Weekly Dashboard 2/26/2021: Workday $WDAY Q4 2020 Earnings

Workday Q4 FY21 Earnings.

👋 Public Comps Customers 👋

This week we break down Workday's recent quarterly earnings.

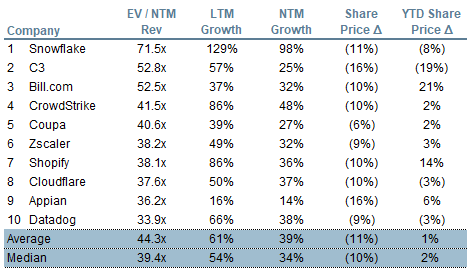

First, a quick snapshot of top 10 SaaS valuations:

This week saw many SaaS names drop, here are the top 10 weekly share price movements, courtesy of Jamin Ball:

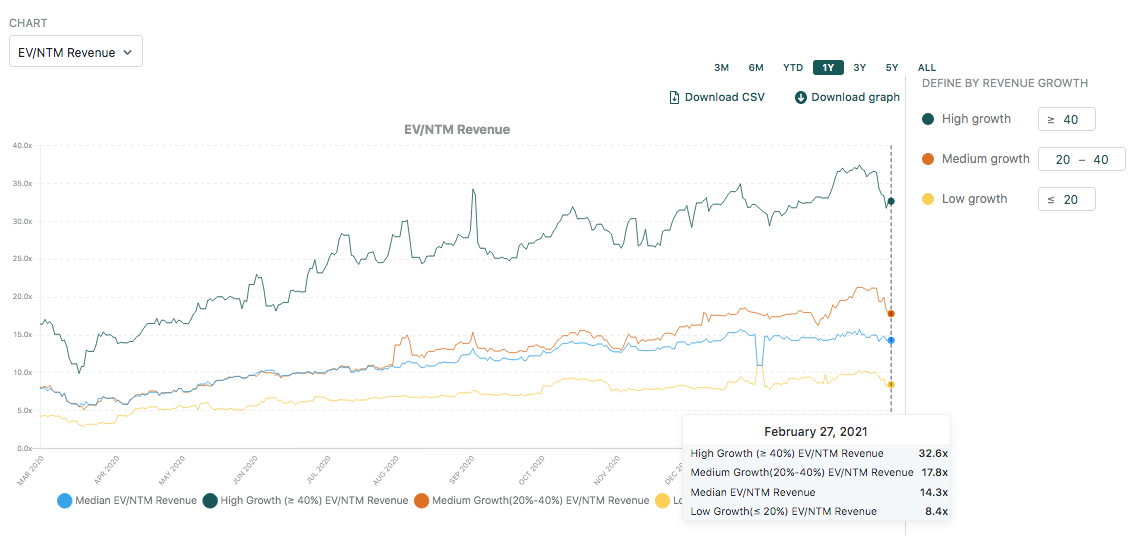

High growth SaaS are down -15% from their highs last week, largely driven by increase in treasury yields, and sector rotation out of high growth.

Summary

Workday is a 59B financial and human capital management software vendor. Over the past decade, Workday has been one of the major category-defining enterprise software successes. Despite seeing major headwinds as a top-down enterprise software vendor that often sold to CFOs, the company's growth remained resilient and showed strong signs for optimism for FY22.

Company Overview

Workday is the leading provider of enterprise cloud-based applications for human capital management (HCM), payroll, financial management, time tracking, procurement and employee expense management. Workday applications for financial management, human resources, planning, spend management, and analytics have been adopted by thousands of organizations - from SMBs to more than 45% of the Fortune 500. Workday enables organizations to turn transactional silos into a complete unified picture, hardwired processes into responsive automation and periodic into real time and continuous planning, execution and analysis.

Product

Workday's human capital management suite encompasses human resource management, benefits administration, talent management, workforce planning & analytics, big data analytics, recruiting, payroll solutions, time tracking, and project & work management.

Workday's platform has a simple interface across the entire suite, and is built from the ground up and delivered in the cloud. Its the only global enterprise application that unifies human resources, benefits, talent management payroll, time and attendance as well as recruitment.

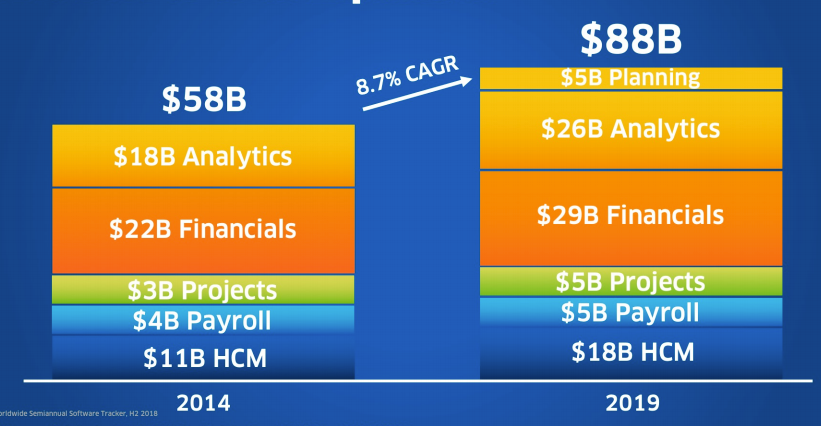

Market Opportunity

Fundamentally, Workday provides an essential back office software platform that every organization could use. As the first-mover in this space, and an all-encompassing platform - the market becomes their opportunity to lose.

Workday aims to further penetrate the HR market, specifically among mid-large size enterprises.

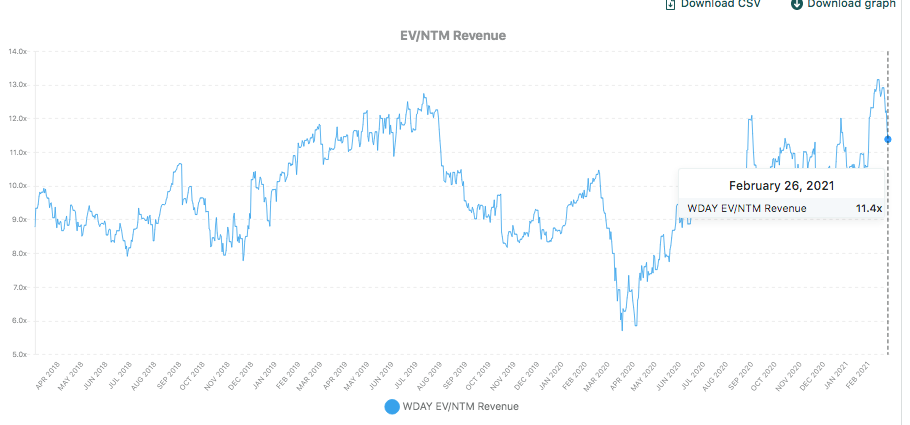

Workday benchmarked vs. other enterprise software peers:

Q4 FY21 Earnings Highlights

- Revenue: $1.13B, +15.9% YoY

- Subscription revenue: $1.01B, +19.8% YoY

- 24-month subscription revenue backlog: $6.53B, +19.2% YoY

- Total Subscription revenue backlog: $10.09B, +21.6% YoY

- Operating loss: $-73.3M (-6.5% margin)

Fiscal Year 2021 Highlights

- Total revenue: $4.32B, +19% YoY

- Subscription Revenue: $3.79B, +22.4% YoY

- Operating loss: $248.6M (-5.8% margin)

- Operating cash flow: $1.27B, +46.7% YoY (29.4% margin)

Other News/Highlights:

- Announced intent to acquire Peakon ApS, an employee success platform that converts feedback into actionable insights. With Peakon, Workday will provide organizations with a continuous listening platform to help drive employee engagement and improve organizational performance.

- New Workday Enterprise Finance solution expands Workday's TAM. The new offering provides customers the flexibility to accelerate their digital finance transformation with as little friction as possible.

- Announced a COVID-19 vaccine management solution that combines real-time HR data with immunization information, providing customers with the insight and resources needed to help foster healthier workforces and safer workplaces.

Key Takeaways

1. Entering FY22, Workday is positioned to drive accelerated new bookings growth.

- Management highlighted strength in North America; specifically, the education, government, healthcare, and professional services verticals.

- Both large and medium enterprise sales teams outperformed, driven by continued momentum in their installed base efforts.

- Saw solid demand for suite of products that support the office of the CFO and Chief Procurement Officer, including Workday Adaptive Planning, Prism Analytics as well as Workday Strategic Sourcing and the broader Spend Management solutions.

- Solid performance with more than 40% growth in new ACV bookings in Q4 against a very difficult comp.

- Improved pipeline efforts: pipeline generation has been improving since the onset of the pandemic. Management reported meaningful accelerated growth in Q4 with record pipeline generation across all regions. There's some COVID-related pipeline impact from certain industries but those headwinds appear to be lessening.

- Improvement on new ACV in Q4: stronger lands in the pipeline across both HCM and FINS.

2. Innovation cadence has accelerated and Workday continues to bring out market-leading innovation to support customers.

- Management touched on success in expanding presence within their existing customer base. A big part of the success was driven by the introduction of new products.

- In the last three years, Workday has delivered 50% more in terms of monetizable solutions compared to the prior three years.

3. Workday saw lengthening of overall contract duration this past year, providing more predictability in future revenue.

- Workday saw lengthening durations in Q4 across both net new contracts as well as renewals. Generally, longer contracts are a positive as you don't have renewal risk as often.

- Workday (sometimes 5-7 years) has some of the longest contracts in enterprise software, which speaks to the strategic nature of Workday and the trust that customers place on them.

- When looking at the historical impact of renewals on backlog growth, Workday has consistently seen growth each year in the amount of ACV up for renewal, making renewals a positive contributor to backlog growth.

- In FY22, the ACV up for renewal is relatively flat compared to FY21. This dynamic is a function of the mix of historical contract lengths but will serve as a headwind on both the 24 month and total backlog growth for the fiscal year.

- Management believes that the headwind will not persist beyond FY22 and expect the renewal base will grow again in FY23. They guided for 18% growth on 24 month backlog.

4. Accelerated bookings growth is driven by pull-forward demand in FP&A.

- Core planning inquiries were up close to 30% and as the pandemic eases, while many of the core accounting projects were going to be delayed, the ones that were in '23 and '24 and '25 were getting suck forward, because people realized that they needed to start on that digital transformation.

- While financials has been hit hard during the pandemic, management believes its going to get accelerated.

Valuation

Today, WDAY trades at 11.4x NTM revenues and 12.7x ARR - pretty reasonable multiples relative to other B2B SaaS given their dominant position as a category-defining cloud company and strong profitability (45% FCF margins, growing top line at low 20s).

Workday was one of the hardest hit B2B SaaS companies but will likely see RPO acceleration in FY22 against easier comps and digitalization trends continue among larger enterprises.

Albert Wang, Public Comps Team

albert@publiccomps.com

https://twitter.com/albertwang23

Like this analysis? Subscribe to the newsletter here where we send out investment memos, market maps and analysis on the broader SaaS market.

Disclaimer: The author owns stock directly in CRWD, TWLO, DDOG, FB, ZM, DASH, SHOP, CVNA, COUP, FSLY, BABA, TDOC, BILL, DASH, SQ, ANGI and SE. Public Comps (SaaSy Metrics LLC) provides financial and industry information and analysis regarding public software companies as part of our weekly dashboard, our blog, and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice.