point-of-sale systems (POS). The company provides a multitude of services targeted at middle-market and up-market customers with deep integrations with best-of-breed third-party service providers in the payments, shipment and fulfillment, and POS space. Unlike other e-commerce platforms, BIGC implements an open SaaS solution which means it offers the benefits of a SaaS platform, but with complete API access and platform modularity that allows larger businesses to integrate, modify, and deeply customize their e-commerce stores to match their specific requirements. Currently, BigCommerce supports 60,000 online stores in 155 countries, with notable customers including Avery Dennison, Ben & Jerry’s, Burrow, SC Johnson, SkullCandy, Sony, among others.

Business Model

BIGC targets three separate segments, which they define by the dollar value of annual online sales:

- SMB's: annual online sales less than $1M

- Mid Market: annual online sales between $1M and $50M

- Large Enterprises: annual online sales from $50M+

Of these segments, BIGC is extremely focused on Mid-market and Enterprise customers.

BigCommerce prices on a subscription basis with pricing based on the number of services utilized by a customer. SMB customers pay one of three rates: the standard package for $29.95/mo with a take rate of 2.9% + $0.30 for each item bought, the plus package for $79.95/mo with a take rate of 2.5% + $0.30, and a pro package for $299.95/mo with a take rate of 2.2% + $0.30. The TTV GMV threshold for these plans are $50k, $180k, and $400k respectively with any SMB going over the $400k threshold paying an additional $150/mo for each $200k in GMV. Enterprise clients are locked in 1-3 year contracts and face a take rate of 2.05% + $0.49. Typically, it takes 3-6 months for BIGC’s sales team to acquire an enterprise customer.

Product Overview & Differentiation

BigCommerce’s platform is fundamentally different from other e-commerce services due to its innate scalability and platform openness. BigCommerce utilizes multi-tenant SaaS, which allows for centralized continuously updated services for customers without needing new databases and infrastructure reallocation to customize new solutions. This allows for greater scalability which is paramount for BIGC’s enterprise customers with significant sales volume ramps.

BigCommerce is also a large proponent of open SaaS which allows for complete API access to every level of BIGC’s platform stack. This allows for much greater site customization while enabling extensive integration with external applications. By implementing an open SaaS protocol, BIGC enables effective cross-channel commerce which drives sales growth while driving partnership with companies in adjacent markets like payment processing and resourcing planning. With this focus on long-term partnerships with companies in adjacent markets, management is able to obsess over providing best-in-class services in e-commerce instead of attempting to penetrate verticals they are ill-suited to compete in. Open SaaS also enables headless commerce which allows customers to take advantage of BigCommerce’s backend while implementing their own custom front end. Customers tremendously value this greater design flexibility and brand design optionality, with many customers converting to BIGC to due this cost-effective headless commerce offering.

When SkullCandy decided to transition to another e-commerce platform from Salesforce Commerce Cloud it considered both BigCommerce and Shopify but ended up choosing BIGC due to pricing and platform versatility.

“Salesforce Commerce Cloud was expensive to manage and maintain. It didn’t have a lot of agility and our team was tied to using external development resources that resulted in higher costs,” - Mark Hopkins, Skullcandy Chief Information Officer

With BigCommerce's open SaaS model, Skullcandy was able to navigate within its own tech framework and inject its own code snippets to ensure that its high transaction volumes are processed and that systems are keeping up with demand.

“The APIs allow Skullcandy to connect its product information system, keep inventory synchronized, interface with the credit card companies, calculate taxes, and translate all the information into the ERP system for fulfillment.” - Mark Hopkins, Skullcandy Chief Information Officer

Through social commerce integration built directly into BigCommerce, Skullcandy was able to greatly increase site traffic and conversion rate. Skullcandy cities that in a YoY comparison between Jan–Mar 2021 and Jan–March 2020, the business experienced a 104% increase in site traffic, a 146% increase in revenue, and a 50% increase in its conversion rate.

“We are really taking bets on social commerce, leveraging built-in BigCommerce integrations to serve product catalogs across social channels where orders start in the social channel, and seamlessly drop into BigCommerce’s control panel for streamlined fulfillment.” - Mark Hopkins, Skullcandy Chief Information Officer

Market Positioning & Market Opportunity

BIGC’s positioning is dependent on various market segments including SMB, middle-market, and enterprises. In the SMB space, Shopify dominates with WooCommerce also being a large competition. Although the street indicates BIGC and Shopify as direct competitors, Shopify has a differentiated approach to creating e-commerce solutions. Shopify is principally focused on enabling SMB merchants and offers a variety of vertically integrated solutions (the biggest being payment processing) to abstract away the complexities of managing eCommerce. While Shopify Plus allows for headless commerce, the Shopify platform is not natively built on open SaaS principles that enable greater customization and flexibility. BIGC has been built with customization as a guiding principle and for the last half-decade has focused on gaining traction with enterprise clients. In this market, BIGC competes with legacy providers Magento (Adobe Company), Salesforce Commerce Cloud (formerly Demandware), and Shopify Plus.

The market for e-commerce has grown tremendously and has experienced step function increase with COVID-19 drastically increasing penetration. In 2020, U.S consumers spent $791.70B online with U.S merchants, a 32% YoY increase, but significantly less than the $4B overall retail spend. This 20% penetration in online retail spend was forecasted to occur in 2022. BigCommerce will experience strong tailwinds from this vast acceleration in e-commerce with seemingly no upper bounds on growth.

While the market size for e-commerce is well understood by the street, BIGC’s serviceable addressable market will be greater than street estimates as there is plenty of growth runway for multiple winners.

Thesis

1. Customer Replatforming: BIGC is uniquely positioned to capture market share in the ecommerce-as-a-service (EaaS) space due to its commitment to multi-tenant open SaaS and management’s opportunistic penetration of legacy player customer bases.

BIGC is one of the smallest EaaS players by revenue and implied GMV but is poised to capture market share from incumbents, particularly Magento.

Magento released version 2.0 of its eCommerce platform in late 2015 to account for shortcomings as the space matured. Version 2.0 was faster, had SEO functionality, and was more user friendly, however, of Magento’s more than 250k current active sites, only 12% of them are upgraded to version 2.0. The conversion is an arduous process that takes months to complete and is for many an insurmountable barrier. Magento ended support for version 1.0 in June of 2020 which leads to compliance and security issues, yet still, companies refuse to transition. This alone leaves 220k sites available to re-platform to BIGC’s offerings, which is 22x BIGC's current number of enterprise and middle-market merchants. BIGC expertly positions themselves to be able to replatform companies on the scale of weeks as opposed to months for competitors (including transitions from Magento 1.0 to 2.0). This enables customers to receive an immediate ROI from transitioning to BIGC which is further compounded by Tegus transcripts that indicate that the Magento platform is decidedly more costly.

In addition to faster implementation speeds, BIGC provides an ecosystem that is future-proof and caters to enterprise companies looking to expand their technology. Its multi-tenant SaaS allows for high performance, user-friendliness, and continuous updates, while its open SaaS enables the extensive partnership program and extreme customizability. These factors amalgamate into an incredibly compelling push for companies looking for new and long-term platforms. BIGC uniquely aims to be the “glue” that holds a company’s eCommerce ecosystem together, rather than the entirety of it. This focus is a large selling point in merchant wins and enables the runway for growth.

2. New Accounts: BIGC’s best-in-class software functionality and shift to middle-market and enterprise merchants enable it to land incremental accounts ahead of its competitors.

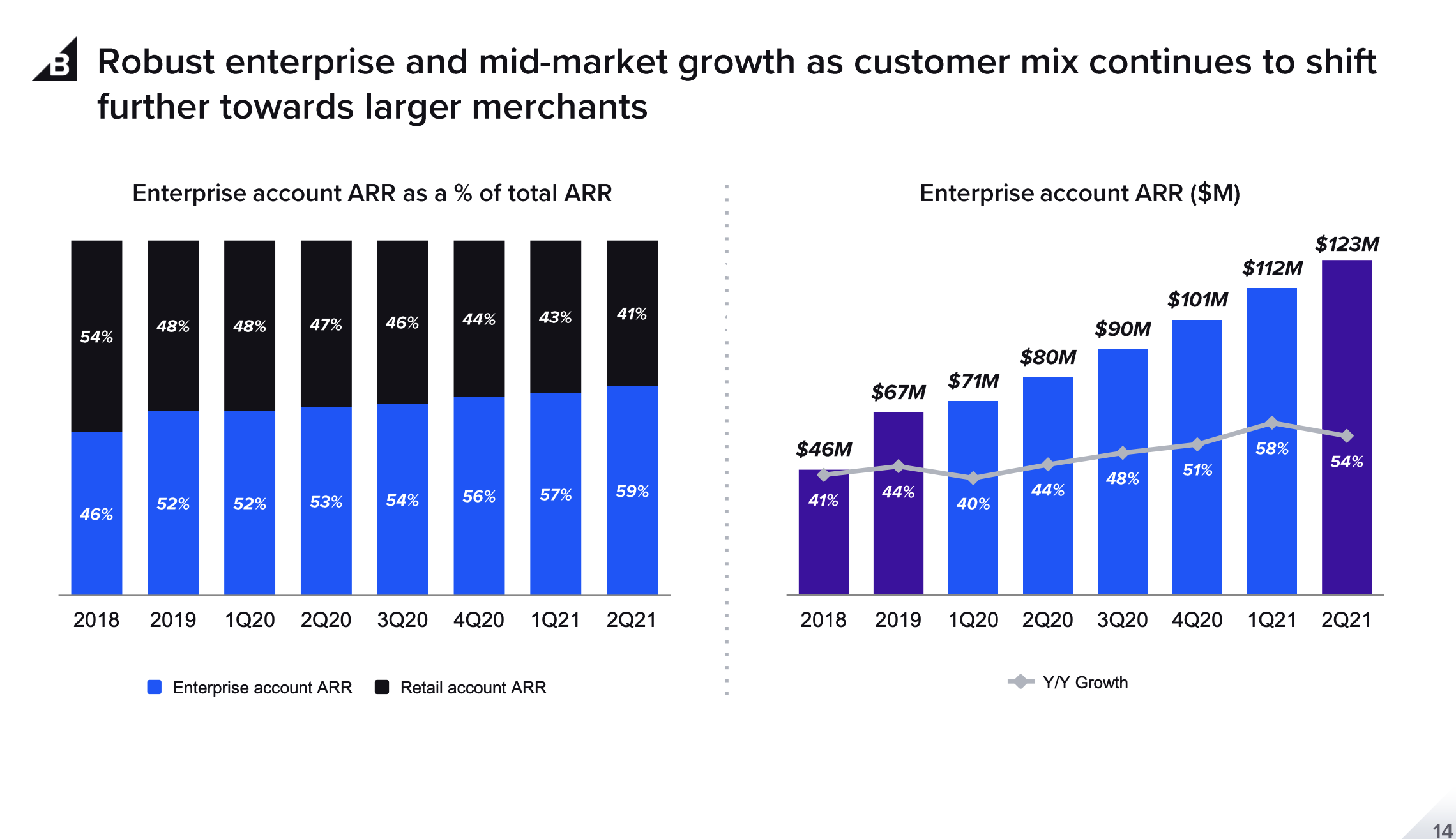

In 2015, BIGC's management team led by Brent Bellm strategically shifted its focus away from SMB’s and toward middle-market and enterprise clients. This strategic move not only shifted BIGC’s target demographic, but also its competitive landscape. Enterprise and middle-market merchants provide better-operating margins, have lower churn, higher ARPA (average revenue per account), but require longer and more convoluted sales cycles. However, most importantly, this market has a very different incremental merchant.

COVID-19 acted as an intense motivator for SMB’s and large enterprises alike to move their brick and mortar operations online into eCommerce platforms. For SMB’s, this was a new business owner requiring a simple implementation of a very technical transition and for the enterprise merchant, it was stress-testing existing legacy systems. As the impact of COVID-19 subsides, the demand for eCommerce does not subside with it. There still remain these two types of incremental merchants, however, they lie in separate competitive landscapes. Shopify currently has an overwhelming command on the incremental SMB merchant, with their deep network effects, out-of-the-box functionality, and ease of use. Even with this hold, the requirements of SMB’s and enterprise merchants differ such that Shopify does not meaningfully compete in both spaces.

In the enterprise space, the types of companies that are most likely to have an in-house or non-existent eCommerce ecosystem are B2B companies. With BIGC’s best in class B2B offerings, they are well-positioned to win these incremental merchants. Unlike most competitors, BIGC has a single integrated platform that manages B2B and B2C eCommerce ecosystems seamlessly. They also have excellent integration with CMS (content management systems) partners and automated pricing segmentation, which caters to companies that operate in both B2B and B2C segments. More generally, BIGC offers a very high-quality product. With lightning-quick load times, nearly perfect uptime, and a knowledgeable sales team, BIGC is at the forefront of innovation in the space and is best positioned to win the incremental middle-market and enterprise merchant away.

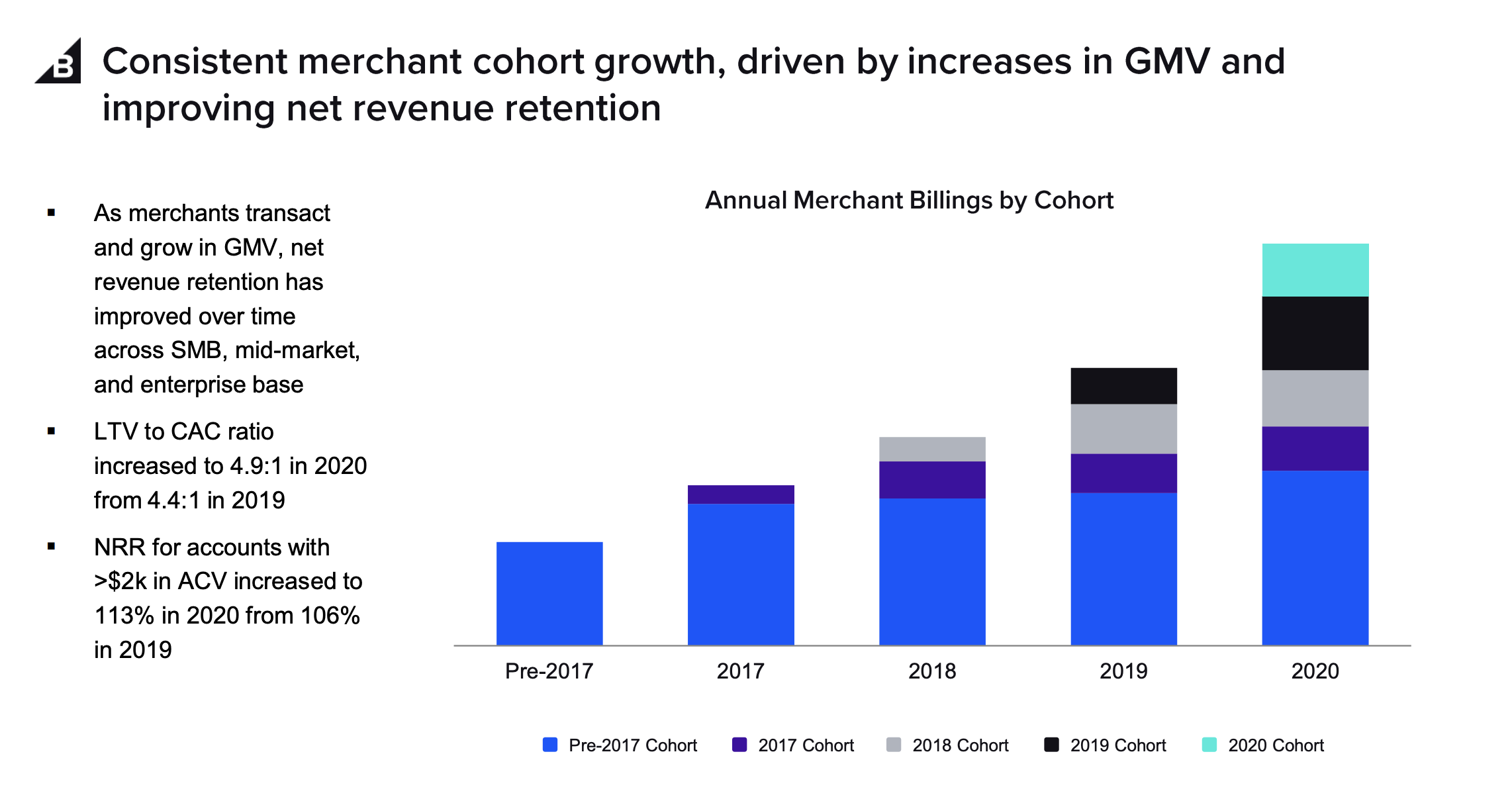

3. Customer Onboarding: BIGC's land-and-expand model is misunderstood resulting in low projections for implied GMV and revenue

The massive size of the e-commerce market is well understood by Wall Street, but the customer acquisition ramping process is not reflected in how the Street models BigCommerce. Tegus transcripts suggest that when shifting over to BigCommerce, companies generally only initially utilize BigCommerce for a portion of their business. It takes time for their entire business to be fully integrated with BigCommerce with an optimized workflow. Thus, after BigCommerce spends the 3-6 months required to acquire a new customer, the growth in their GMV does not occur instantly, and there is not a direct linear relationship between the number of new contracts added and the GMV increase from those contracts. The street, however, models in GMV growth as the number of new contracts, where I feel that existing contracts continue to add residual GMV growth over time. This only makes their ability to capture market share more powerful, as they will continue to grow in the future based on incremental adds in the short term.

Valuation & Financial Model

For the last few months, BigCommerce has suffered from venture capital firms selling off due to fund structure restrictions which has resulted in a non-fundamental depression in valuation. In particular, General Catalyst one of the biggest VC investors in BIGC has routinely sold off in the last few months. At this current share price of $46.1o, an asymmetric opportunity exists.

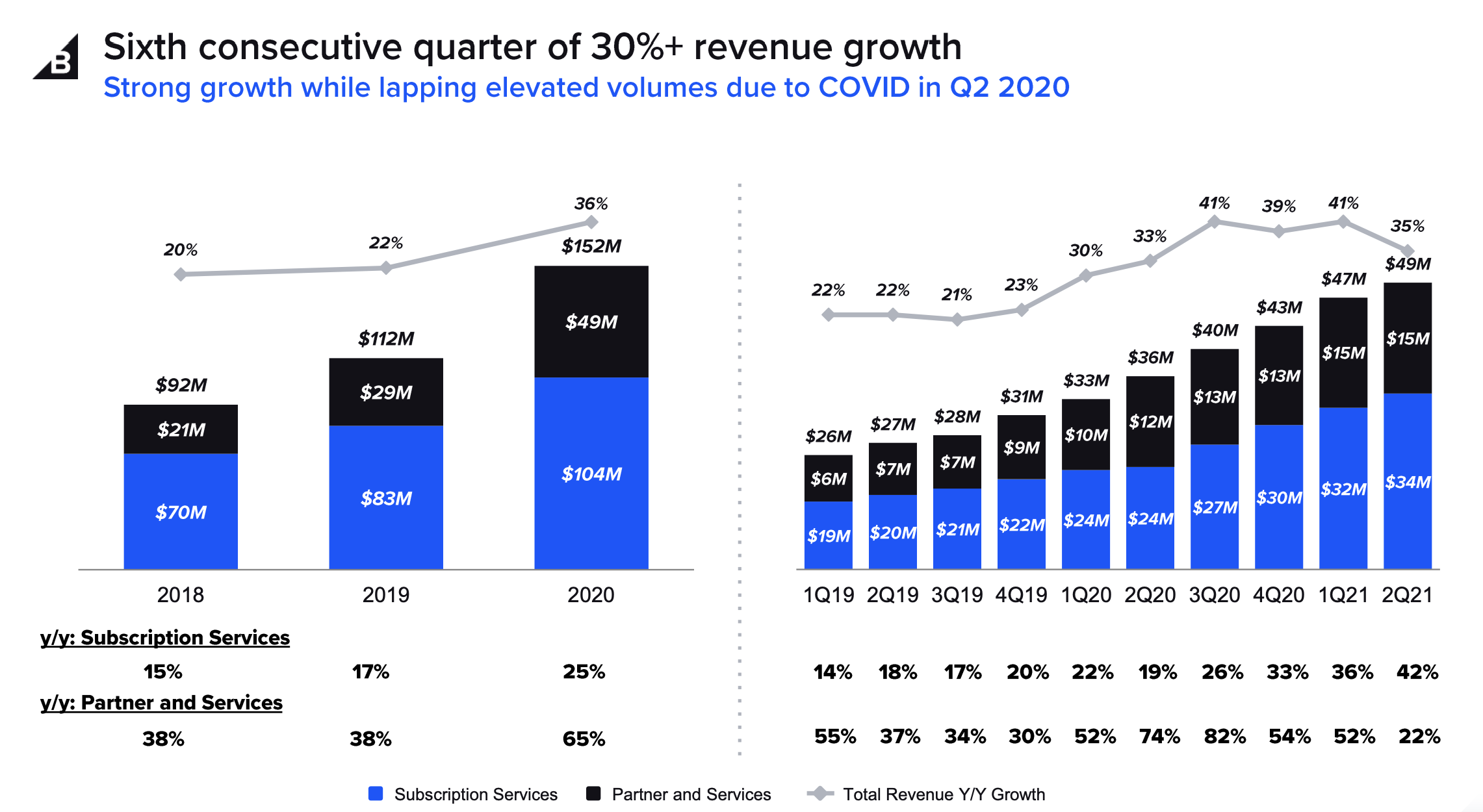

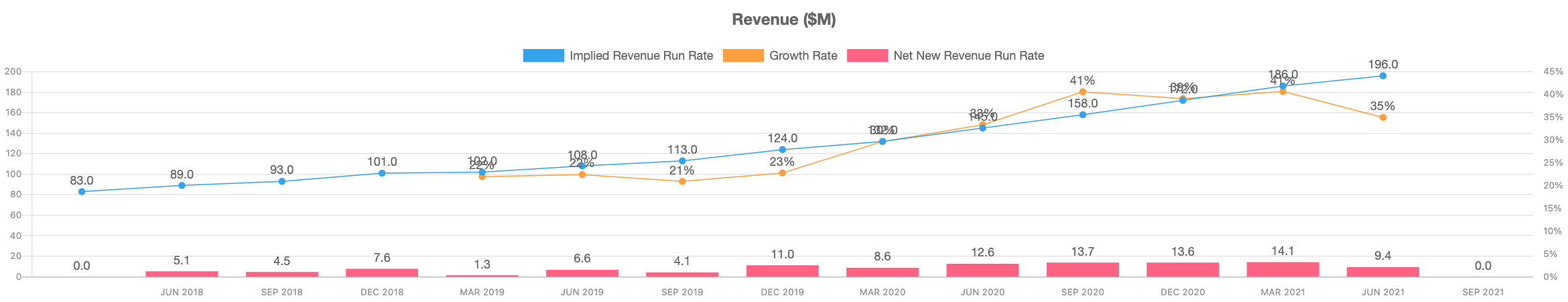

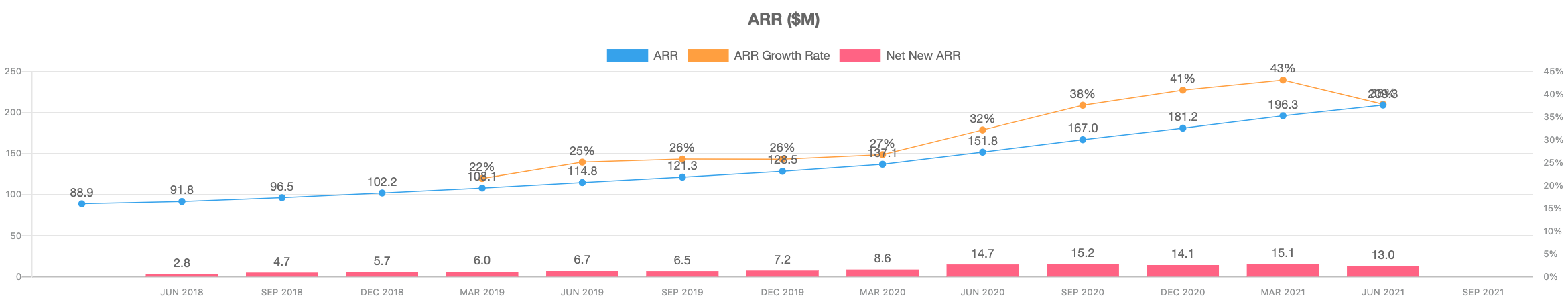

To model out BIGC's revenue we linearly increased net adds by 250 for Enterprise & Middle Market customers and tapered down Entperise & Middle Market subscription ARPA by around 1.5% annually to get an annualized ARPA of $24,060 in 2026 with 24,444 total accounts. Using this we back calculated revenue in 2026 as $813M with ARR in 2026 as $865M. I utilized the Public Comps Excel plugin to seamlessly gather most of the historical financials.

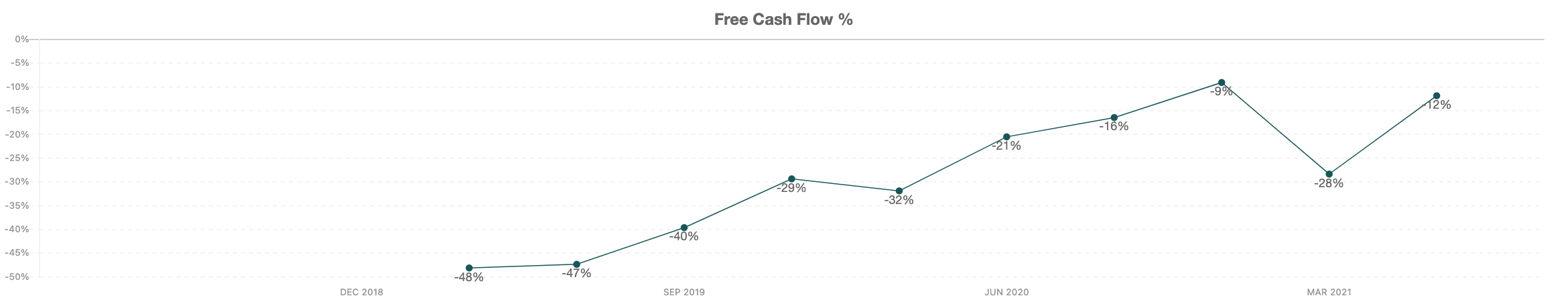

We also expect operating margin and FCF margin to improve faster than the street expects due to operating leverage from greater than street revenue numbers.

Applying a 15x multiple on 2026 forward earnings of $813M and discounting at 15.0% leads us to our present value calculation with a 5-year 26.6% IRR.

That's it for this week, hope you liked the thesis, and please let me know your thoughts on BigCommerce. As always, don’t hesitate to shoot over a message with any feedback or if you’d just like to chat. Would love to chat with people with differing opinions on BIGC!

Cheers,

Aneesh Tekulapally (@aneesh_tek on Twitter)