Zillow $Z Investment Thesis

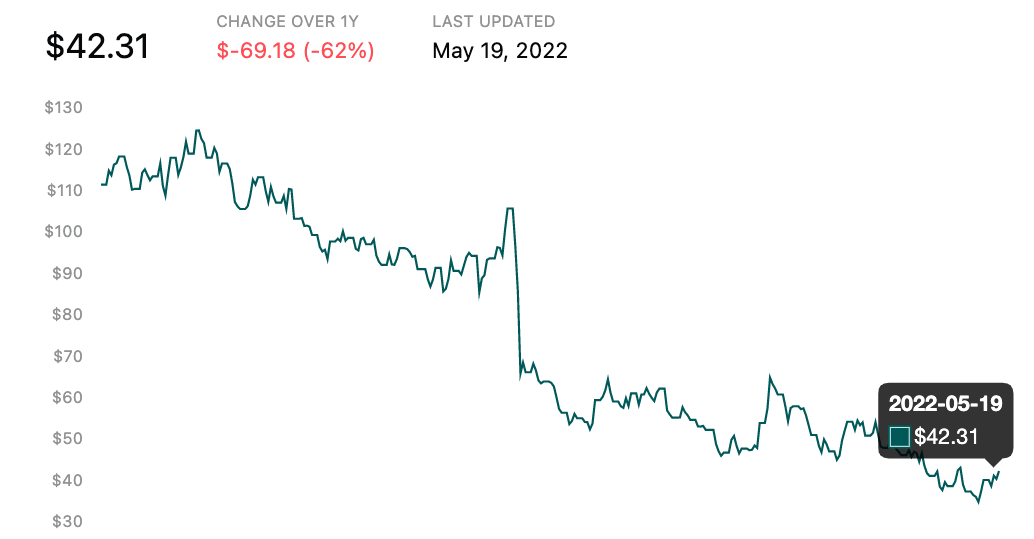

On a go-forward basis, Zillow is a best-in-class, highly profitable business in a large under-monetized market. The stock has been underappreciated following the iBuying fiasco and expectations for their core IMT business have been stagnant presenting a unique investment opportunity.

Hey Public Compers, it's been a pretty brutal few months in public markets. This week I've been looking at Zillow, an asset-light best-in-class real estate player that I think is pretty favorably valued in the current market environment.

Investment Summary

- Zillow is the dominant best-in-class player that will accrue the majority of value in the online real estate space

- The gradual transition to Flex performance-based pricing model will increase Zillow's take rate on customer transactions and increase overall revenue in higher transaction value zip codes

- Zillow is best situated to become the all-encompassing "Housing Super App"

Business Overview

Zillow is the most visited real estate website in the U.S., reaching 211M average monthly unique users in Q1 ’22. The company, as well as its affiliated brands including Zillow Rentals, Trulia, StreetEasy, HotPads, and Out East, are consumers’ and agents’ gateway to real estate transactions providing solutions that reduce the complexity and time associated with buying, selling, financing, and renting residencies.

The company’s core offering and cash cows are the Premier Agent and Premier Broker products. These services provide real estate agents and brokers with validated customer connections or leads which are priced on a share of voice basis. Effectively, connections are distributed to Premier Agents and Premier Brokers in proportion to an agent advertiser’s share of total advertising purchased in a particular zip code. Pricing in zip codes is determined by market-based pricing (MBP) meaning that agents essentially bid for their customer connection allocation. In the past few quarters, Zillow has continued to roll out its Flex performance-based pricing model in urban centers with greater property values. With Flex, agents get validated leads at no upfront costs and Zillow earns a 25-35% commission on completed transactions.

Zillow additionally monetizes rental services which are advertising sold to rental professionals with the company also receiving a flat service fee from potential renters submitting applications to various properties. The company further monetizes ancillary services like its construction marketplace as well as its web and mobile sites via advertising. Furthermore, for the last several years Zillow has acquired software solutions to remove pain points in the customer journey including dotloop a document sharing and signing solution, and more recently ShowingTime a SAAS appointment center.

Lastly, Zillow provides financial services via purchased and refinanced loan originations through Zillow Home Loans. Zillow also earns revenue from advertising purchased by other mortgage lenders and mortgage professionals on a cost-per-lead basis. Management views financial services like mortgages as an integral part of the customer experience and draws comparisons to platforms like Uber where payments are directly embedded in the product.

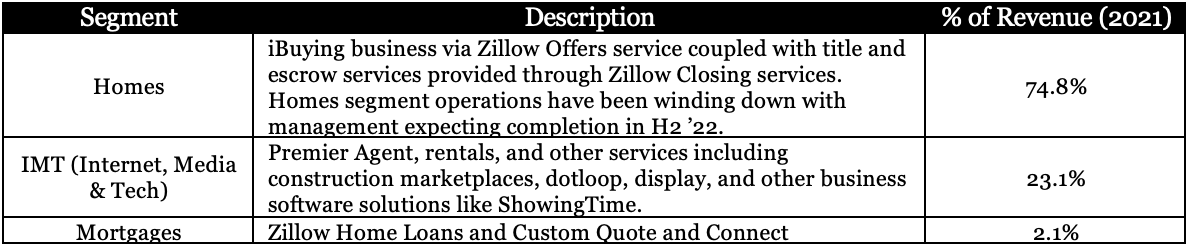

Revenue Segments: Zillow officially reports revenue in three segments.

On a go-forward basis, the IMT segment will represent 90%+ of revenue.

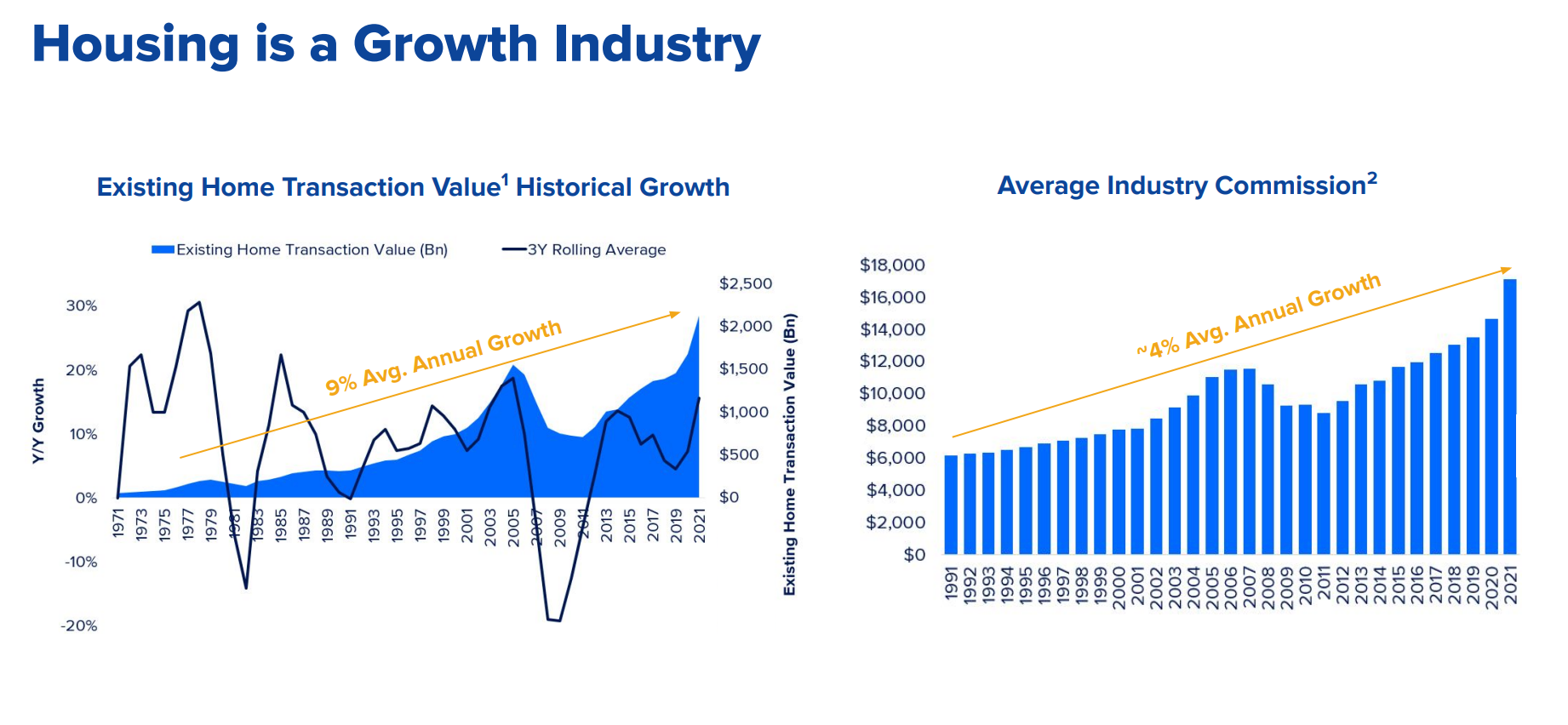

Market

Management recently expanded its TAM beyond residential real estate-related advertising to include potential inflows from its Flex performance-based pricing model and other ancillary services. In 2019, a Borrell Association report sized the residential real estate-related advertising market as a $19B opportunity with management estimating that rental advertising spend is nearly $11B annually. The company estimates that Flex commission fees to be a $100B opportunity with financial services like mortgages presenting an additional $155B market. Furthermore, Zillow cites annual property management software spend as $5B. The company cites untapped additional opportunities including insurance, home renovation, moving, and appraisal services as $119B, $595B, $18B, and $9B markets respectively.

Thesis Point 1

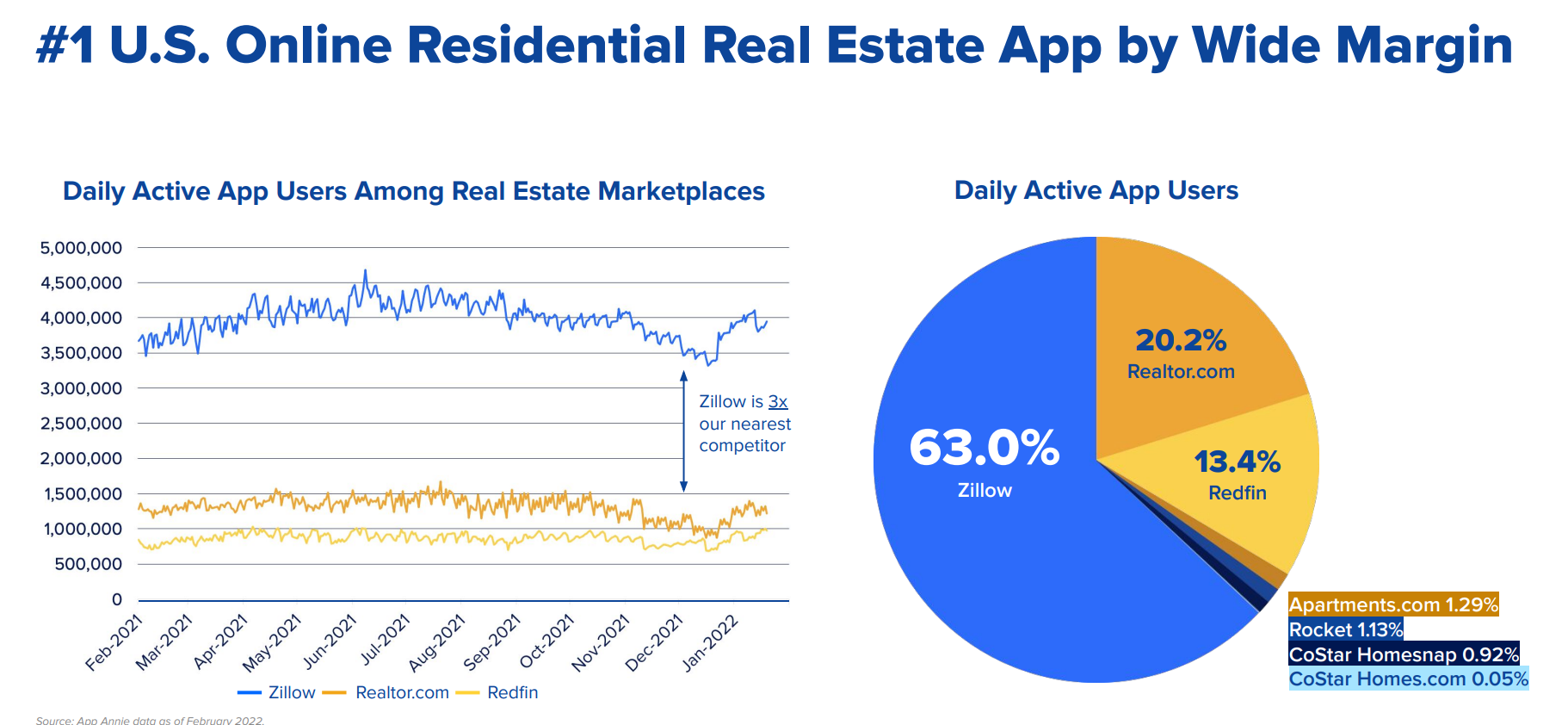

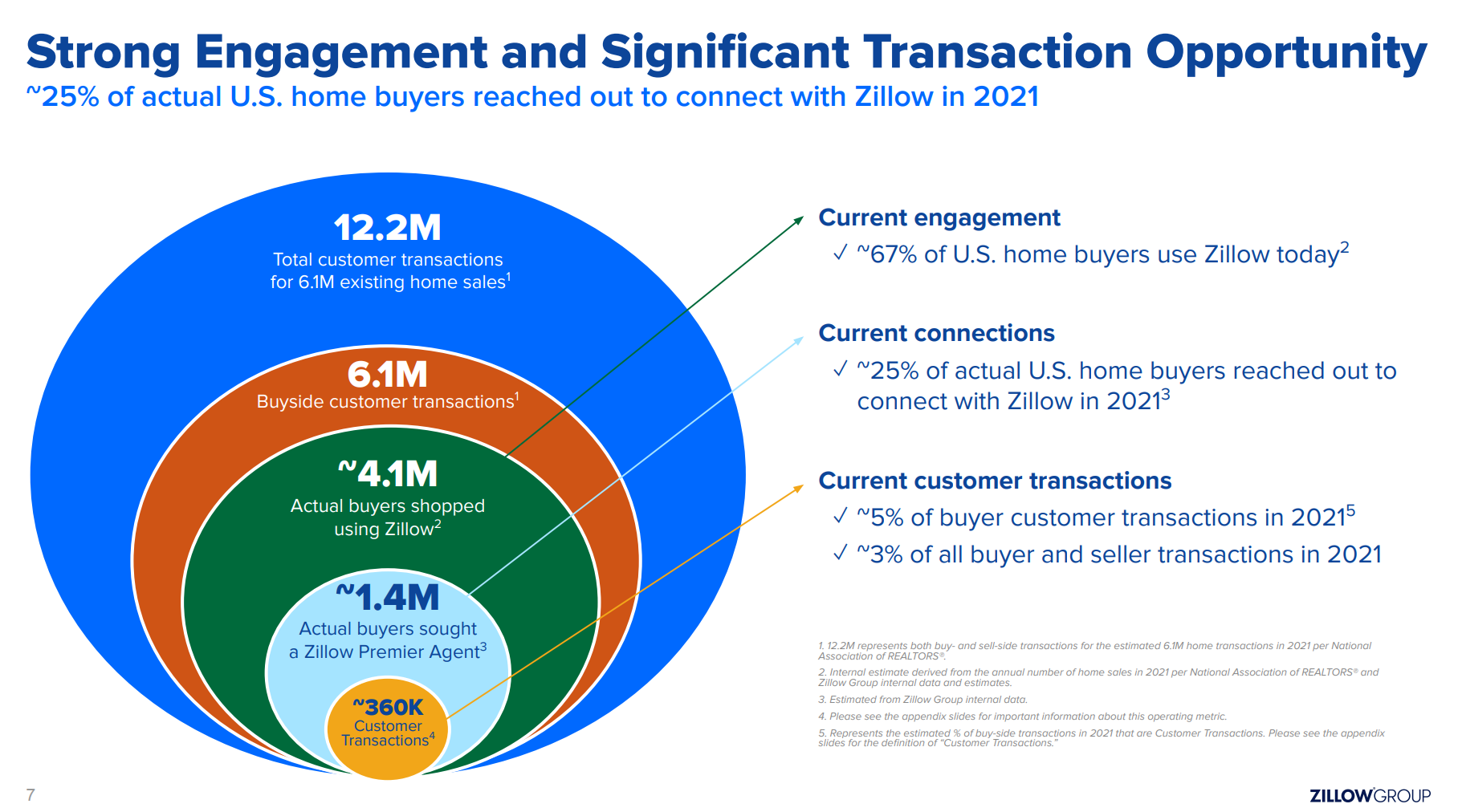

The write-off of the Homes business unit brings focus to the IMT (Internet, Media & Tech) segment which is a fantastic internet-scale business. The IMT business represents a classic aggregator as it controls the relationship with end-users, incurs zero marginal costs, and has leverage over suppliers (agents). As the already dominant player with 67.2% market share compared to competitors Realtor.com and Redfin, Zillow is poised to gain market share as it expands its already best-in-class product offering with additional features including personalized discovery and immersive shopping. For example, during the Q1 ’22 earnings call, management touted the real-time availability feature of recently acquired ShowingTime, a solution that solves the massive pain point of determining the availability of all agents. Management stated this feature saw nearly 100% adoption in released markets with Co-founder & CEO Richard Barton exclaiming that “no other company has been able to tackle this nagging industry-wide problem.” With the write-off of the Homes business, the restructured Zillow is well capitalized with a fortified balance sheet that enables organic and inorganic product launches that continuously improve the end-user experience.

As a result, Zillow’s best-in-class product will drive incremental customers to the platform and increase the proportion of users ultimately transacting (conversion ratio). The conversion ratio is particularly important for agents and brokers advertising on Zillow as the higher the conversion ratio the more willing an agent or broker is to pay for that lead. As the platform with the highest conversion ratio, Zillow will win incremental advertising spend and add to its already sizable advertising revenue. The Street has a perception that growth has stalled after a step function increase in IMT revenue in 2021. However, as the de-facto platform for buyers, Zillow will accrue a disproportionate amount of value going forward. The segment is facing extremely tough comps in FY ’22, but IMT remains massively profitable with expected Adj. EBITDA of $786M at a 38.8% margin.

Thesis Point 2

The continued introduction and subsequent adoption of the Flex performance-based pricing model alongside the market-based pricing (MBP) model further align incentives with customers and high-performing agents. While the MBP model results in the highest bid per customer connection, the system fails to best suit shoppers as they could potentially be paired with a bad agent which reflects poorly on Zillow. Moving to the Flex model improves utility for shoppers by pairing shoppers with the best agents in the area. The standard to be invited to the Flex program is remarkably high with expert calls denoting that only the top decile of performers on a conversion ratio basis are invited (which means just one or two agents in some zip codes). Agents invited to the Flex program have long-standing fruitful relationships with Zillow with the company having access to their historic conversion ratio and other pertinent metrics.

Flex is not just great for consumers though, it improves ROI for top-performing agents while removing the associated nuances of the MBP model. Under MBP, expert calls denote that agents with a set budget can call for advertising services but are turned away as Zillow can’t give availability with the waiting list also being long. Furthermore, bidding dynamics mean that agents can’t just pay 10% more to overtake another agent. In hot markets, consumer traffic will also have to grow or agents will have to wait for existing agents to retire. The Flex model prevents this inherent ceiling in MBP while improving lead conversion dramatically for agents on Flex. Expert calls suggest that lead conversion for brokers on Flex went up from 2% up to 8-10% in part because agents on Flex receive leads further into the buying process. While the 30% associated Flex fee is non-trivial, the ROI for agents under Flex means the program is worthwhile. For example, let’s say there are 500 transactions in a zip code and you are 2% of the market. 10 transactions a year, with a $400k average transaction value, and a 2.5% commission nets you $100k. Under Flex you are 10% of the market so with the same assumptions you are making $350k as your commission drops to 1.75%. Formers state that an internal study of the Flex model comes out ahead of MBP for even the highest performing agents. Additionally, Flex improves the relationship between Zillow and agents as leads are directly tied to performance.

While improving the experience for consumers and agents, Flex also improves the unit economics for Zillow. Going back to the example in the last paragraph, let’s say that the agent pays Zillow $5k for their 2% share of voice. Here Zillow makes $250k, but Zillow will make $150k under Flex. However, under Flex pricing, not all agents are under Flex so the remaining 90% of transactions use MBP. Let’s say the remaining 90% of transactions charge a reduced $2250 for a 1% share of voice. Thus, Zillow’s total income is $352.5k. While this is just an example and numbers vary drastically by market, management seems to have high conviction in Flex as they rolled out Flex in hot retail advertising markets like Denver. A step function increase in Flex revenue compared to Q4 ’19 with Flex representing approximately 5% of Premier Agent MRR is expected as adoption increases in higher average transaction value zip codes.

As Flex adoption increases over time, markets will have a combination of both MBP and Flex models which optimizes Zillow’s revenue. Being the dominant platform, Flex is able to retain agents under MBP as expert calls note that “Zillow is probably making up about 80% of our [online] lead generation business.” 70% of agent lead generation comes from platforms which further cements Zillow’s leverage and dominance.

The mix-shift to Flex will drive increases in revenue per customer transaction, improve top-performing agent economics, and most importantly optimize the consumer’s experience which extends Zillow’s lead advantage over Realtor.com and Redfin. Realtor.com in particular has tried to emulate the Flex model, but experts note that they “don’t hold the accountability as high”.

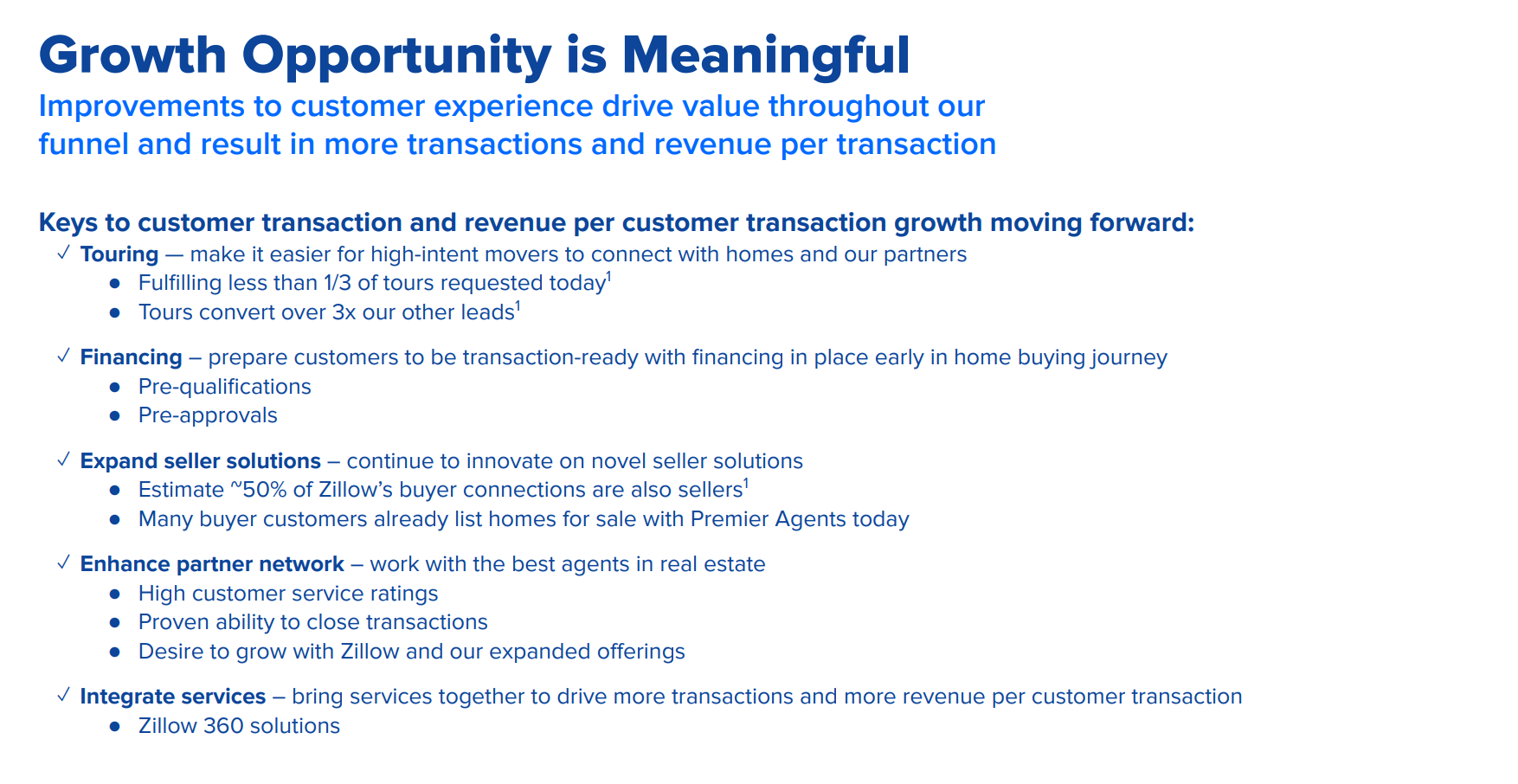

Thesis Point 3

Zillow’s scale and relationship with end-users provide the long-term call option of becoming what management calls the “Housing Super App.” The vast majority of the company’s IMT business stems from buyer solutions with seller solutions providing a long runaway for increases in revenue per customer transaction. Other avenues for increasing revenue per customer transaction include Zillow 360 a complete buying and selling service. Simply, Zillow’s dominant positioning and market share make it the most likely platform to create a “Housing Super App” if that existed in the U.S. market.

Valuation & Risks

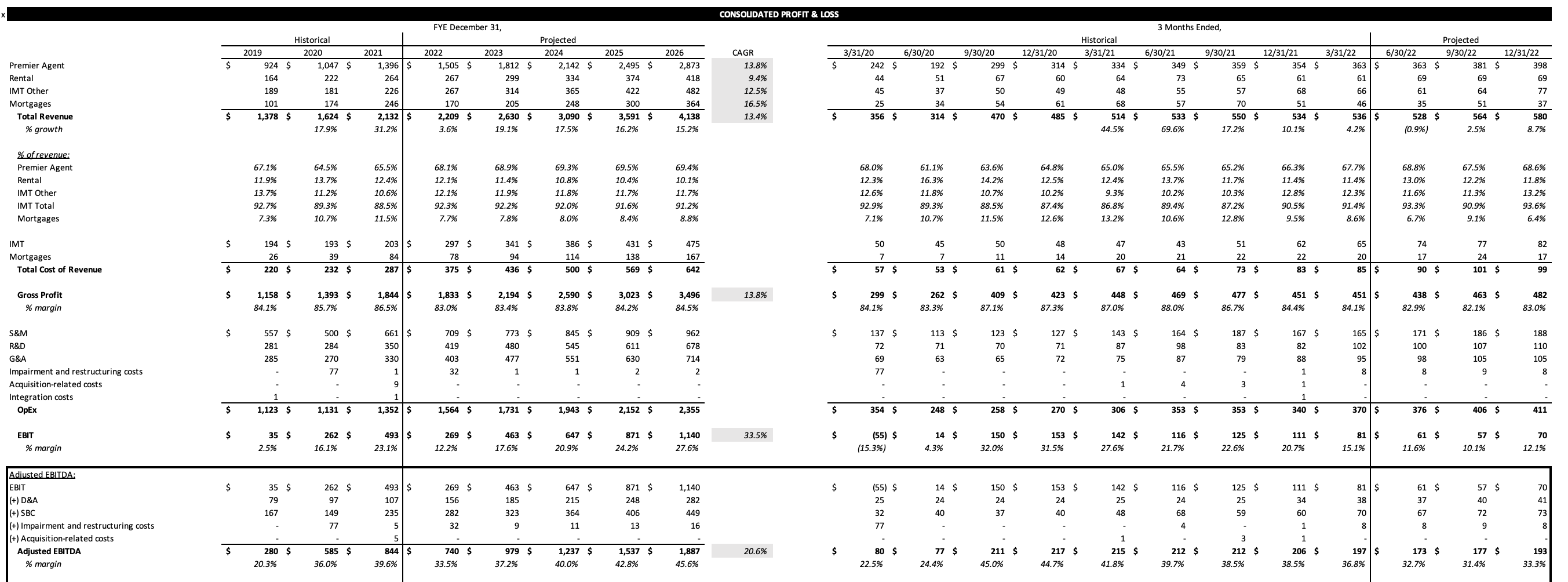

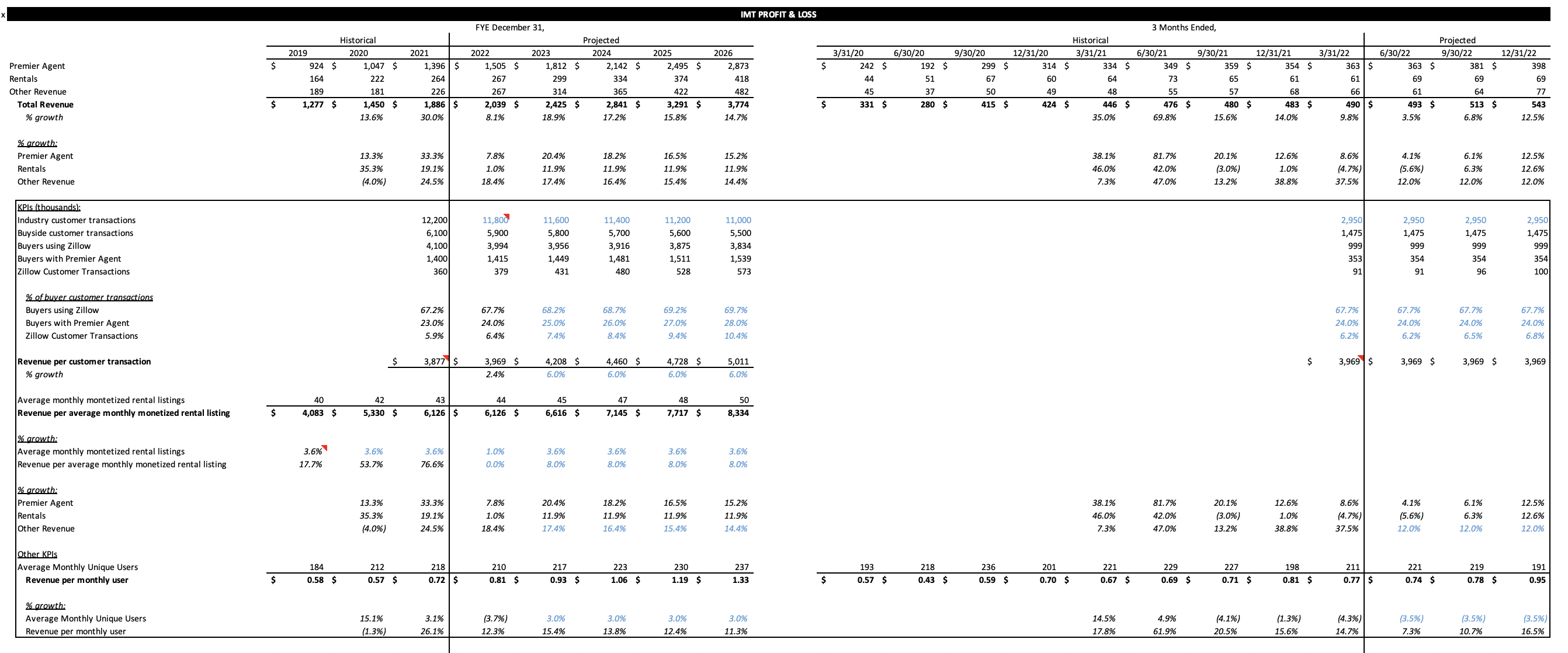

With the write-off of the Zillow Offers iBuying segment, Zillow's revenue will be primarily comprised of revenue from the IMT segment which can be further split into Premier Agent, Rentals, and Other segments. The Flex performance-based pricing model will become a greater part of Premier Agent over the next few years, so thinking about Zillow's customer conversion funnel is the more appropriate way of thinking about the segment. Taking a 8.0x forward adjusted EBITDA multiple in 2025 and discounting at the WACC to the present suggests a $51 price target at the end of the year. Additionally, my 2025 EOY price target is $72 and my 2024 EOY price target is $64 which nets a 17.4% and 19.4% IRR respectively.

I've attached screenshots of my model below that outline my thinking for the next few years.

The biggest risk to the IMT business is the implosion of the housing cycle as a narrow top of the conversion funnel inherently limits revenue regardless of the conversion rate. However, in my model for the IMT segment I already decreased the number of potential transactions year-over-year in line with expectations.

That's it for this week, hope you enjoyed it, and please let me know whether you would invest in Zillow at this price given the market conditions. As always, don’t hesitate to shoot over a message with any feedback or want to look at my full model. Would love to chat with people with differing opinions on $Z!

Cheers,

Aneesh Tekulapally (@aneesh_tek on Twitter)