Public Comps Weekly Dashboard 9/18/2020: OKTA Q2 Earnings Teardown & new SaaS benchmarking matrix!

We break down Okta's Q2 Earnings.

👋 Public Comps Customers 👋

tl;dr This week's newsletter recaps Okta's Q2 earnings from a few weeks ago, in which I breakdown the earnings call & lay out a high-level investment thesis on the company and announce a new feature update to Public Comps!

1️⃣ SaaS Stock Prices vs. Benchmarks 📊

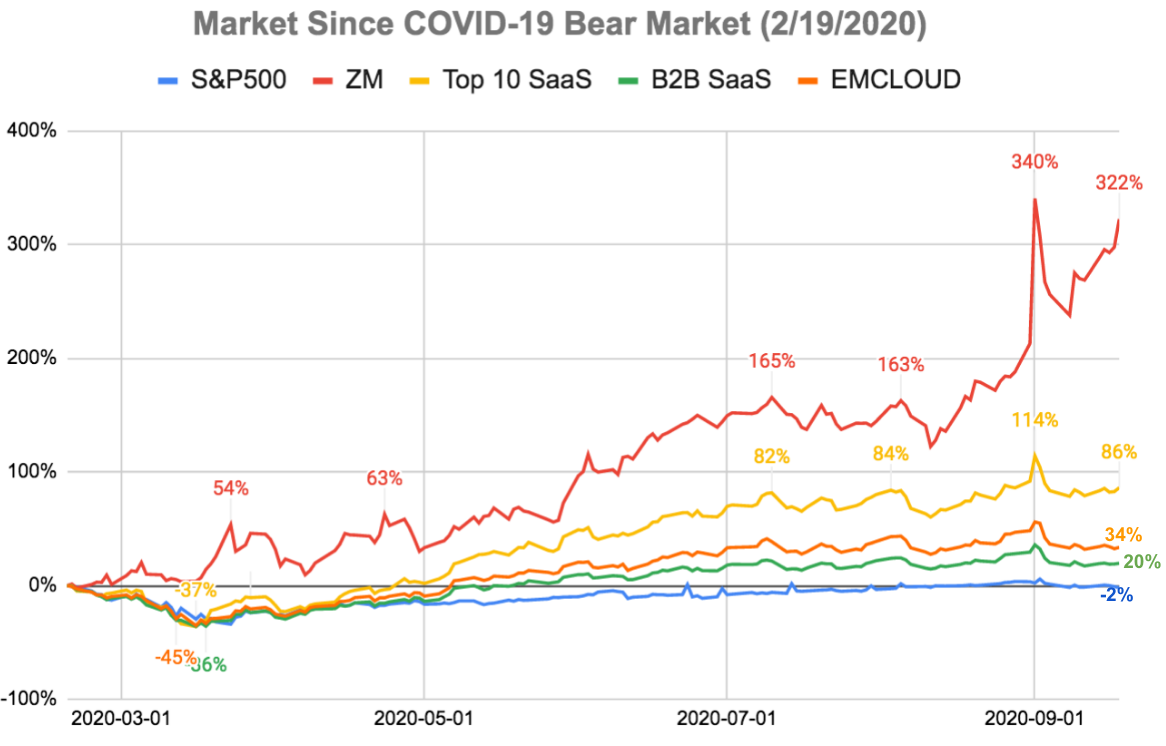

Change since bear market start (2/19/2020):

- ZM: +322.1%

- Top 10 SaaS: +86.1%

- Bessemer Cloud Index (EMCLOUD): +33.6%

- B2B SaaS: +19.6%

- S&P 500: -2.0%

Change in the past week:

- ZM: +14.6%

- Top 10 SaaS: +4.0%

- Bessemer Cloud Index (EMCLOUD): +1.3%

- B2B SaaS: +2.0%

- S&P 500: -0.6%

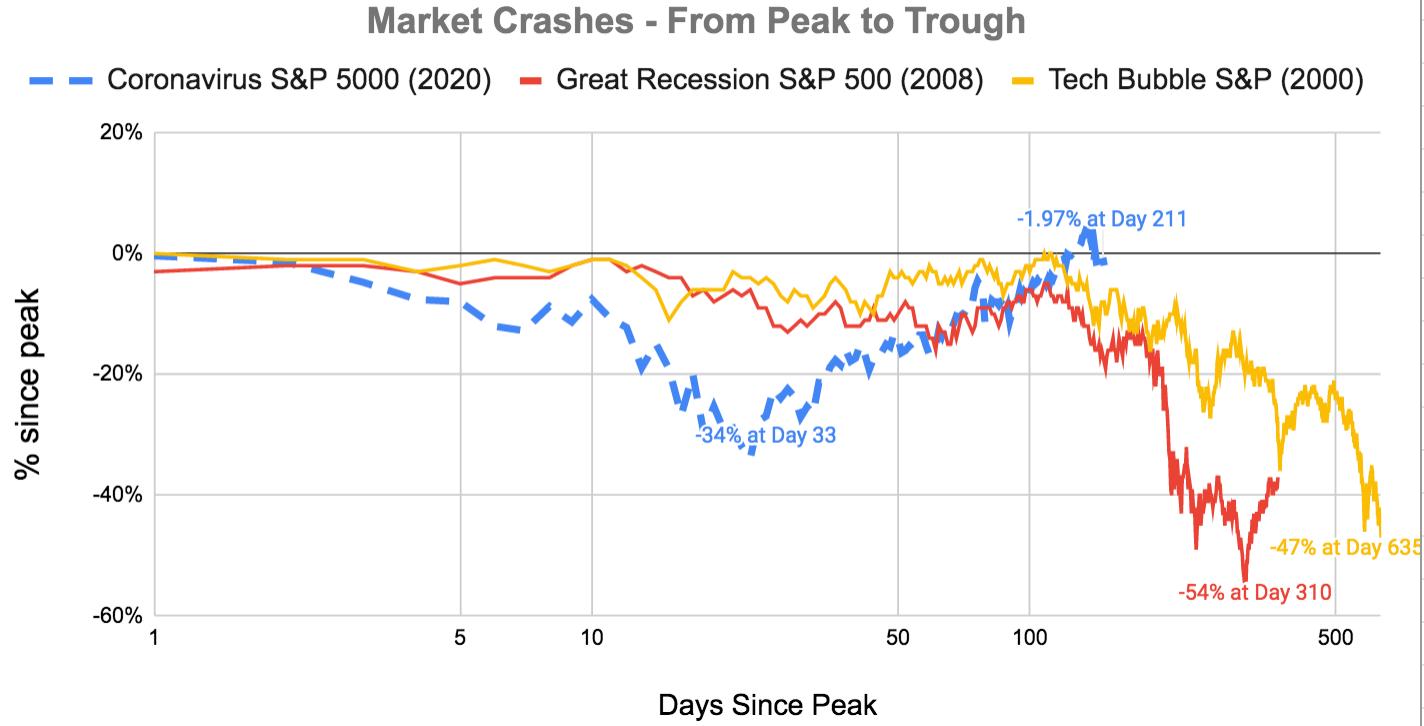

Market update 📉: The market started off strong early in the week on news of Gilead Sciences' acquisition of Immunomedics and Nvidia's purchase of ARM holdings, but saw a decline in the latter half as COVID-19 vaccine optimism was offset by worries that the Fed's monetary policy was becoming less effective in supporting recovery. The Fed announced that short-term interest rates would remain near 0% through 2023, while tempering expectations for the size of the economic contraction in 2020 from 6.5% to 3.7%; however, investors were still disappointed by the lack of certainty surrounding the Fed's updated rate guidance as they made no changes to their quantitative easing program. Investors continued to unload shares in internet and tech giants that have led the market in recent months as value and small-caps outperformed. The energy sector also saw gains, helped by a large and unexpected drawdown in domestic oil inventories and Saudi Arabia's efforts to force product cuts by other major oil exporters. The communications sector fared the worst, dragged down by a report that the FTC was preparing an antitrust action against Facebook.

2️⃣ Median B2B SaaS EV/NTM Revenue Valuations

High Growth SaaS: 19.2x

All B2B SaaS: 11.2x

3️⃣ SaaS Earnings - Okta (OKTA) 💸

With no SaaS earnings this past week, I thought I'd revisit Okta which reported earnings on 8/27.

Q2FY21 Earnings | Press Release | Earnings Transcript | Presentation Slides

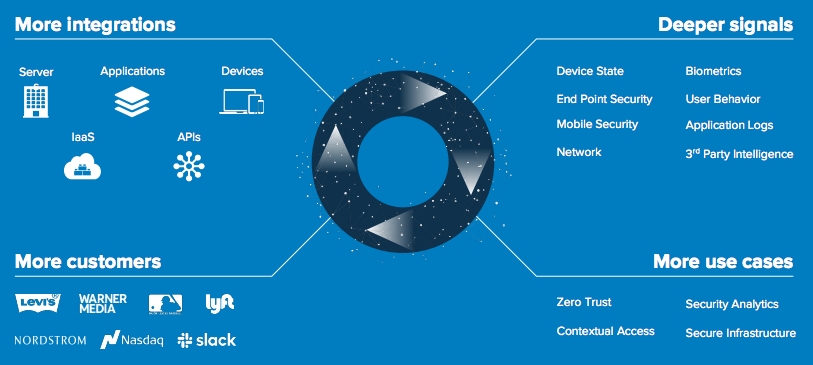

Overview: Okta is the leading independent provider of identity for businesses. Their technology allows the right people to securely connect to the right technology at the right time. The Okta Identity Cloud enables organizations to securely connect the right people to the right technologies at the right time. With over 6,500 pre-built integrations to applications and infrastructure providers, Okta customers can easily and securely use the best technologies for their business. Over 8,950 organizations, use Okta to help protect the identities of their workforces and customers.

Q2 Financial Highlights:

Revenue: total revenue grew 43% y/y, subscription revenue grew 44% y/y, and RPO grew 56% y/y.

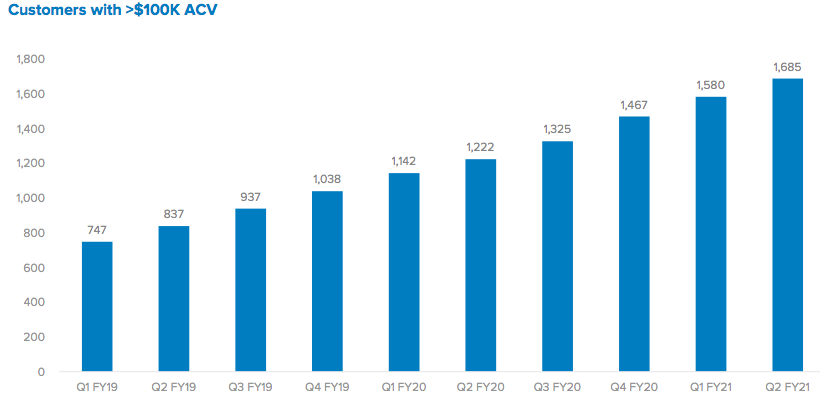

Customers: the total number of $100k+ customers is now nearing 1,700 and Okta has over 100 customers with an annual contract value (ACV) greater than $1 million.

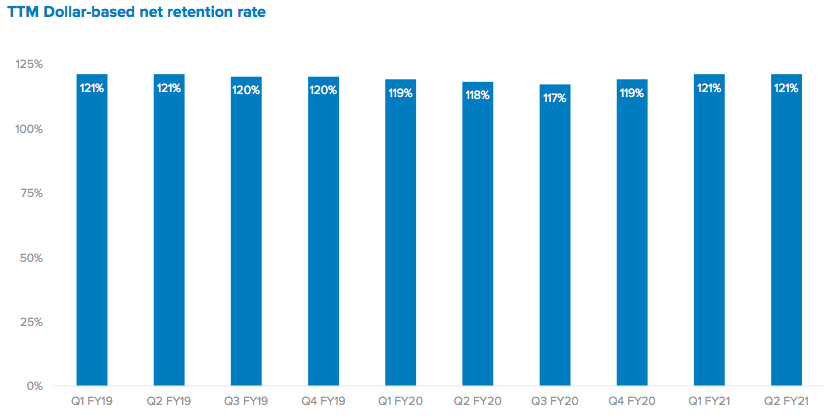

Net dollar retention: 121%, management noted that they had not experienced any degradation in gross renewal rates during the pandemic and continue to experience strength with customer upsells, particularly to enterprises.

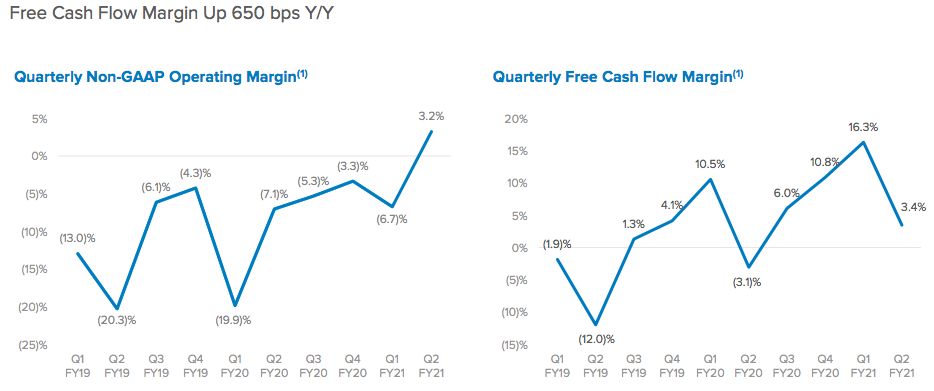

Free cash flow: Okta generated $7M of FCF in the quarter, a +3.4% margin, up from -3.1% a year ago.

Q2 Earnings call highlights

- During this crisis, Okta customers are using the platform more than ever. From March through July, there was a 1-day record of over 145 million logins, and the number of unique app logins increased almost 70% to nearly 16 billion. Total MFA usage increased nearly 3x over the same period last year. These numbers reflect the massive number of new remote workers around the world and Okta's strong growth in total customers, especially large enterprise companies.

- Okta recently announced a major milestone in cloud reliability and uptime, offering 99.99% uptime to all customers in every region of the world. This lays the foundation for a new standard of reliability across the cloud industry, not only for the betterment of our customers but any organization pursuing digital transformation.

- Okta, CrowdStrike, Netskope and Proofpoint joined forces in a coordinated effort to help organizations implement an integrated zero trust security strategy required to protect today's dynamic and remote working environments.

- Total and current calculated billings grew 27%. Management noted that they experienced some mild pandemic-related business headwinds. In the Q1 earnings call, they experienced some beneficial invoice timing in Q1 that created a modest headwind for Q2 billings growth. Q2 billings was also negatively impacted by strong upsell activity – when large enterprise customers expand their purchases, they often want to align new contract start dates with existing contracts, and thus, we only bill them for the stub period before the new large contract starts. This delay of the new contract billing creates a headwind on that quarter's billings duration, but the new contract ultimately becomes a tailwind to future quarters because of the increased contract size.

High-level thesis on OKTA

1. Category leaders are disproportionately benefiting from having superior product and thus grabbing more market share from markets that were historically fragmented.

- Customers trust superior product: Okta helps consolidate a complex multi-organization and multi-vendor identity environment into one. Okta wins on its product's improved security, greater agility and faster integration.

- Large enterprises are continuing to buy from vendors where they're very comfortable with and Okta is the de facto name in identity management.

- Migration to cloud creates higher switching costs and strengthens Okta's moat: if a customer already has all of their identity information in the cloud and they want to do governance/attestation about that identity information, they aren't likely to bring it back on-premises to do what was already sitting in the cloud. Okta's flexibility helps them capture a large share of hybrid cloud users as well.

2. Breadth of products win in the identity management space – and Okta has the most.

- More products & features than focused competitors: by developing more products and features that can leverage more integrations, Okta can unlock more use cases, attract more customers and generate more data insights that can be harnessed to build better products that make customers more successful – this builds positive feedback loops and creates network effects.

- Integrations allows Okta to have greater versatility with where it lands within customers. As management's highlighted in past earnings calls, Okta often lands in one space and then expands across the entire enterprise, as we've seen with Okta's amazingly consistent net dollar retention.

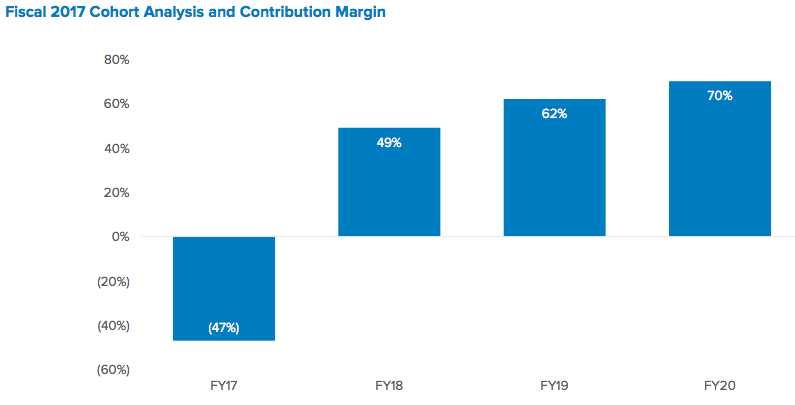

The net dollar retention is sustainable because contribution margins increase over time:

3. COVID-19 is a structural tailwind for OKTA

- The continued adoption of cloud software will inevitably lead to more apps, more devices, more digital transformation and heightened requirements for usability and security

- CIOs continue to stress the importance of identity management, which has accelerated three key drivers of growth:

- Adoption of hybrid cloud technology - most of software is still on-prem, and most of enterprise IT is still hardware and services. This creates plenty of runway to make it a software only in a cloud-only world.

- Digital transformation - digital transformation is secular growth as COVID-19 accelerated removal of barriers to adoption.

- Digital security - as everything moves online, more people work from home and become users of software -- this accelerates risk of phishing attacks and highlights the importance of multi-factor authentication.

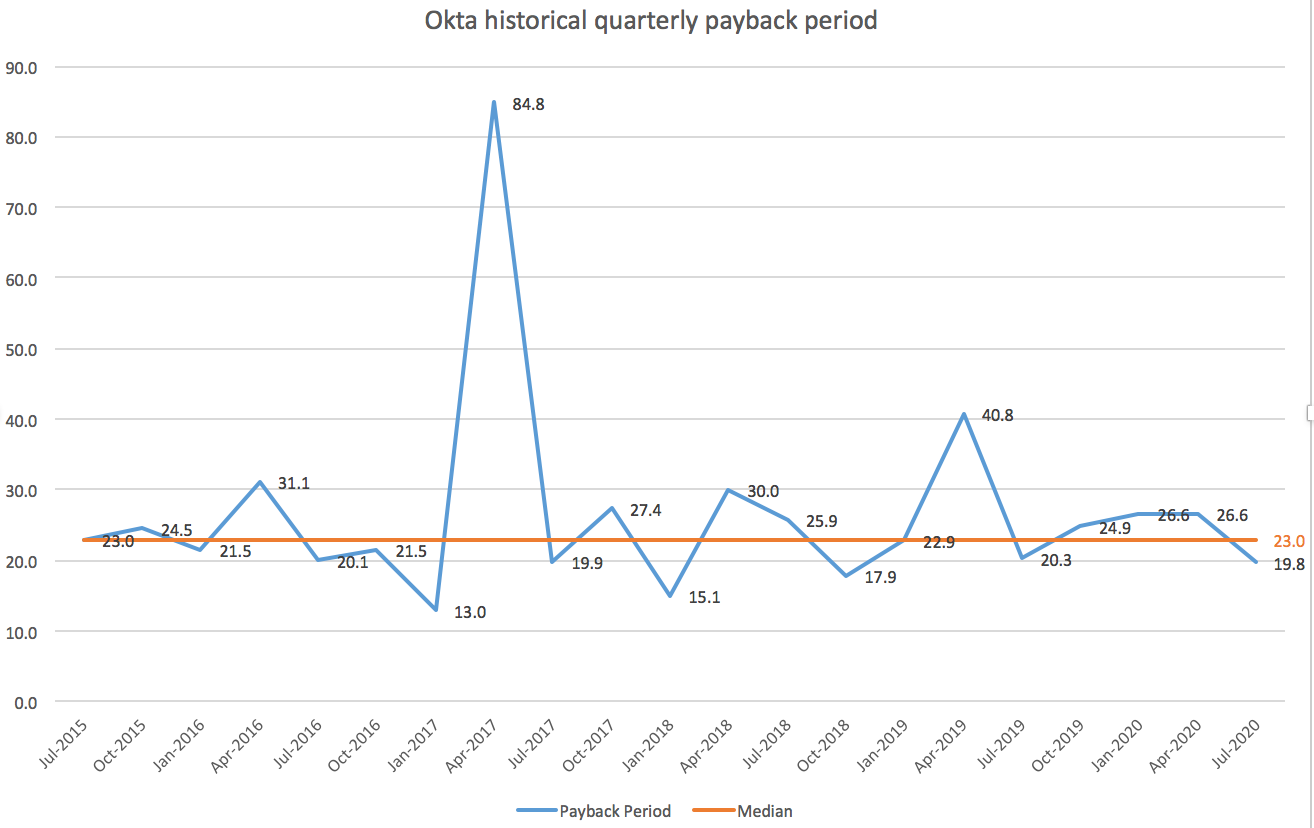

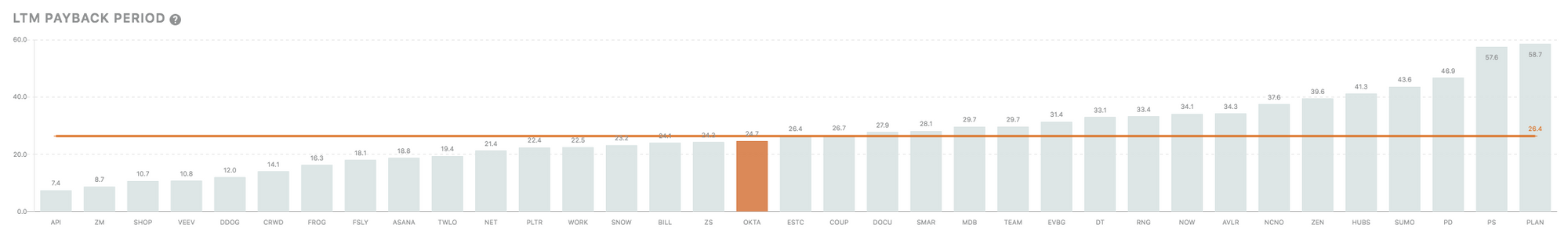

Despite decelerated revenue, S&M expense as a % of revenue improved 7% y/y and sales efficiency has actually improved:

Okta has consistently maintained/improved sales efficiency which drives operating leverage:

- Q2 billings growth may have slowed down in the most recent quarter but thats likely due to Okta primarily targeting enterprises, and as we've seen in other SaaS earnings, many enterprise deals were pushed out of Q2 and should see significant recovery over the next few quarters.

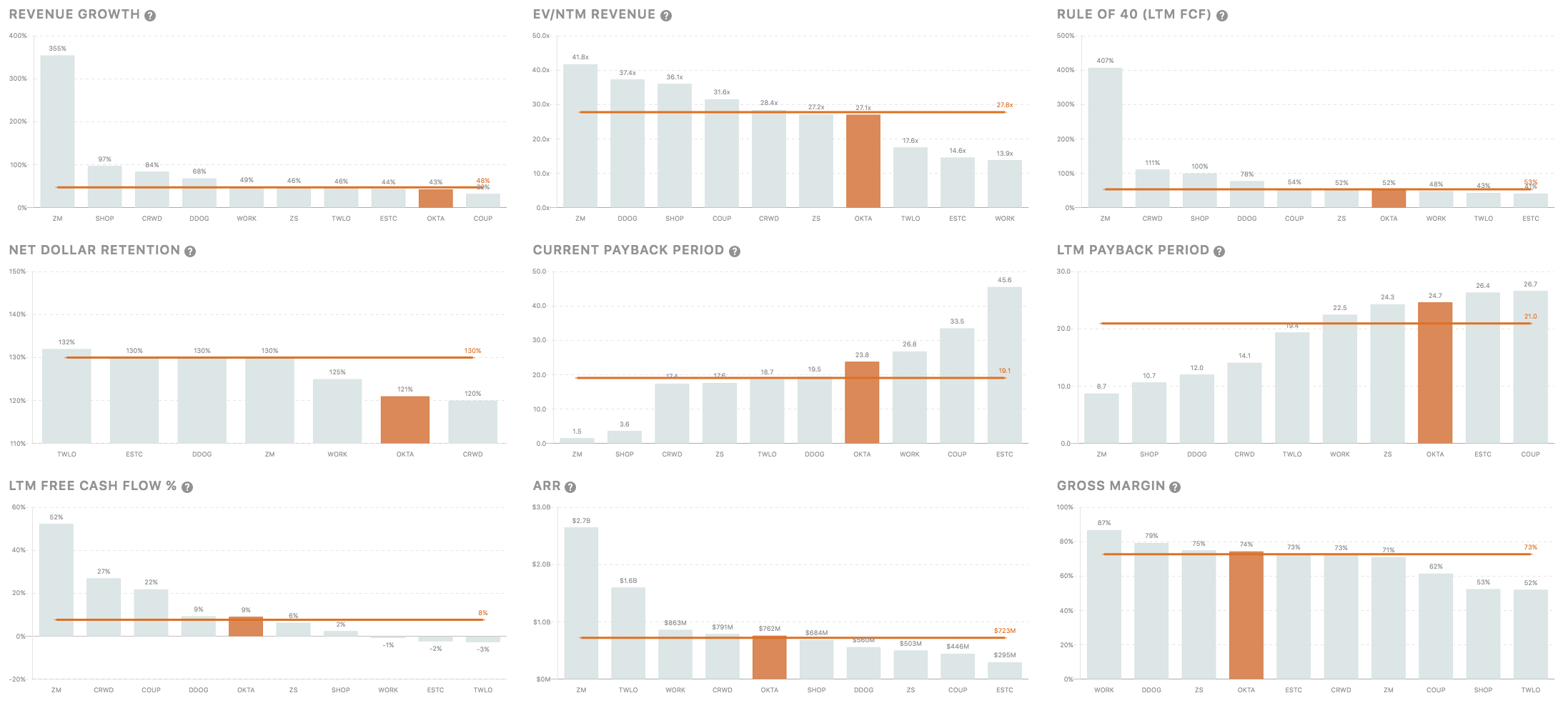

4️⃣ Product Update: SaaS Benchmark Matrix 🎉

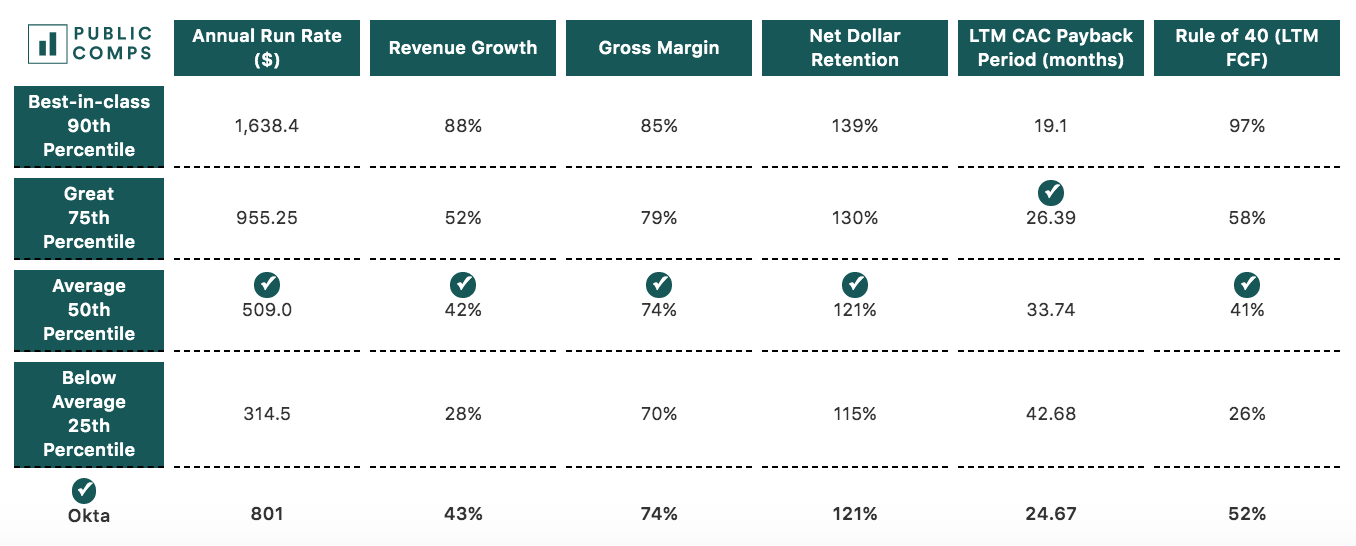

We've added benchmark matrices to high growth SaaS names! You can now see how companies stack up, percentile wise, against all B2B SaaS:

We've broken it down along 6 key SaaS metrics: ARR, revenue growth %, gross margin, net dollar retention, LTM CAC Payback Period, and Rule of 40! You can see which class each SaaS company belongs in: best-in-class (90th percentile), great (75% percentile), average (50% percentile), below average (25th percentile).

You can find this matrix on each company's page!

Stay safe everyone,

Albert Wang, Public Comps Team

albert@publiccomps.com

Like these weekly dashboards? These are for Publiccomps.com customers only but you can have your friends subscribe to the newsletter here where we send out investment memos, market maps and analysis on the broader SaaS market.

Views expressed in theses emails are ours and ours alone and don't represent that of our previous or current employers. Public Comps provides financial and industry information regarding public software companies as part of our weekly dashboard, our blog, and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice.

Full disclosure: I own CRWD, TWLO, SHOP, LVGO, FB, MSFT, DDOG, ESTC, AYX, SMAR, PLAN, ZM and BILL.