Docusign (DOCU) Q4 2020 Earnings Teardown

This post breaks down Docusign's (DOCU) Q4 2020 earnings.

This post breaks down Docusign's (DOCU) Q4 2020 earnings. We break down the business, benchmark the metrics, and provide takeaways from the earnings call.

Summary

- Q4 Billings growth +46% YoY

- Q4 Revenue grew 57% YoY to 431 million and subscription revenue grew 59% YoY to 410 million

- 125,000 enterprise & commercial customers and 892,000 total customers (70k net new)

- Strongest expansion and up-sell yet, driving net dollar retention to 123%

- 80% non-GAAP gross margin

- 10% FCF margin

Company Overview

DocuSign’s mission is simple: “to accelerate business and simplify life for companies and people around the world”.

The company creates solutions for “automating and connecting the entire agreement process” with DocuSign’s products designed to be frictionless, cloud-based, and cost effective for global organizations with 90% of Fortune 500 organizations using or having used DocuSign.

Founded in 2003 as an eSignature product, DocuSign gained traction after real estate brokers adopted the solution to reduce closing costs and times. The product scaled rapidly enabling customers to sign documents securely using almost any device globally. Growth further accelerated following the release of the DocuSign mobile app on Windows, Android, and iOS. The app revolutionized the signature process allowing users to annotate and sign documents by storing their signature and attaching it, allowing users to take photos of handwritten signatures and upload them, or allowing users to type their name in a signature generator with various styles. By offering a variety of signature options and a dead simple user experience, DocuSign’s eSignature is the #1 signature product globally.

DocuSign’s focus on reducing friction led to the creation of the broader DocuSign Agreement Cloud, a suite of cloud-based solutions that automates and connects the entire agreement process. By leveraging the cloud, DocuSign’s automation and agreement platform is the most comprehensive and seamless for customers, ensuring DocuSign will dominate the agreement space for years to come.

As DocuSign scales, management looks to continue its evolution into an agreement cloud company through 3 primary goals:

- DocuSign aims to be the best way to agree to anything anywhere.

- Docusign wants to digitally transform the entire agreement process.

- DocuSign wants to be embedded into every application (already integrate with 350 apps).

Product Overview

DocuSign’s core product is the DocuSign Agreement Cloud, a suite of services including their leading DocuSign eSignature solution with 350+ pre-built integrations with other applications, like Microsoft, SAP, Google, Salesforce, and Workday.

The DocuSign Agreement Cloud includes:

- DocuSign eSignature - the most cost effective and fastest digital signature solution.

- DocuSign CLM - an automation solution for the entire contract lifecycle that generates agreements, facilitates negotiation, tracks redlines and ensures version control across contributors, reviewers, and approvers.

- DocuSign Insight - contract analytics tool that finds, filters, and analyzes all existing agreements to help customers build a deeper intuition in contract structure.

- DocuSign Analyzer - provides an AI powered automation tool to analyze agreement-documents for risks and opportunities for contract negotiations.

- DocuSign Notary - electronic notarization tool that securely authenticates and verifies signers’ identities anywhere in the world.

DocuSign also provides ancillary services with DocuSign Payments a product that collects and processes payments during the signing process and DocuSign Identify a verification tool that enables customers to securely verify signers’ identities prior to accessing an agreement.

Business Model

DocuSign operates as a freemium software provider, charging users for their eSignature product on a per user basis, with various plans for individuals, SMBs, and enterprise customers. The free plan allows users to request 3 signatures monthly with signing received documents always free. The Personal plan is suitable for individual contractors and limits a single user to sending five documents monthly to collect signatures. DocuSign additionally offers a Standard and Business Pro plan with unlimited eSignature requests, additional security, and team-oriented features charged on a per user basis. An Advanced Solutions package comprising the Enterprise Pro and Platform plan is built on top of the Business Pro package and includes additional services from the Agreement Cloud suite like CLM, Payments, and smart contract solutions.

Why DocuSign wins

Essential business product

- Contracts lie at the core of every transaction, and the digital transformation induced from COVID has made DocuSign an essential solution that empowers the day-to-day operations of businesses globally. As the Agreement Cloud steadily increases its breadth of enterprise focused on automation and smart contracts, the cost savings, operating efficiency, and broader value add of implementing DocuSign’s CLM make it a necessity for every business.

Competitive market positioning

- DOCU’s product is a lightweight cloud first solution that has quickly become the de facto leader in the eSignature and broader CLM market. As the trailblazer in the eSignature market, DocuSign’s enjoys global brand recognition and is synonymous with CLM. Additionally, DOCU’s one of the few vendors in the enterprise focused contract management space that has the scale and distribution to land global Global 2000 customers. DocuSign has over 70% market share in the eSignature market and COVID has further separated DocuSign from competitors.

Consolidating CLM market:

- DocuSign is poised to become a category defining end-to-end solution “Gorilla” for all processes related to CLM. Management has shown the ability to pinpoint high-growth verticals in the contract agreement space like contact analysis and notary services. By implementing this land and expand strategy, DocuSign’s acquisitions and essential eSignature product increase TAM, allow further pricing power, and consolidate the CLM market.

- Recent acquisitions of Liveoak Technologies and Seal Software, expand the Agreement Cloud’s capabilities and demonstrate management’s laser focus on offering the most complete software package that automates mundane paper-based processes. The Liveoak Technologies acquisition serves as the underpinnings of DocuSign’s Notary solution that requires audio-visual technology to complete a notarial action. The acquisition of Seal Software allows for AI driven contract analytics that allows users to rapidly search large collections of agreements by legal and business concepts and automatically extract and compare critical clauses and terms side-by-side. This allows DocuSign to pinpoint areas of risk and opportunities, further adding value to the Agreement Cloud suite. Furthermore, the acquisition of SpringCM in 2018 has led to DocuSign’s industry leading CLM solution indicating management's ability to increase TAM and upsell additional products.

“And I think you may see us do more of that in the future, increase the number of small investments we're making in companies we see in the broadly defined agreement cloud space. And then, potentially have those as acquisition opportunities. The second part of your question around the competitive landscape, we don't think there's been any change. We always say very aggressively, when we think about competition, we fundamentally think about paper, when we think about paper and manual processes. We are so early into this game in terms of where the TAM is. The vast, vast majority of all of our growth is coming from new field expansion. From time to time, people want to upgrade. Particularly in signature, we'll see that where someone will wanna move from a less advanced sort of smaller feature set provider.” - CEO Dan Springer

Market Opportunity

Management seems to slightly overestimate TAM by generating a list of all companies in core markets and applying an approximate ACV to each company based on size, industry, and location. Direct calculations of TAM by global research firms are unspecified but a report from Fortune Business Insights expects the digital signature market to reach approximately $8B in 2027 with a 28.9% CAGR. A report from MGI research expects the cloud-based CLM market to have a TAM in excess of $7.6B by 2022 and a TAM around $20B later in the decade with a 31% CAGR. While CLM adoption is still in the early stages, DocuSign is well positioned to become the dominant player due to its eSignature solution with 70%+ market share. Additionally, Gartner predicts that AI will bring 30% more efficiency in contract negotiations and DocuSign’s massive customer base coupled with their aggressive acquisition strategy should ensure the Agreement Cloud suite is the best trained and most effective AI powered CLM suite.

Key Takeaways

1. International expansion looks to be an even bigger TAM with stronger growth rate:

- Currently only 20% of revenues come internationally. Over the past 3 quarters, Docusign has been ramping up its international employee headcount, which saw a big jump from 2019 and grew 55% YoY over the past 3 quarters.

“One of the things that was really interesting for us finishing up the year, and you don't get to say this very often, but the same thing happened in Q3, happened in Q4. Every single geography that we're in outside of the U.S., and for that matter, the U.S., exceeded its plan.” - CEO Dan Springer

“I think we're just realizing it's a very large TAM opportunity outside of the U.S., and we're starting to really hit that growth curve in the way we'd like to be hitting it, and we're optimistic we're gonna continue to see that through the year ahead.” - CEO Dan Springer

2. Docusign is capitalizing on a secular and structural change in the way companies do business.

- Barriers to adoption have been removed as the world needed to digitize. New use cases sprawled up and customers from every industry began to adopt.

And this shift is secular.

“We haven't seen anything in our business that suggests that that will change. Now if you recall, we've said this about -- starting about three quarters ago, that our forecast on this is that the people that have come with new customers or new use cases to DocuSign that are COVID-19-centric, they're not going back. People aren't going back to paper. They're not going back to manual processing. So the real question, I think, is interesting in your question is, will that rate of new people coming to us change with -- as we start to move into some sort of return to "normalcy". We haven't seen any change yet." - CEO Dan Springer

Docusign went from a nice-to-have to mission-critical software.

“For example, one of our financial services customers in the U.S. came onboard early last year as part of its COVID-19 response strategy, and they deployed DocuSign across more than 20 use cases in the past six months alone. So far, DocuSign has powered almost 100,000 transactions for their HR, procurement, customer service and in-branch onboarding needs. These transactions took less than a minute to complete on average, delivering a rapid ROI. And DocuSign went from a crisis response solution last year to a business as usual solution today.” - CEO Dan Springer

3. Customer adoption of Docusign is strong, but decelerating

Docusign saw its lowest net new paying customer adds since before the pandemic. Total customers also saw its fewest net adds since Q1, showing that digitalization trends are still growing, but have decelerated from its peak in Q3.

4. Net dollar retention has risen the past 7 quarters.

Docusign’s net dollar retention has been on the rise and just reported their highest net dollar retention in Q4, showing that usage has been increasing among customers. Docusign is able to upsell customers by selling more users or upgrading to higher tiers on the e-signature product, as customers increase their usage of the product.

5. Q4 billings, despite the deceleration, looks more impressive when considering it was up against a tough comp and a Q3 had some major deals.

Billings can fluctuate more just given the nature of that metric and the timing of invoicing. Management points to the four-quarter average as the best indicator of underlying business growth because it smooths out the changes quarter-to-quarter. And if you take that lens and apply it to Q4, it was really right in line with the last couple of quarters in that trailing average.

Q4 billings came pretty close to the pin relative to the prior quarters where DocuSign had put up pretty strong double-digit beats against the high end.

DOCU’s Q3 2020 was exceptionally strong based on timing of deals and some early renewals that came in Q3. And so Q4 was a strong growth as well at 46%, just not as strong as the Q3 growth.

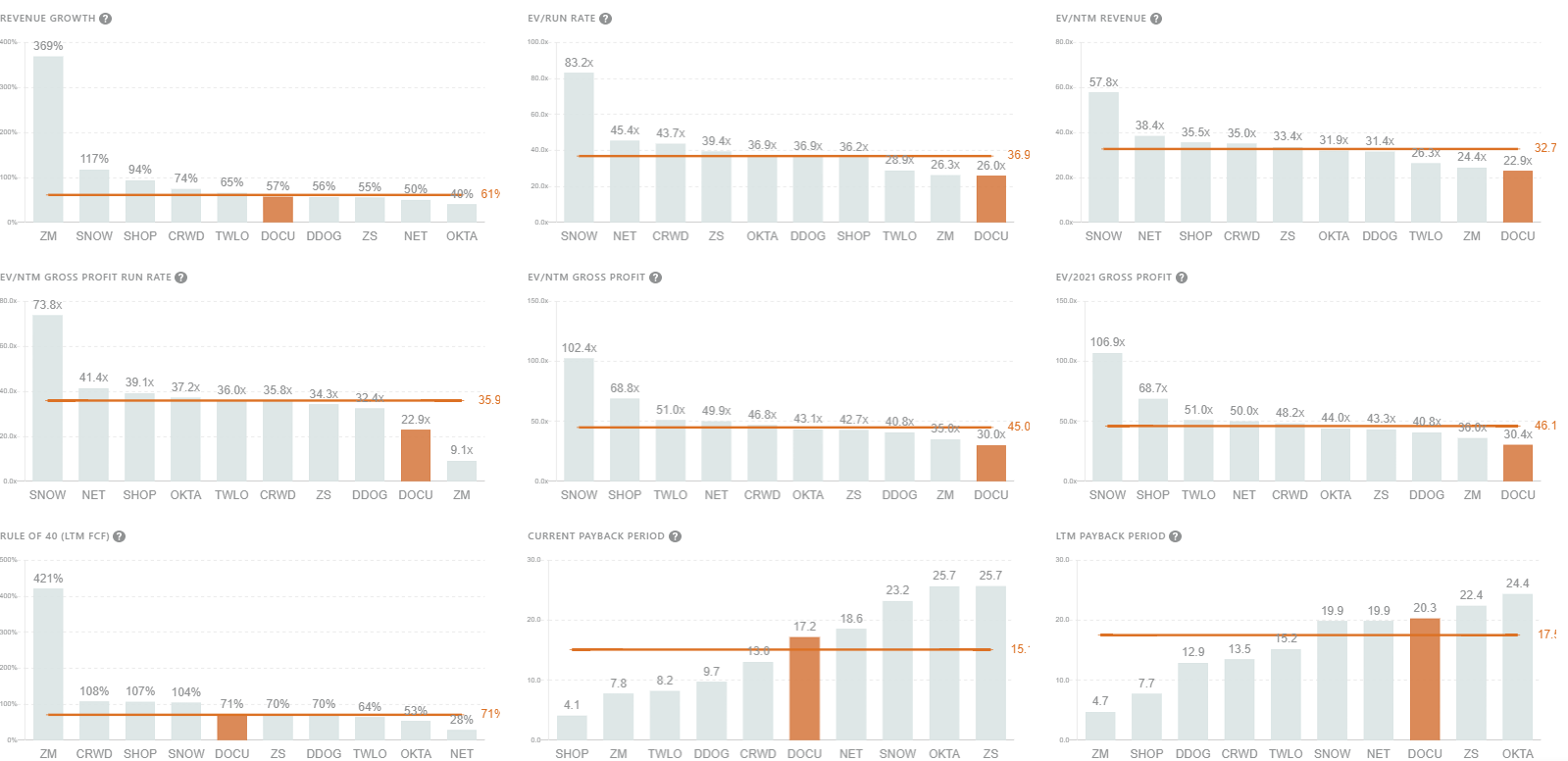

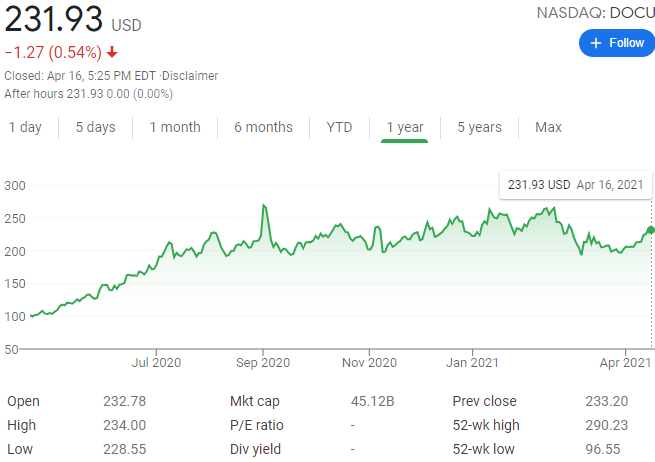

Valuation

Although the stock has traded sideways for the past 3 quarters, at 26x ARR and 23x NTM revenues growing 57% YoY, the valuation doesn't seem unreasonable. DOCU faces tough comps in 2021 given the large number of new lands.