Public Comps Weekly Dashboard 8/28/2020: BILL & PLAN Earnings, S-1 Teardowns

Weekly Dashboard and BILL Q4FY20 earnings teardown

👋 Public Comps Customers 👋

In this newsletter, I benchmark SaaS against public indices, take a quick look at median B2B SaaS valuations, teardown BILL's earnings, and highlight a few thoughts on recent S-1's.

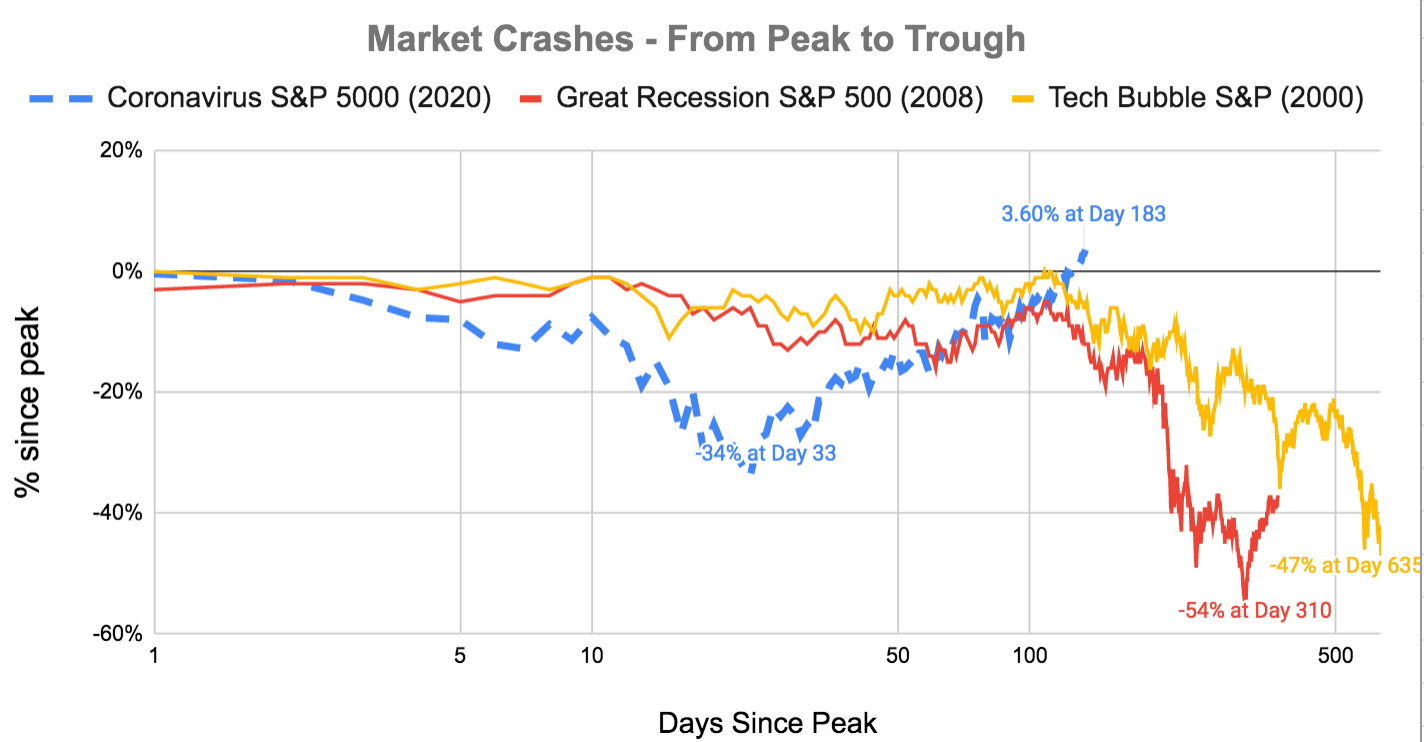

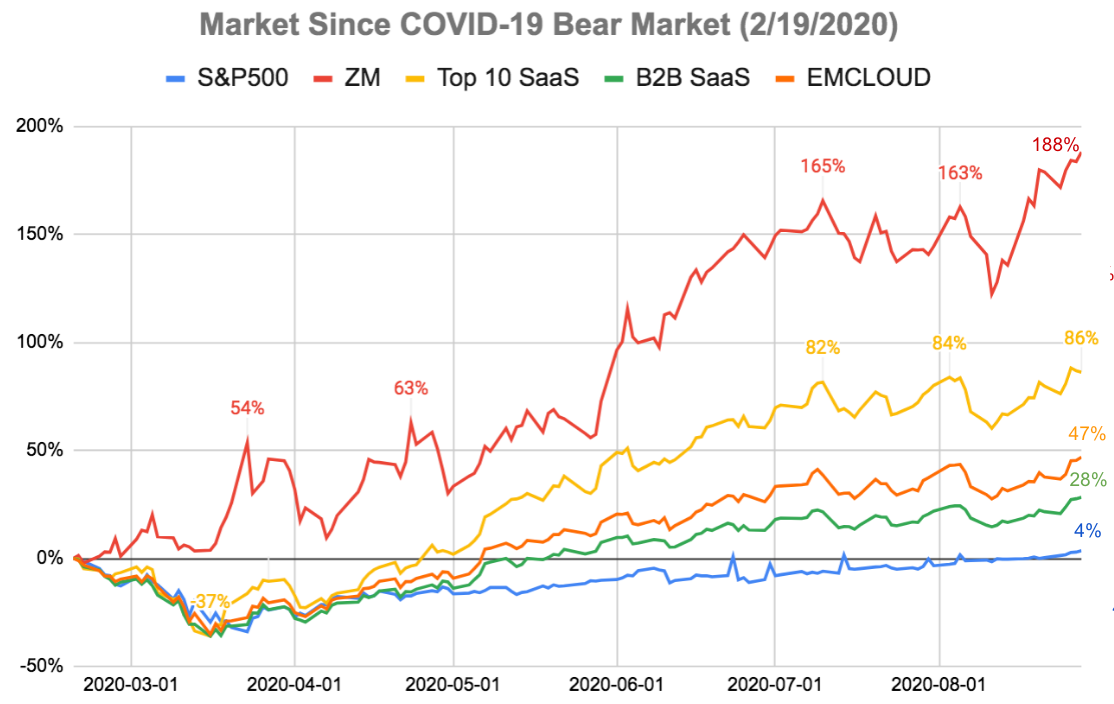

1️⃣ SaaS Stock Prices vs. Benchmarks 📊

Change since bear market start (2/19/2020):

- S&P 500: +3.60%

- B2B SaaS: +28.3%

- Top 10 SaaS: +86.2%

- Bessemer Cloud Index (EMCLOUD): +46.8%

- ZM: +188%

Change in the past week:

- S&P 500: +3.2%

- B2B SaaS: +5.5%

- Top 10 SaaS: +3.6%

- Bessemer Cloud Index (EMCLOUD): +6.7%

- ZM: +3.3%

Market Update: this was a rare week in which top 10 SaaS underperformed relative to less-concentrated benchmarks. The biggest driver for this was Salesforce, which jumped 26% following its solid earnings and news that it was being added to the Dow Jones Industrial Average (DJIA). Additionally, Anaplan's (connect planning software) rebound earnings report helped drive investor confidence in traditional "land and expand" growth stocks such as workplace collaboration software tools, as Smartsheet, Slack, Alteryx all saw solid double digit returns this past week.

In the broader market, major indices saw solid gains on the positive news flow about potential vaccines and treatments for COVID-19. Airlines and manufacturing saw solid gains this week on this news; however, higher-valuation growth stocks outperformed lower-priced value companies, extending recent trends. Large-cap companies easily outpaced small-caps, as large information technology firms continued to drive the market’s upward momentum.

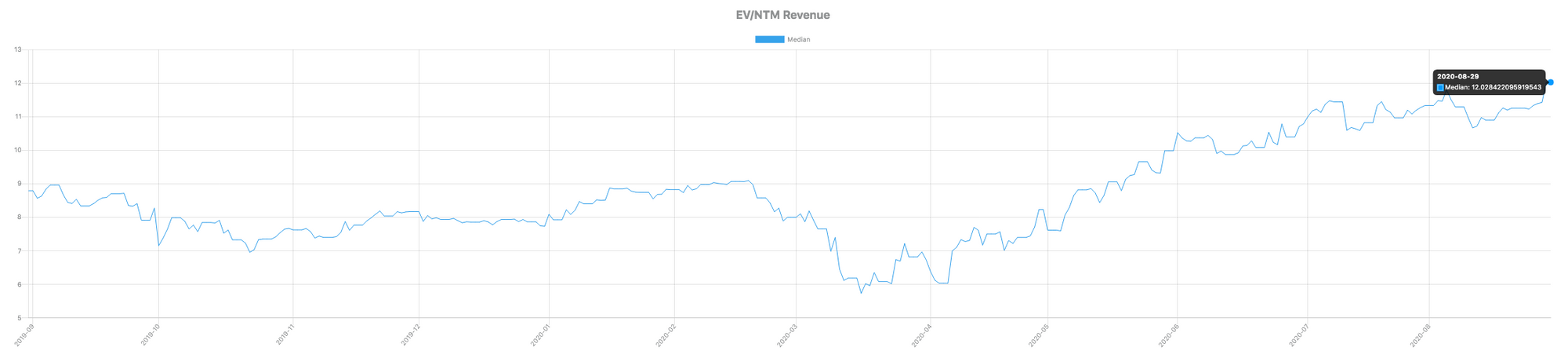

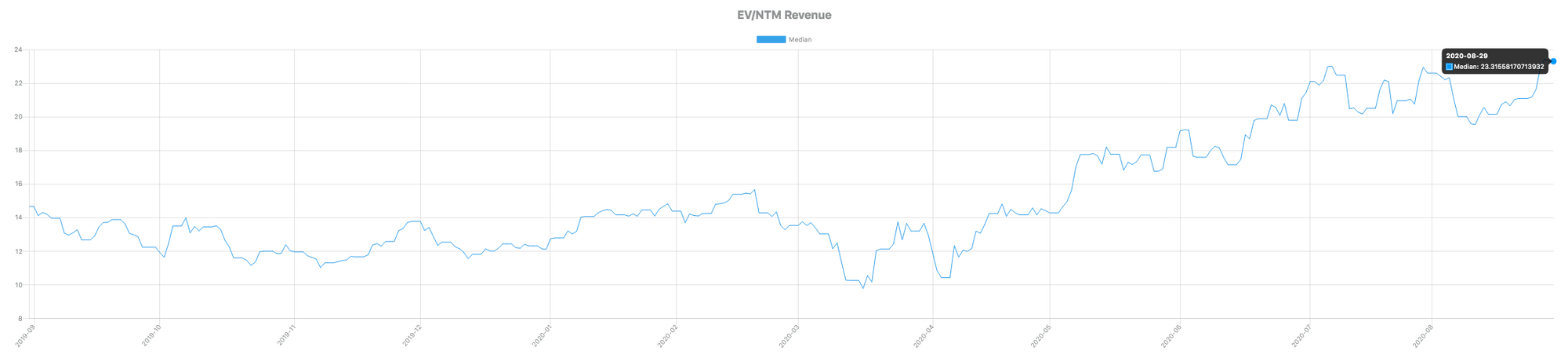

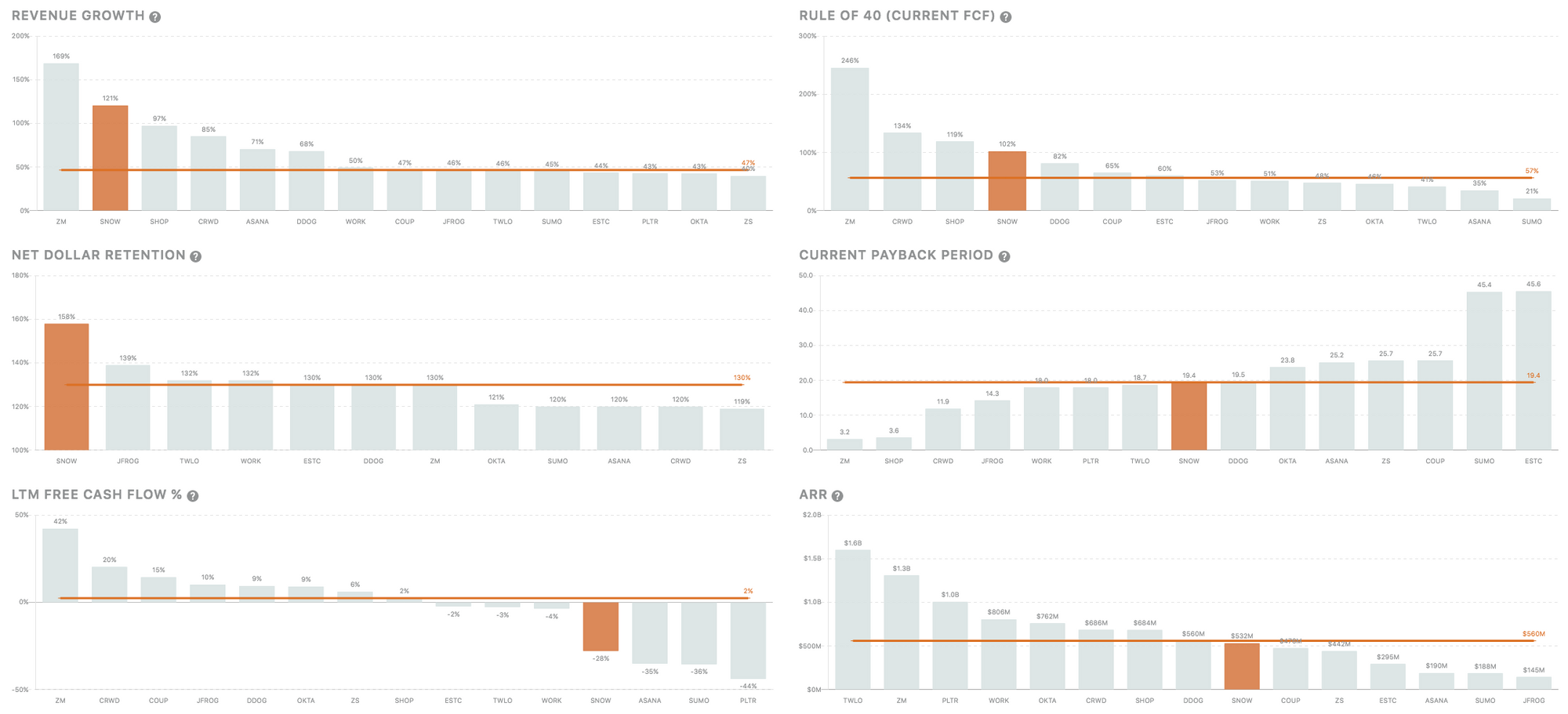

2️⃣Median B2B SaaS Valuation Multiples: 12.0x🔥

3️⃣SaaS Earnings - Bill.com (BILL) & Anaplan (PLAN) 💸

With many B2B SaaS earnings coming out this past week, and since Howard already gave a great in-depth teardown of Elastic (ESTC)'s earnings, I thought I'd recap two I personally found interesting.

Bill.com (BILL) Earnings:

Overview: Bill.com is an AI-enabled financial software platform that enables their customers (primarily SMBs) to create connections between their suppliers and clients for accounts payable and accounts receivable operations. Customers use BILL's platform to generate and process invoices, streamline approvals, send and receive payments, sync with their accounting system, and manage their cash. Bill.com has built sophisticated integrations with popular accounting software solutions, banks, and payment processors, enabling customers to access their financial services through a single connection.

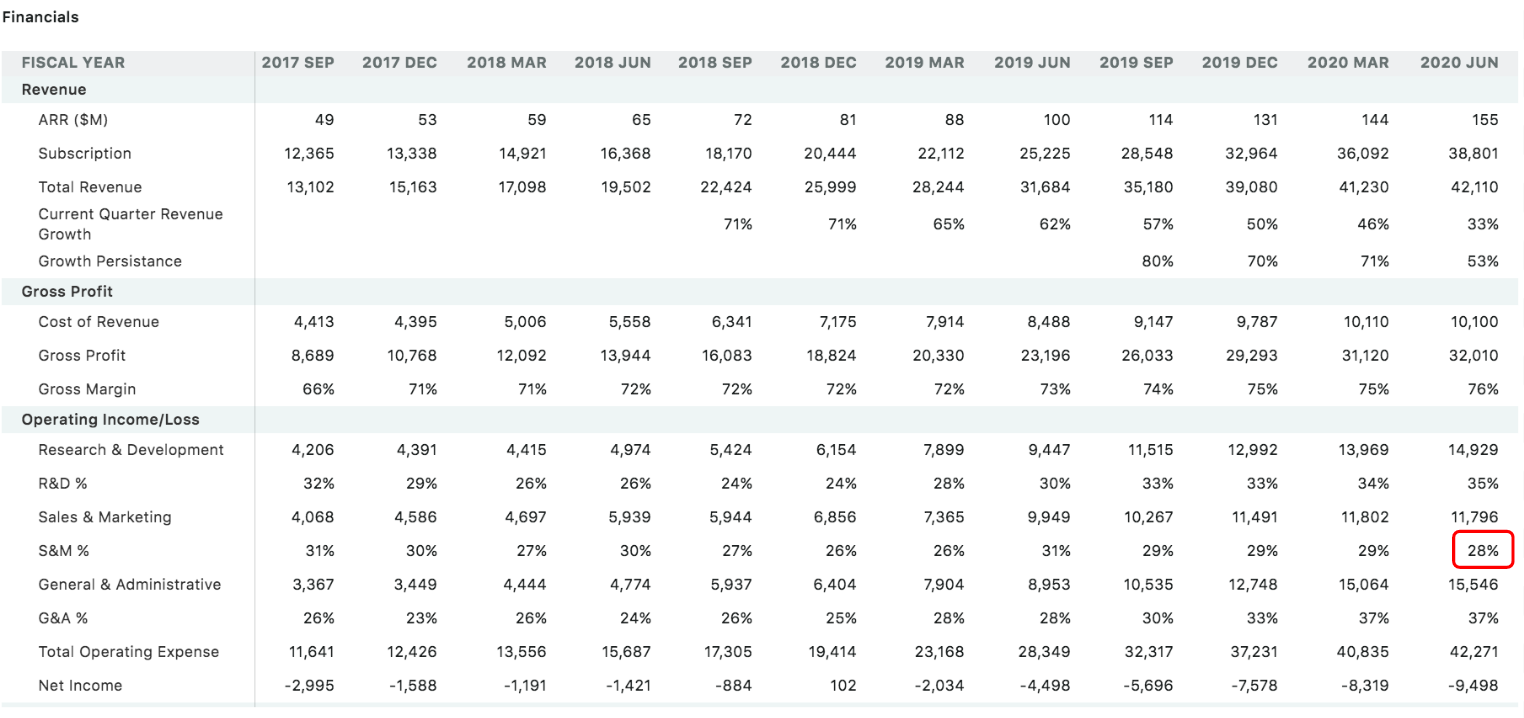

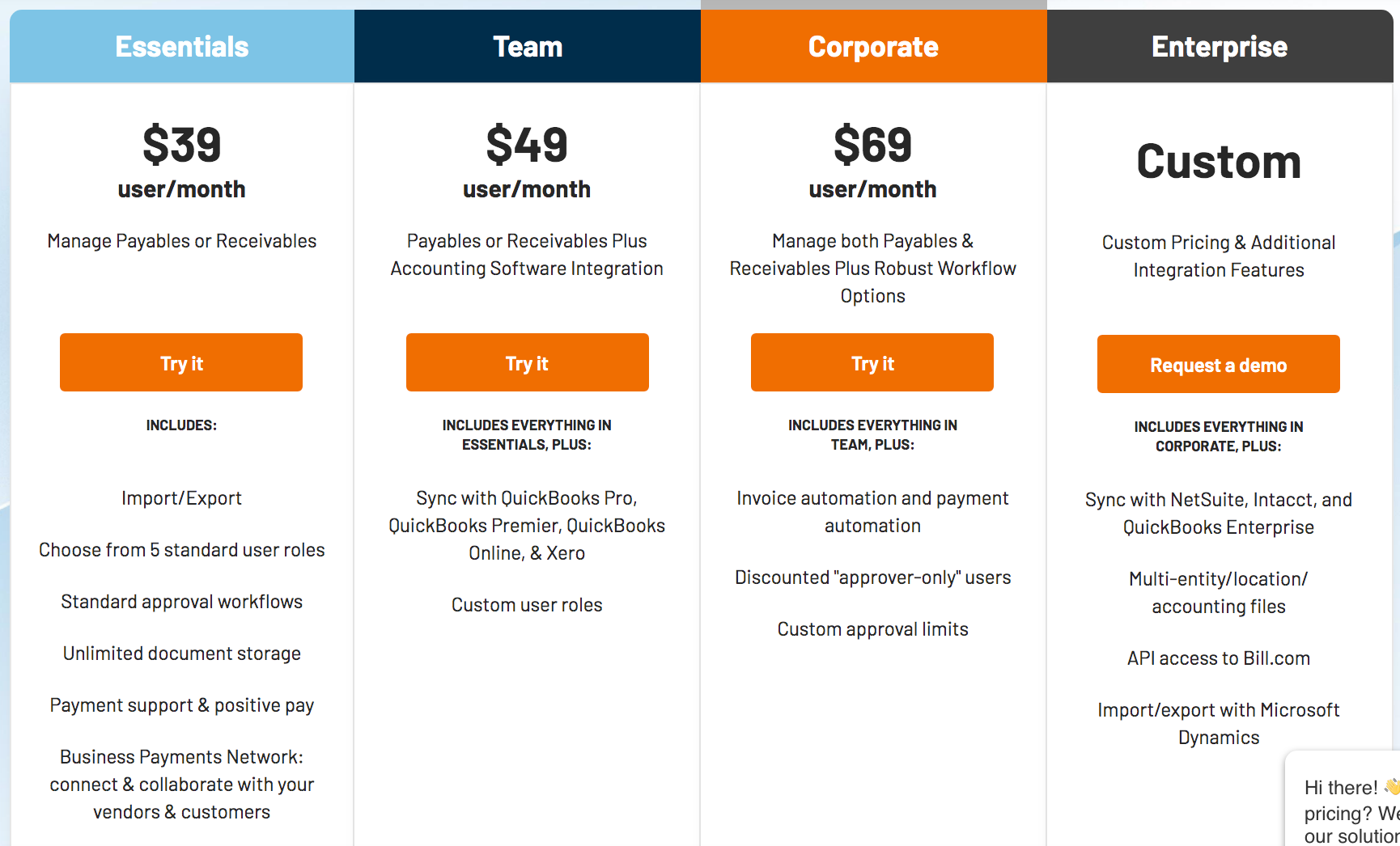

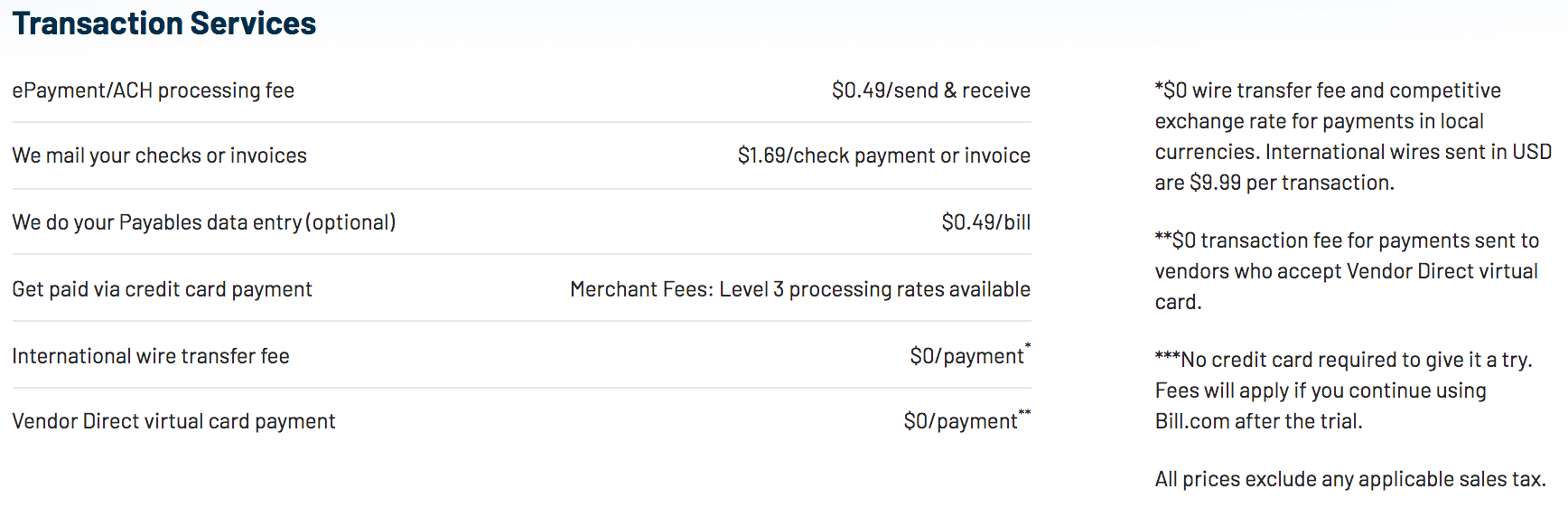

Business Model: BILL generates revenue from selling subscription to its platform and charging transaction fees for payments processed on their platform. The relevant metrics here to understand their business are ARR (annual recurring revenue) for subscription revenue and total payments volume (TPV) for transactional revenue.

Financial Highlights:

$BILL earnings:

— Public Comps (@publiccomps) August 27, 2020

📈Total Rev: 42.1M +33% yoy

🚀subs/trans rev: $38.8M +54% yoy

🙌Customers: 98k +28% yoy

🎉Gross margin: up from 73.2% yr ago to 76%!

👍non-GAAP loss: -2.1M (-6% margin)

🔥2.5M network members, +39% yoy & expanded agreement w/ a top three bank!

Shares ⬇️AH

Earnings highlights:

- Bill's business is growing faster than the revenue number suggests: "Core revenue, which we define as subscription plus transaction revenue, grew by 54% year-over-year to $38.8 million. Total revenue in the quarter grew by 33% year-over-year to $42.1 million. We also delivered a strong non-GAAP gross margin of 78.6% in the quarter."

- Net customers adds are accelerating: BILL grew customers 5.9% qoq from Q2 to Q3 (85900 -> 91000) but had 7000 net adds this past quarter, representing 7.7% growth qoq and 28% growth yoy.

- BILL's network is growing even faster: Bill.com has over 2.5 million network members, an increase of 39% yoy.

High-level thesis on BILL:

1. BILL represents mission-critical automation for every SMB and captures on the migration to cloud narrative as back-office accounting/B2B transactions become increasingly complex and data-driven.

- Mission-critical: BILL facilitates work-from-home, and solves a fundamental problem for every business.

- Easily deployable: BILL's platform is a self-service product, and doesn't require an implementation solution the way competitors do.

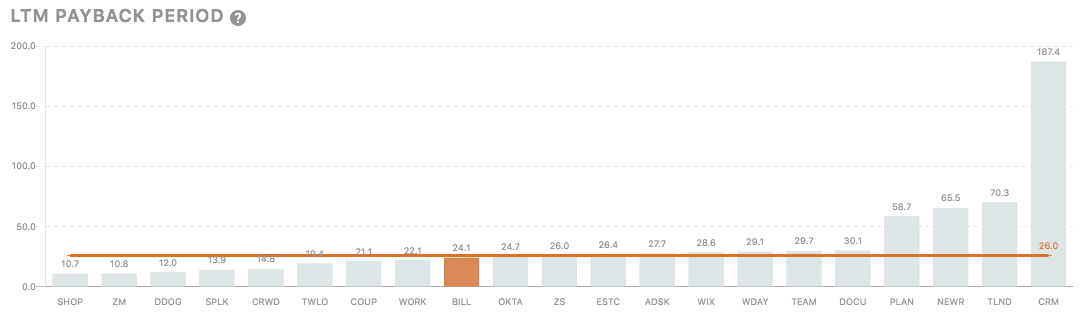

- Sales are underratedly efficient:

- BILL is the best product on the four key pain points of customers: 1) Efficiency – BILL's platform automation allows customers to send and receive payments faster; 2) All-in-one integration between customers and suppliers – BILL's platform integrates with accounting software, banks, and payment processors, enabling customers to access all partners through a single connection; 3) Secure data – offloading data storage and compute to the cloud is the best choice for customers; 4) Visibility – customers can easily view their transaction workflows, enabling them to gain deeper insights.

- BILL faces little competition from software vendors, and its biggest competition is customers doing this in-house, a significant land grab opportunity.

- As the space becomes increasingly complex, it leads to market consolidation, which puts the best-in-class solution at the forefront of capturing more market share from a historically fragmented industry.

BILL is a platform that delivers immediate ROI to customers in a market that will see significant consolidation due to cloud tech.

2. BILL is a very under-monetized platform

- As customers continue to build integrations on BILL's platform, it becomes increasingly mission-critical with higher switching costs.

- Customers are likely willing to pay more for its platform subscription – the subscription automates a job that was previously done through manual labor – why pay someone $50/hr to do a job software does better for $0.08/hr?

- Its not a perfect comparison, but I estimate BILL's take rate (total revenue/TPV) to be 0.166%, significantly lower than other payments peers.

- BILL's take rate is still early on the S-curve and actually declined quarter-over-quarter due to macro: interest-rates are near zero and COVID-19's affecting SMB spending.

- PayPal's transaction and total take rate:

Takeaway: even in this interest rate environment, BILL has significant potential to grow its take-rate.

3. BILL's management team is incredibly prudent and has effectively identified two key areas of growth that are early on the S-curve: increasing TPV through cross-border transactions and virtual cards.

- In the future, transaction revenue from TPV will likely represent a larger portion of total revenue (26% growth yoy): BILL reminds me a lot of SHOP in its early days in which the majority of revenues came from subscription solutions. Shopify identified early on that it should be a platform, not just a tool -- something BILL's management seems on track for. I love this quote from Tobi Lutke on platforms: "everyone in the world wants to be a platform, but you’re only really a platform if the value of the ecosystem on top of a platform is larger than the company who owns the platform". Here I believe management has identified two key areas to grow the ecosystem on top of their platform: cross-border transactions and virtual cards.

- Cross-border efforts: according to McKinsey's 2019 global payments report, worldwide B2B cross-border flows exceeded $133 trillion in 2018. Management believes there's a large opportunity to capture the portion of these flows that represent U.S.-based SMBs paying their international suppliers. In FY20, BILL disbursed over $2.3B to international suppliers on behalf of our U.S. customers, up 300% from FY19. BILL launched this offering in late 2018 after doing the analysis of foreign supplier payments recorded on their platform and receiving requests from customers who wanted a more efficient way to pay offshore vendors. This is crucial because if an accounts payable customer makes the payment in USD, BILL charges a flat fee which is priced at a premium over our domestic transaction prices. If the disbursement is made in foreign currency Bill.com performs the FX conversion based upon the payment amount. For these payments revenue is ad valorem that is based on the size of the transaction.

- Virtual card efforts: in its Business Payments 2022 Report, Mastercard projected the virtual card market to grow at a 5-year CAGR of 19.2% from 2017 to 2021. Mastercard states that 6% of B2B check volume has already moved to card payments and that there's an opportunity to ship another 2% to 5% in the next few years. BILL's had success in converting a portion of check payments to virtual cards which required building in-house capabilities to handle supplier enablement and payment exception handling. BILL will continue to make investments in this area as they expand efforts to convert not just checks, but also ACH transactions to virtual cards. BILL is working to automatically determine which vendors accept cards. At scale, this will make the supplier enablement process faster and less labor-intensive. For Q4, virtual card volume represented just 1% of total TPV and they believe there is room to grow from there.

Takeaway: management is smart, competent with their execution plans and have identified two key areas with accelerated growth opportunities.

This was just a high-level thesis on BILL, its definitely a company I want to look into further.

Anaplan's earnings:

If you've been reading this newsletter for a while, you'll know that Anaplan was one of my highest conviction ideas during the craziest months of the bear market in March. I wrote out a couple of my thoughts on the stock and other "land and expand" software ahead of its earnings this past week in this thread.

Anaplan $PLAN Q2 Earnings:

— Public Comps (@publiccomps) August 26, 2020

⬆️Rev: $106.5M +26%, subscription +32%

🔥Billings acceleration: +32% (from +10% in Q1), RPO: +36%

👍Gross margins: 78%

non-GAAP op income: -$9.6M (-9% margin)

Free cash flow: -$12.9M (-12.1% margin)

📈Shares up 22% today on billings acceleration!

4️⃣ S-1 Teardown Update

Some of the most anticipated 2020 IPOs: Snowflake, Asana, JFrog, Palantir, and Sumo Logic all dropped their S-1 filings this past week!

Check out Jon Ma's Snowflake S-1 Teardown on our blog!

As always, feel free to shoot me an email if you have any questions, feedback, or concerns.

Stay safe everyone,

Albert Wang, Public Comps Team

albert@publiccomps.com

Like these weekly dashboards? These are for Publiccomps.com customers only but you can have your friends subscribe to the newsletter here where we send out investment memos, market maps and analysis on the broader SaaS market.

Views expressed in theses emails are ours and ours alone and don't represent that of our previous or current employers. Public Comps provides financial and industry information regarding public software companies as part of our weekly dashboard, our blog, and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice.

Full disclosure: I own CRWD, TWLO, SHOP, LVGO, FB, MSFT, DDOG, ESTC, AYX, SMAR, PLAN, and ZM.