SaaS continues to get hit due to COVID-19 concerns. Here's why.

SaaS multiples are down 30% in the last month. We discuss why COVID-19 affects SaaS businesses.

We've seen a major drop in SaaS share prices and multiples in the last month. Why does COVID-19 affect software businesses which are predominantly digital and not reliant on physical supply chains like retail stores or directly related to business travel like airline or travel companies ?

SaaS is clearly taking a hit

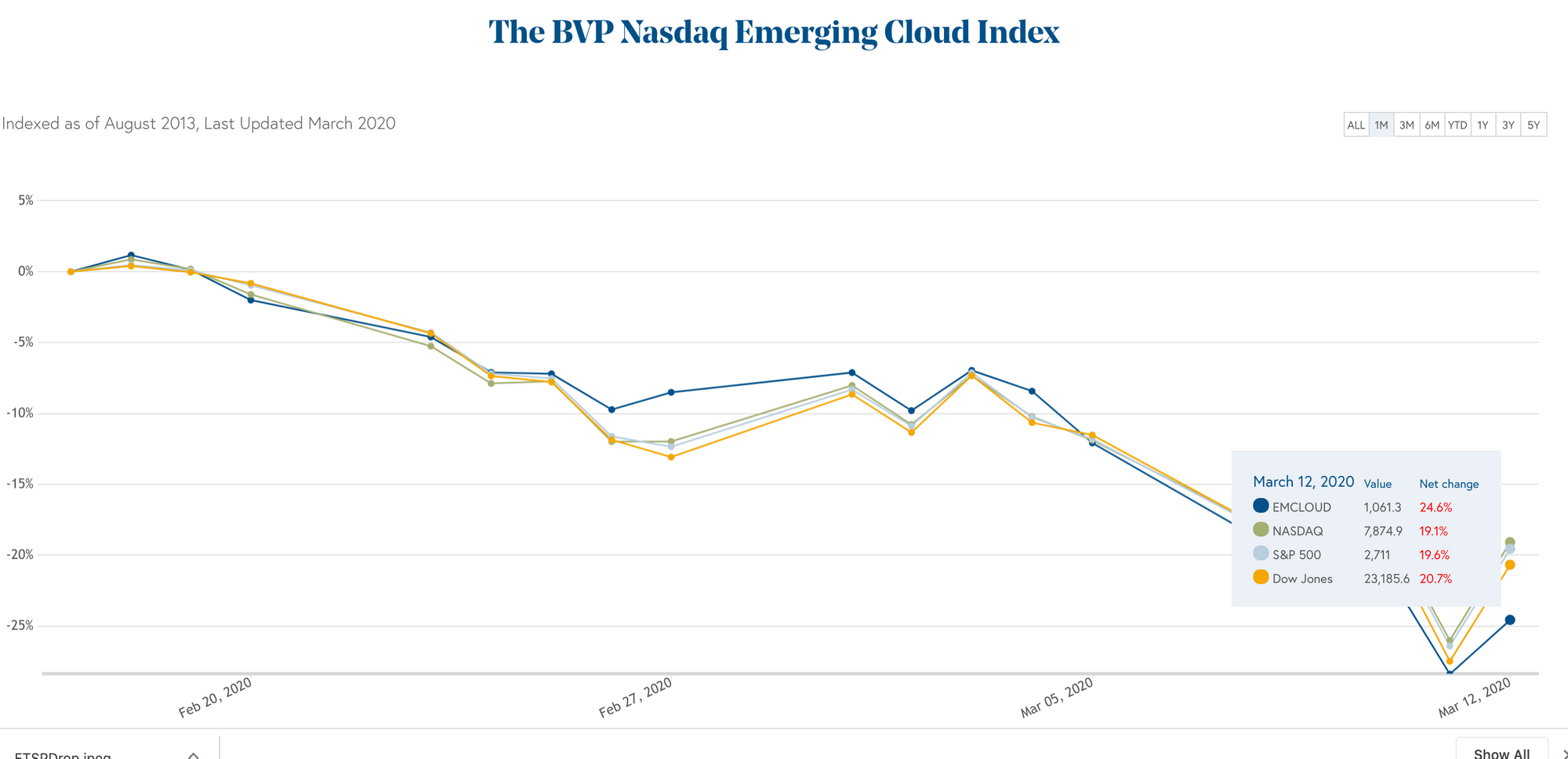

Indexes down: BVP Cloud Index down 25% in the last month and S&P/Dow down ~20%

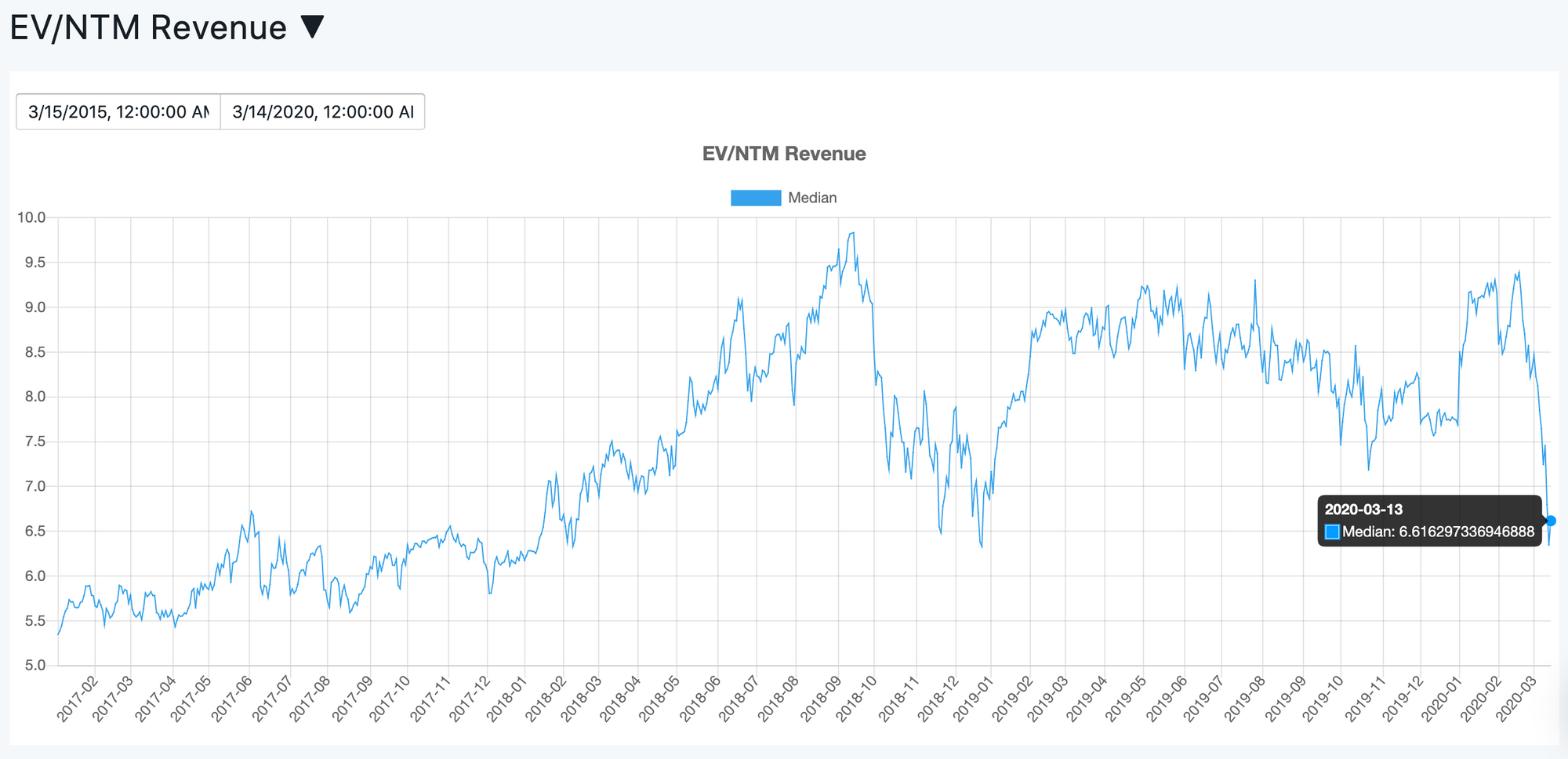

Median B2B SaaS Valuation Multiples: 6.6x ( -30% from the peak of EV/NTM Revenue of 8.3x on 2/18/20 about a month ago!)

B2B SaaS Multiples continue to drop due to COVID-19 concerns. Here's why:

- IT Spend to Drop: "IDC on Wednesday said annual growth in global IT spending this year might drop to 1% in 2020 from an initial forecast of more than 4%. In the worst-case scenario, the total is expected to be roughly $2.3 trillion, down from an earlier estimate of $2.5 trillion." WSJ

- Slack gains users but harder to close deals: "Chief Financial Officer Allen Shim told analysts that Slack was seeing a surge in free use of its service. However, he said, a global slowdown in travel over virus concerns could make it harder to close new deals. Slack’s earnings outlook reflected that uncertainty, he said. The company’s sales forecast of $185 million to $188 million for the current quarter, and $842 million to $862 million for this fiscal year, both fell slightly short of Wall Street projections, according to FactSet. Shares plunged more than 18% in after-hours trading." WSJ

- Adobe deals with delay bookings: "Publishing software provider Adobe Inc. Thursday said the spread of the novel coronavirus was affecting spending, particularly in areas hit by the pandemic. Because of the health crisis, “we expect some enterprises will delay bookings, postpone services implementation and reduce expenses,” Adobe Chief Executive Shantanu Narayen told analysts after the company posted first-quarter results. “The situation is concerning” in the short-term, he said, with “tremendous uncertainty.” WSJ

- Lower Close Rate & Canceled User Conferences: "Baird analyst Rob Oliver in a report said "travel restrictions pressuring large-deal close rates as well as (deal) pipeline damage incurred from cancellation of user conferences and events" will pose a problem for some software companies." Investor.com

- Low Touch Self Service Wins: At Cowen, analyst J. Derrick Wood calls Atlassian one of the software companies that "enjoy favorable business models that can better withstand travel disruption as a result of their low-touch/self-service digital customer engagement models." Investor.com

- Lower Revenue Estimates: "In a similar vein, Jefferies analyst Brent Thill cut estimates for 40 companies in his coverage universe for their current fiscal years by 1%-3%. Thill notes that over the past few weeks, a number of companies have already made cautious comments on the outlook." Barrons

Some Thoughts

- These are one time cuts: A recurring theme in a lot of these explanations is that software spend will take a hit due to travel restrictions preventing the closing of large enterprise deals for more top-down sales heavy companies like Workday, SAP, etc but that self-service products like Atlassian, Zoom, Slack, Alteryx, Twilio, Datadog may fair the storm much better. Additionally, the delay in bookings, implementation of services or closing of customers seems to be temporary. I suspect the one-time shock of Coronavirus will endure as long as it prevents business travel and creates uncertainty around software budgets, but once that passes, companies still need to buy software to run their businesses.

- 1-3% cut is not a lot: Even if companies reduce their revenue estimates (and actual revenue) by 3% (on the higher end of analyst estimateS), for a business like Crowdstrike that has an estimated revenue of CY2020 of $686 and the guidance is actually 3% lower or $665, that's a $21m difference. Crowdstrike added $77m net new ARR in their last quarter so an incremental $21m revenue doesn't seem that worrisome in the bigger picture. A 30% drop in SaaS multiples seems to be an overly large response to a 3% reduction in revenue guidance.

Data Source: we're getting our NTM Revenue source from Zacks.com where we take the median analyst estimate of NTM revenue. You can see the list of our 80 Public B2B SaaS Companies here