Public Comps Weekly Dashboard 8/14/2020: ZoomInfo earnings teardown and Coupa Investment thesis

ZoomInfo Q2 earnings teardown and breaking down Coupa Software

👋 Public Comps Customers 👋

tl;dr In this week's newsletter, I benchmark SaaS against public indices, take a quick look at median B2B SaaS valuations, teardown ZoomInfo's first public quarter since IPO, and dive into why Coupa trades at a premium multiple despite its seemingly slower growth rate!

1️⃣ SaaS Stock Prices vs. Benchmarks 📊

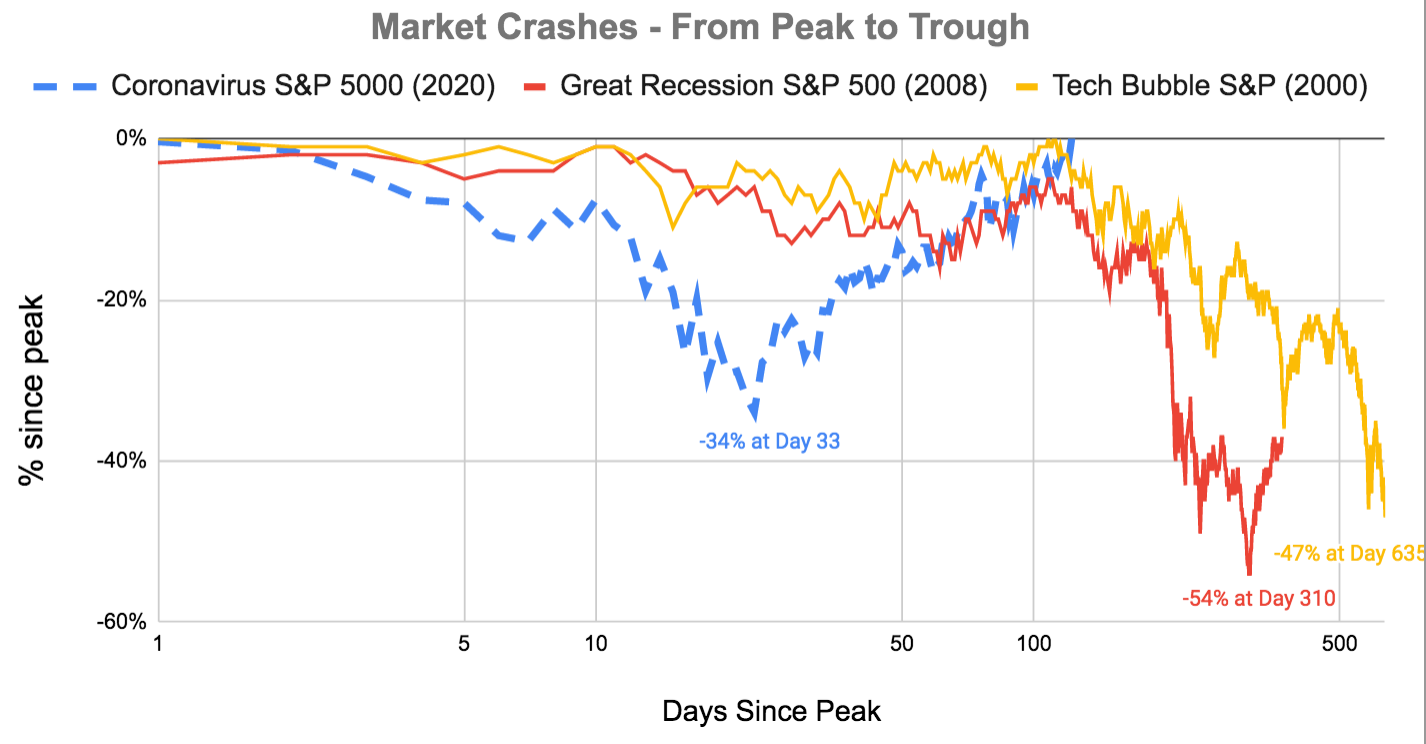

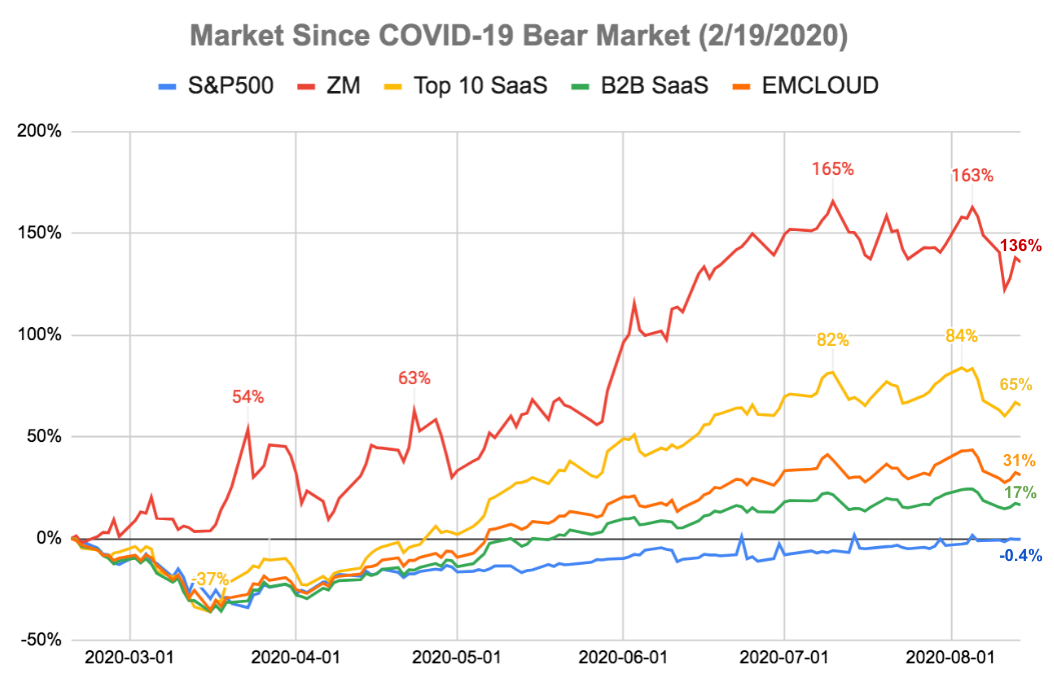

176 days since the start of the bear market on February 19th, and the S&P 500 is just shy of returning to an all-time high!

Change since bear market start (2/19/2020):

- ZM: +135.7%

- Top 10 SaaS: +65.4%

- Bessemer Cloud Index (EMCLOUD): +31.2%

- B2B SaaS: +16.5%

- S&P 500: -0.4%

Change in the past week:

- ZM: -13.2%

- Top 10 SaaS: -2.5%

- Bessemer Cloud Index (EMCLOUD): -1.9%

- B2B SaaS: -2.1%

- S&P 500: +0.6%

SaaS markets: This week saw some more correction to high SaaS valuations. While digital transformations have been accelerating, not all SaaS companies are benefiting in the same way: category leaders are grabbing more market share than they used to; as historically, software markets were far more fragmented than they are today. These larger cloud category leaders also benefit disproportionately from better unit economics and scale in order to maintain operating leverage during COVID-19.

Broader market: For the second consecutive week, slower-growing value stocks outperformed the broader market, which suggests a market rotation is underway after the significant outperformance of growth. Specifically, the industrials sector outperformed within the S&P 500, which was helped by strong gains in package delivery firms FedEx and UPS. With long-term treasury yields increasing, the small utilities and real estate sectors lagged as their dividend yields appeared less attractive in comparison.

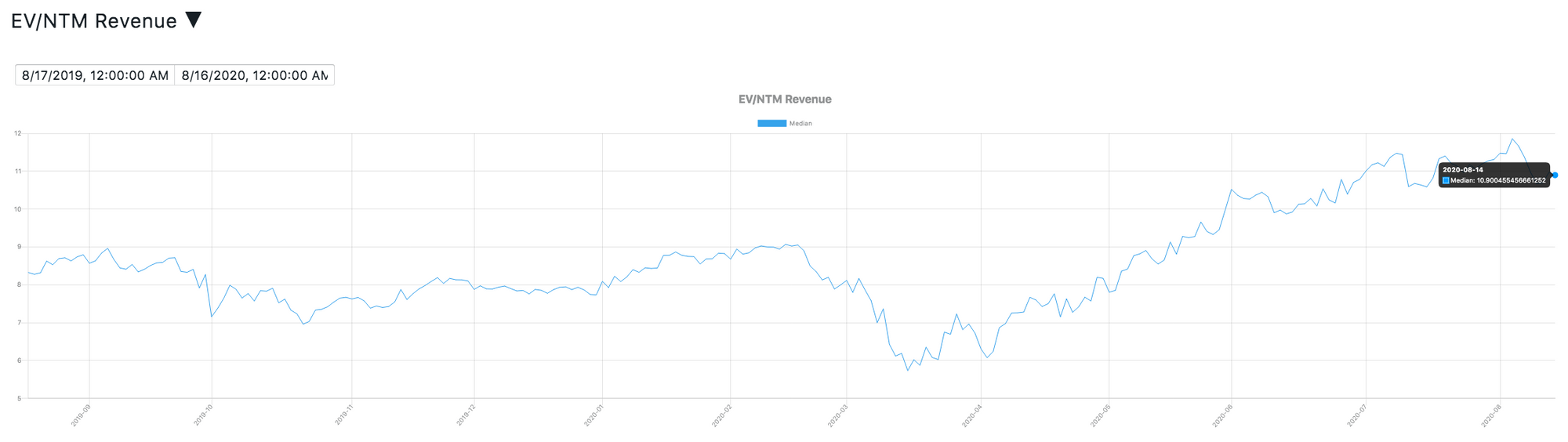

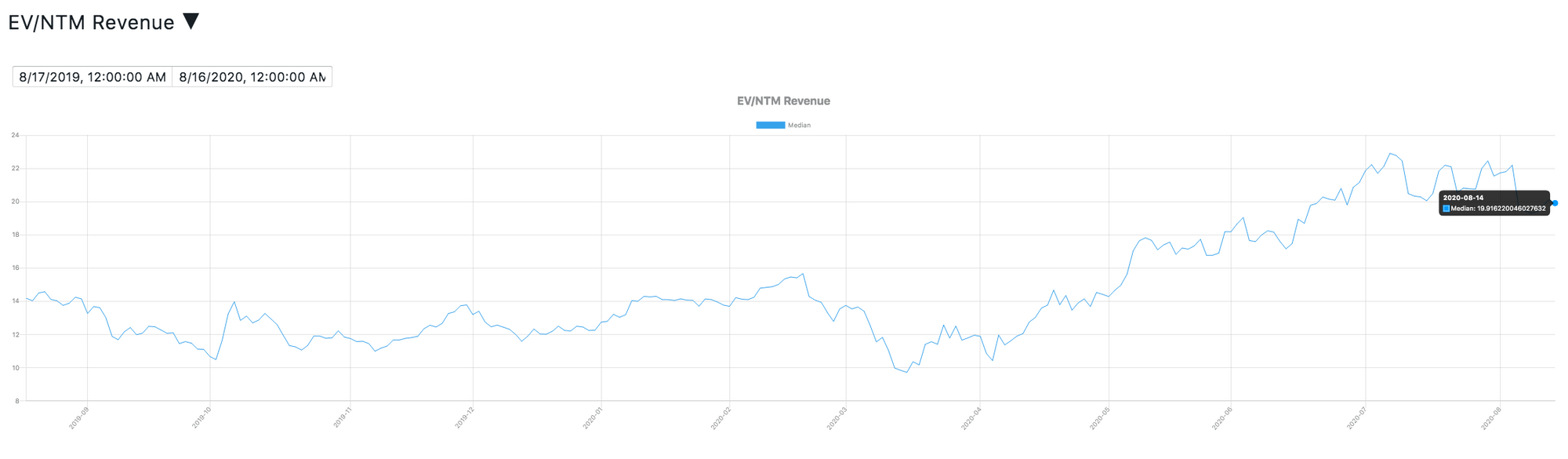

2️⃣ Median B2B SaaS Valuation Multiples: 10.9x 🔥

Median fwd Revenue multiples for all B2B SaaS is 10.9x, and 19.9x for high growth SaaS.

3️⃣ SaaS Earnings - ZoomInfo (ZI) 💸

ZoomInfo Q2 Earnings | Earnings Call Transcript | Earnings Call Presentation

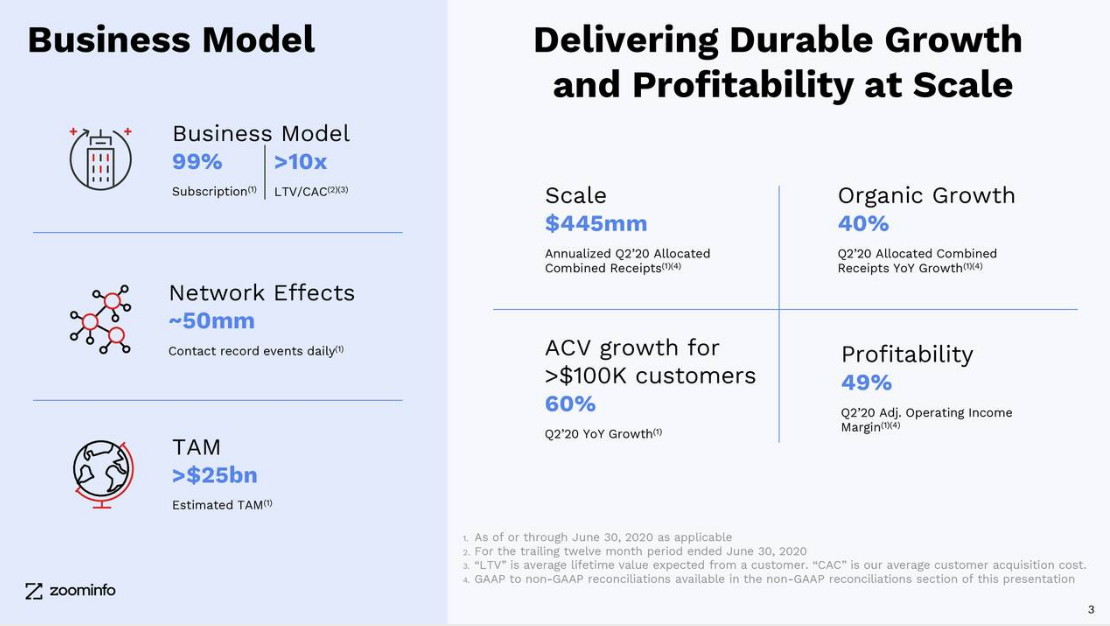

Overview: ZoomInfo is a go-to-market intelligence platform that helps more than 16,000 companies worldwide sell more effectively and efficiently. ZoomInfo provides sellers and marketers, with the data, insights and technologies that enable everything from a simple go-to-market motion to the most sophisticated go-to-market planning and execution at multinational corporations. ZoomInfo's strength is its volume of data they have on companies to empower sales and marketing teams. The platform enables a new way to sell, with data such as the current account of who was hired, who left, and what’s happening with that company in the news.

Earnings highlights:

Revenue: $110M in Q2 (+62% growth yoy, +40% organic growth yoy)

Cash flow: cash flow from operations was $25 million for the quarter, which included $24 million in interest payments. Unlevered FCF was $52 million for the quarter and $107 million YTD.

Cash and cash equivalents: ZI ended the quarter with $260 million in cash and restricted cash. This includes approximately $170 million of cash added to the balance sheet from net IPO proceeds, less repayments of debt and preferred equity.

Other earnings insights/highlights:

- ZoomInfo has seen increased engagement: "our overall engagement rates are up over 20% across all of our platforms. Without the innovation driven by ZoomInfo, sellers and marketers are blind to their target markets and ideal buyers and are completely reliant on disparate, siloed, and manually updated digital rolodexes to drive the targeting of potential customers and the engagement of decision makers within those targets."

- Success of "land and expand": ZoomInfo now has more than 650 clients spending over $100k/year, representing a 60% growth in ACV for those customers.

- Impact of COVID-19: "In Q1, we experienced headwinds as some sales cycles stalled when many business leaders were shocked by the magnitude of change they were experiencing in mid to late March. In Q2, our sales teams adjusted to the new environment and drove improved sales and retention activity relative to Q2 last year and Q1."

- Customers and heavily impacted industries represented less than 4% of ACV: ZI is seeing heightened cancellations and reductions in spend from this subset of customers relative to pre-COVID timeframes.

- Average contract duration was unchanged: primarily due to a shift in customers opting to pay quarterly instead of annually, as customers look to optimize their cash flow in light of the economic uncertainty. One analyst brought up that this change resulted in just 15% billings growth, which management noted was in the right ballpark.

- Improving retention: ZI had close to 2,000 customers increase spend during the course of the quarter. Management expects that they'll continue to see solid net retention through the year.

4️⃣ Why doesn't Coupa get more love? 🙁

Coupa software is quietly one of the top returning SaaS stocks of 2020. Since its March lows, the stock is up almost 161%, and is up 86% YTD. Despite its outsized returns and it being the 5th most efficient stock in our top 10 SaaS, it remains relatively uncovered contrary to other top B2B SaaS stocks.

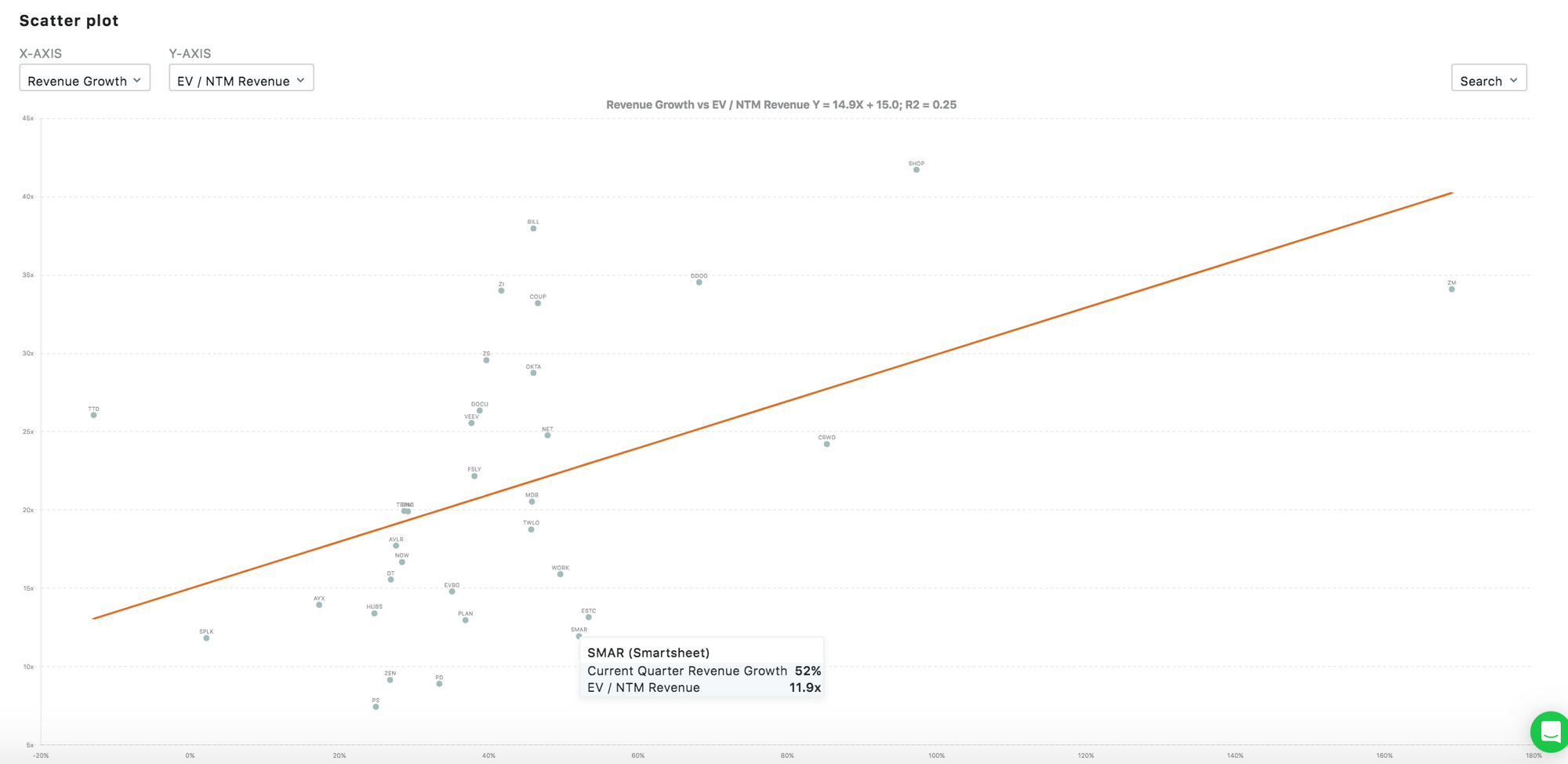

I believe that Coupa remains under-the-radar because on the surface, it appears to more expensive. Its only the 7th fastest growing company (47% revenue growth yoy) in our top 10 SaaS, yet trades at the 4th highest EV/NTM revenue multiple (33.2x). Another reason is growth has been slower than other category-leading cloud industries, as "business spend management" just isn't as cool as cloud endpoint security or cloud infrastructure monitoring.

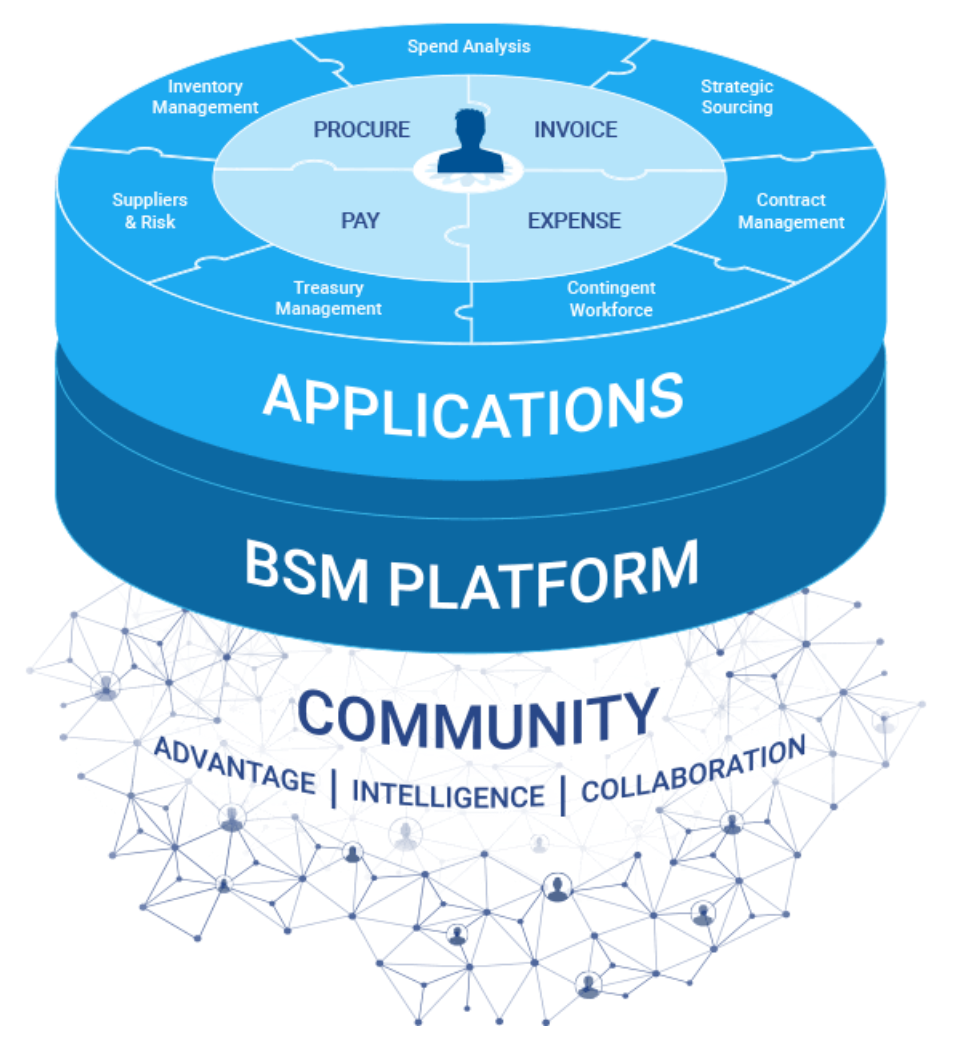

Overview: Coupa is a leading provider of Business Spend Management (“BSM”) solutions. It offers a comprehensive, cloud-based BSM platform that has connected over one thousand organizations with more than five million suppliers globally. The platform provides greater visibility into and control over how companies spend money. Coupa’s platform allows businesses to achieve real, measurable value and savings that drive their profitability.

Its essentially a mission-critical platform as organizations scale and budget/spending/procurement becomes increasingly complex. Coupa empowers employees to acquire the services they need to do their jobs by applying a distinctive user-centric approach that provides a consumer internet-like experience. The myriad of use cases and flexibility on the user's part helps drive widespread adoption of the platform, and significantly increases an organization’s spend under management.

Market opportunity: The overall market for BSM software is highly competitive, marked by rapid consolidation, fragmented, and rapidly evolving due to technological innovations. Competitors include both large enterprise software vendors such as Oracle Corporation, SAP AG and Workday that predominantly focus on database and ERP software solutions; as well as niche software vendors that either address only a portion of the capabilities Coupa provides or predominantly focus on narrow industry verticals. Coupa estimates their TAM to be $56B.

High-level thesis:

- Best-in-class product, can penetrate TAM better than competitors.

- Coupa is a better, all-encompassing product ("Everything You Need to Manage Your Spend in One Place"): previously, customers relied on a multitude of software products in order to manage budgeting and spending; like Datadog, Coupa solved this friction with their BSM platform, which delivers a broad range of capabilities that would typically require the purchase and use of multiple disparate point applications.

- Coupa's platform offers a mission-critical service with high barriers to entry and switching costs.

- Extremely large and growing TAM: cumulative spend under management has been accelerating and illustrates the adoption, scale, and value of Coupa's platform, which enhances their ability to maintain existing customers and attract new customers. Estimated $56B TAM with less than 1% penetration.

- Breadth of offerings allows them to penetrate TAM more effectively by landing almost anywhere with new customers and seeing greater adoption through their de facto industry leader status.

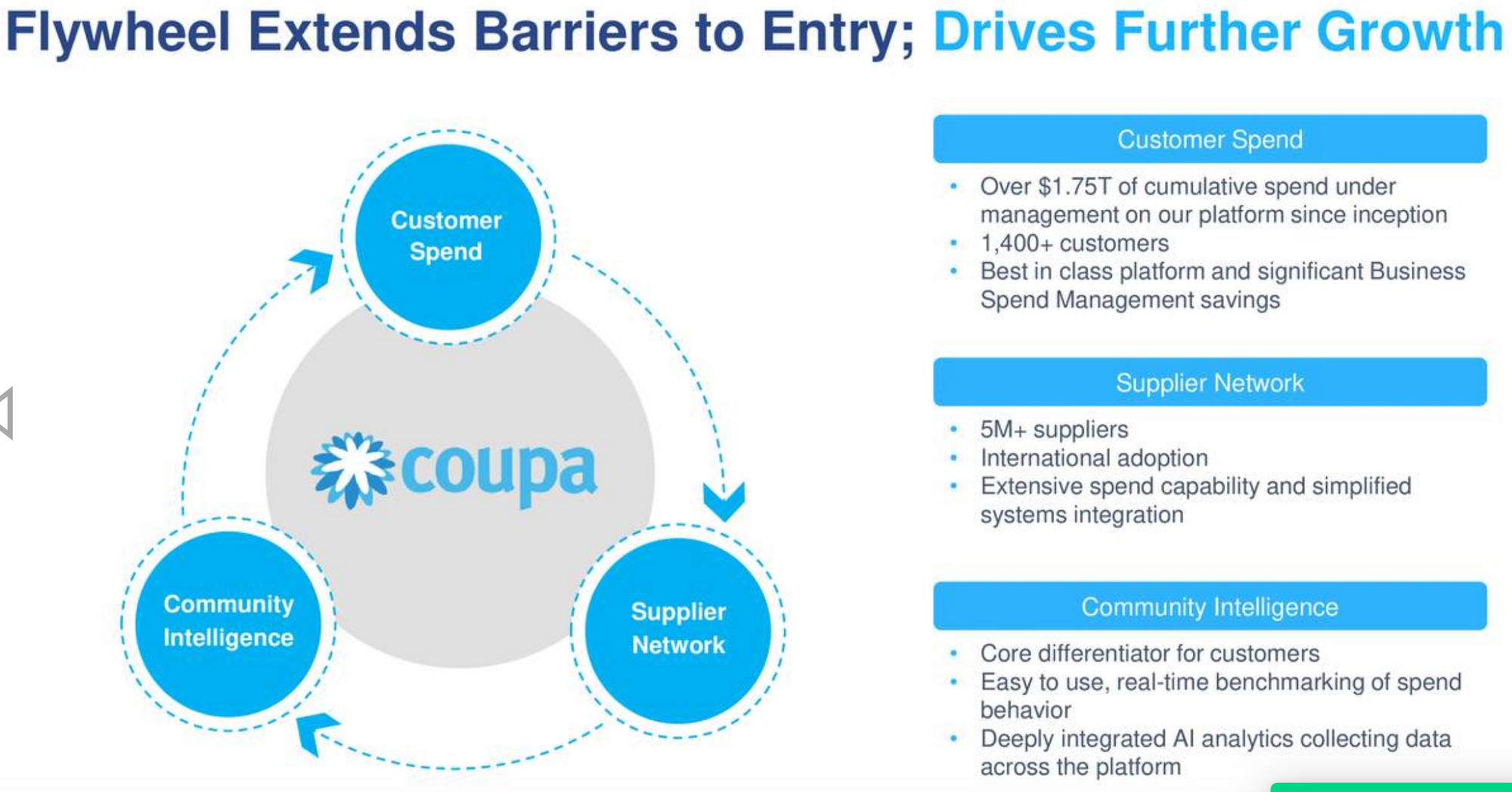

2. Lower sales friction, perpetuated by their positive feedback loop

- Network effects & strength of partner program: as more businesses subscribe to the BSM platform, the collective spend under management on Coupa’s platform grows. Greater aggregate spend under management on the platform attracts more suppliers, which in turn attracts more businesses that want to take advantage of the goods and services available on the platform.

- Reinforcing a positive feedback loop: Coupa can integrate w/ supplier 3rd party systems (Oracle, SAP, others), charges no fees (free) for suppliers, this reduces paper trail & costs and improves operating efficiencies

- Faster deployment for faster tangible cost savings: typically ranging from a few weeks to several months, and an easy-to-use UI that shields users from unnecessary complexity, thus benefiting from a rapid return on investment.

- Favorable payback period (currently 21.8 months): its pretty solid for a company that primarily sells to enterprise, demonstrating strong sales efficiency.

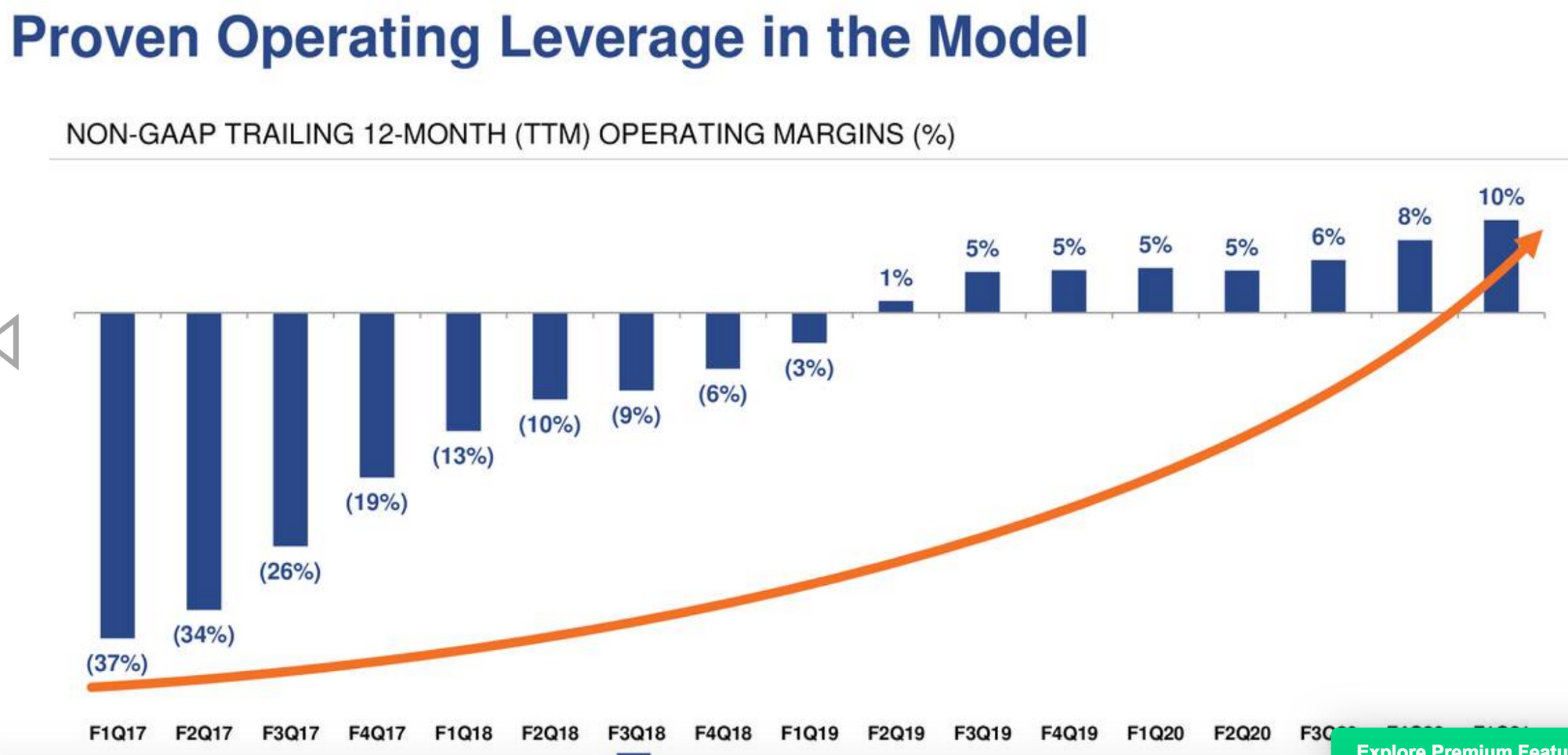

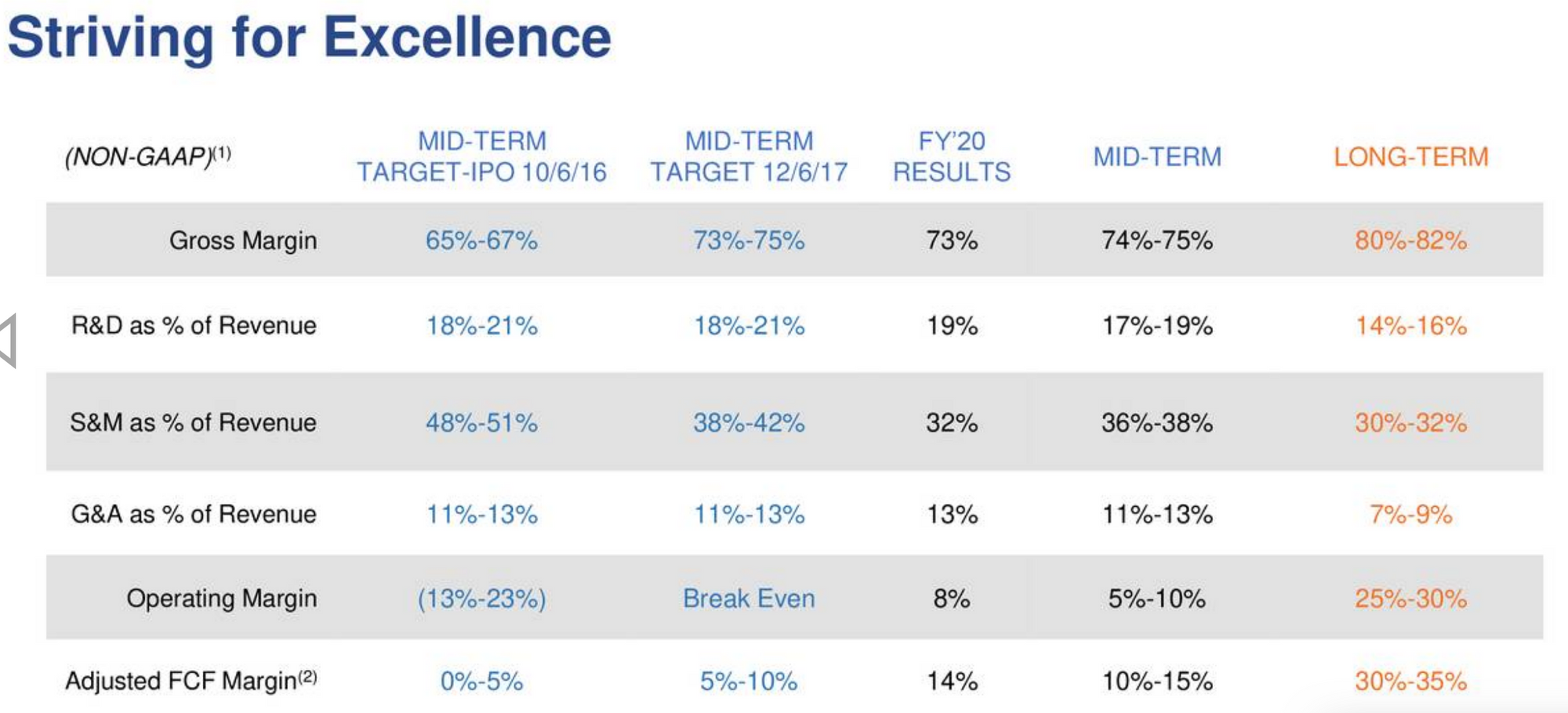

3. Strong ecosystem gives them operating leverage, and high, sustainable, long-term margins

- The aggregate of their ecosystem allows them greater scale to offer additional services to customers that competitors cannot: the ecosystem leverages the collective buying power of customers, offers pre-negotiated savings from trusted suppliers, and offers benchmarking and insights from Community Intelligence.

- Continued margin improvement: network effects from ecosystem growth help scale S&M margins and gross margins will improve as service revenue diminishes as a portion of new revenue.

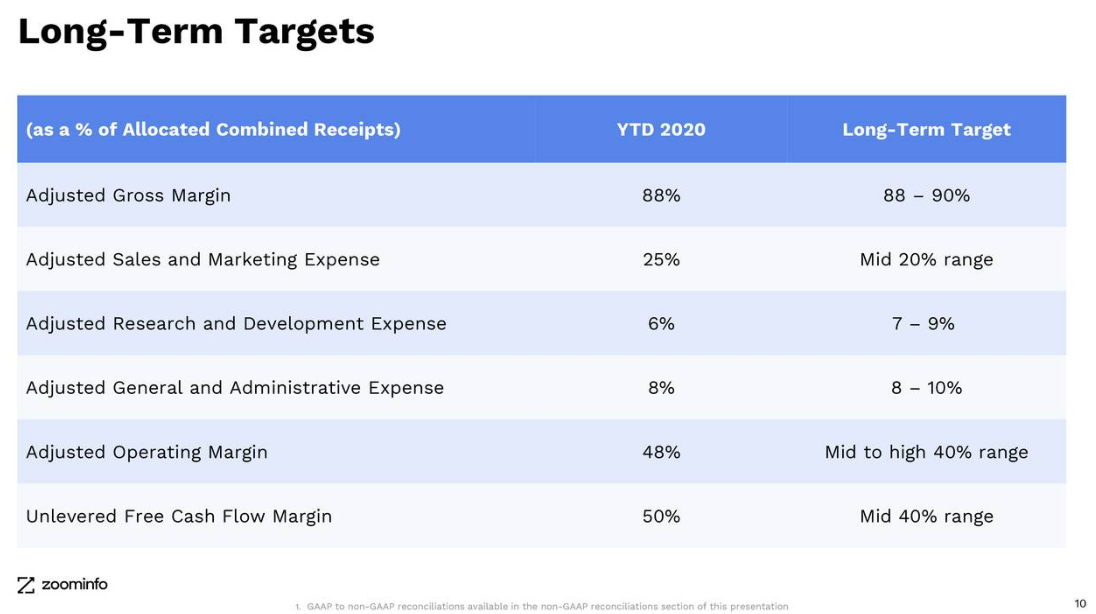

- Progress & track record: operating margins and efficiency have been steadily improving, and Coupa has shown a clear path to profitability.

Risks:

- Lengthening sales cycles

- Revenue deceleration

- Disrupted path to profitability

Valuation:

I don't find current valuation of Coupa to be favorable.

I trust management's long term margin guidance given the progress and clear path to profitability Coupa has already demonstrated, and their growing ecosystem helps dig the moat around their durable platform. In this interest rate environment and given Coupa's highly predictable cash flows, I'd expect investors to demand a 3-3.5% long-term FCF yield for Coupa software, implying a FCF multiple of ~30x.

Doing some simple assumptions: assuming revenue grows at a 35% CAGR over a 5 year period (ARR is currently 476M), and a FCF margin of 33% in 5 years, we'd get a valuation of ~$25-27B, implying just 6-7% IRR over this 5-year period.

I think Coupa is a good business and durable platform with strong value proposition for its customers and growth has plenty of runway ahead The simple calculation done above may be underestimating top-line growth and given the strong fundamentals of their platform, they may trade at a higher FCF multiple, but I don't own or plan on taking a position because I don't find this risk/reward (at 33.2x fwd revs) compelling.

5️⃣ Product Update - improved scatter plot📈

Our scatter plot, which allows users to toggle the x-axis and y-axis to understand correlation between relevant growth and valuation metrics, now has individual name labels, and hovering over a name will tell you the corresponding data values.

As always, feel free to shoot me an email if you have any questions, feedback, or concerns.

Stay safe everyone,

Albert Wang, Public Comps Team

albert@publiccomps.com

Like these weekly dashboards? These are for Publiccomps.com customers only but you can have your friends subscribe to the newsletter here where we send out investment memos, market maps and analysis on the broader SaaS market.

Views expressed in theses emails are ours and ours alone and don't represent that of our previous or current employers. Public Comps provides financial and industry information regarding public software companies as part of our weekly dashboard, our blog, and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice.

Full disclosure: I own CRWD, TWLO, SHOP, LVGO, FB, MSFT, DDOG, ESTC, AYX, SMAR, PLAN, ZM, and ANGI.