Bill.com S-1 & IPO Teardown

We go through Bill.com's S-1 and benchmark the business against other high growth software companies

Description: Founded in 2006 by René Lacerte, Bill.com provides cloud-based software for small and medium businesses to pay vendors, approve bills, and collect money from customers. Additionally, Bill.com services accounting firms (over 70+ of the top 100 accounting firms) by helping them grow their book of business by automating bookkeeping tasks on behalf of customers. Banks also use Bill.com to provide their customers with a digital solution around cash flow management. The business also pitches itself as scaling with growing mid-size businesses like Hashicorp.

- Pay Bills (Account Payable): Bill.com solves the pain point of customers having to manually send physical checks to pay for bills or track invoices and bills in filing cabinets. The company provides customers the option of paying via ACH, physical check or through a virtual credit card and if its an international vendor, Bill.com waives the international wire transfer fee.

- Approval Workflow: Company's product can scan and digitize invoices in PDF and automatically generate a bill that kicks off the approval process by notifying the person who needs to approve the bill or invoice.

- Get Paid (Account Receivable): Business also enables SMBs to send digital invoices to customers and sends automatic reminders to for customers to pay.

- ROI: The company claims to have cut down the processing time of paper bills and invoices for a customer from 3 days a month to 1 hour and to help customers get paid 2x faster. In some instances, customers claim to have saved on not having to hire a full-time accounts payable person given the 2,000+ bills they receive in a year.

Business Model: Bill.com makes most of its money from subscription -- business owners pay $40-$100/user/month-- and transaction fees from ACH processing, checks or invoices mailed, virtual card payments, etc.

Go-to-market: Company acquires SMBs directly via online channels, word of mouth and trade shows. Additionally, Bill.com acquires customers indirectly via partnerships with 70+ of the top 1000 accounting firms which then introduce Bill.com to their clients.

Competition: Bill.com has various competitors that go after SMBs from larger enterprises like SAP, Sage Intacct, and Netsuite but also startups like Expensify that focus mostly on receipt and expense management (and not necessarily invoices). The accounting software tools like Freshbooks, Xero, and Quickbooks also provide some sort of AP and AR management but don't seem to act as direct competitors.

Strengths

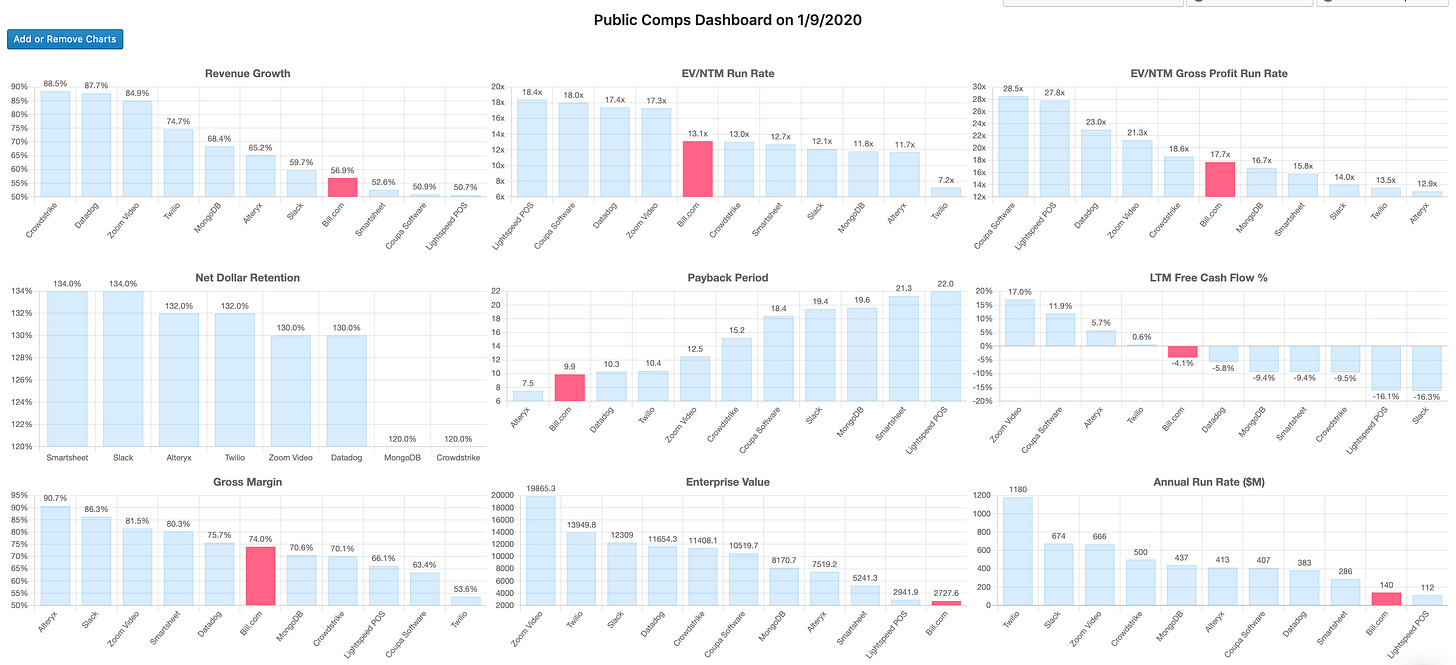

👏Growth: 8th fastest-growing Public software company at 57% YoY and $140m revenue run rate (quarter revenue *4). Note the revenue isn't necessarily recurring software.

👏Low Cash Burn: the business consumed nearly $190m of capital to get to $140m revenue run rate which is ok from a capital efficiency perspective and most recently is -4% FCF which is effectively cash flow break even.

👏Gross Margins: margins are ~74% which is good but not necessarily amazing.

Weaknesses

🤷♂️Payback Period: While we have Bill.com as 2nd lowest payback period at 10 months using our 1/CAC Ratio methodology but the company does explicitly note that the average payback period in 2018 was 15 months which is good but not best in class for a business servicing SMBs.

🤷♂️Net Dollar Retention: Moderate net dollar retention at 110%. Understandably Bill.com is going after SMBs unlike the other high growth enterprise software companies

🤷♂️High Valuation: Business is trading for 13.1x EV/NTM ARRR which is in the middle of the pack for high growth software companies despite not necessarily having best in class NDR, payback period, or growth

🤷♂️Older Business: The company has been around since 2006 (versus the 2019 IPO class, the median founding date was 2010) and took nearly 13 years before going public. One worries that there may be a new up and coming product like Brex that may grab market share from Bill.com as companies like Brex move payments from ACH and invoices to credit cards.

Overall: Bill.com is a software company that's moving SMB payments online and growing quickly. However, the valuation is quite rich relative to peers and doesn't have exceptional business metrics.